Weekly Market Review & Analysis For June 29, 2020

The S&P 500 market climbed 4.0% this week to recover last week's drop and some, as the markets began the third quarter with the same ricocheting mindset as the second quarter. The heavy-tech weighted Nasdaq Composite index posted +4.6%, trimming the benchmark index to close at a new record high. The DJI Average climbed 3.3%, and small-cap Russell 2000 index rose 3.9%.

The increases were widespread and noteworthy. All eleven S&P 500 sectors finished in positive territory with accumulations ranging from financial posting 1.6% (the only sector to raise less than 2.0% for this week) to communication services sector print of 5.6%.

Strangely enough, this week's trading wasn't all that dissimilar from last week coming from a macro-level news scene. Many companies and states proceeded to take preemptive steps to help decelerate the record number of new COIVID cases, while economic numbers resumed depicting a faster than predicted recovery. However, this time around, though, the stock market embraced its faith in a speedy recovery.

In the job market, the payroll rose by 4.8 million in the previous month; however, the June unemployment rate marked lower to 11.1%, from 13.3% posted in May. The weekly initial job claims decreased for the 13th consecutive week to post 1.43 million mark.

Apart from the employment standpoint, the Institute for Supply Management (ISM) Manufacturing Index for the last month returned into the expansionism tone with a 52.6% posting, but, pending home, sales bounced 44.3% m/m in the month of May, and the factory orders bounced back 8.0% in May.

In other immeasurable developments, Pfizer and BioNTech reportedly made headway on their coronavirus vaccine campaigner development, and Boeing renewed its 737 MAX flights for FAA certification.

Tesla shares rose whooping 26% this week, drawing its market capitalization to $224B, as capital continued to move into momentum stocks. Tesla also entertained investors and traders by the end of the week with a report that it delivered almost 90,650 vehicles in the second quarter of 2020.

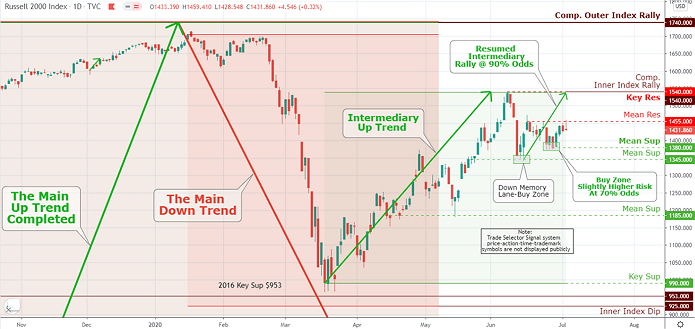

Click the Image to Enlarge

Technical Analysis and Outlook: As noted before, the small-cap index is an excellent overall market indicator; The Russell 2000 index shows us resuming its uptrend since June 15. A new buying zone is identified at Mean Sup $1,380, with the exit at Key Res, and completed the Inner Index Rally marked at $1,540. Good trading.

Market action elsewhere

U.S. Treasuries market closed mixed this week. The Two-year yield decreased one basis point to finish at 0.15%, while the Ten-year yield rose three basis points to close at 0.68%. The U.S. Dollar Index faded 0.2% to post 97.2. West Texas Intermediate (WTI) crude oil rose 5.0%, or $1.93, to $39.39/bbl.

Symptoms of an economic rebound stretched to the Eurozone and Asia region. Both Germany and France saw record waves in retail sales and consumer spending. Manufacturing Purchasing Managers' Index for last month was revised higher in France, Italy, and Germany. The most important stock markets in Eurozone saw increases.

Much better than anticipated industrial profits also China's manufacturing indices good showing lifted the majority of Asia-Pacific markets. This included Hong Kong's Hang Seng Index, notwithstanding the U.S. deferment of preferential treatment for Hong Kong subsequent China's passing effective July 1st, its new national security law.

The land of the rising sun countered the global markets rally and was the only influential developed market to see their stocks into reverse. In contrast to robust rebounds observed elsewhere in May, Japan published its fourth continuous month of declining retail sales and industrial production.

After cracking the new eight-year high of $1,800 on Tuesday, Gold retreated. Overall, Gold was up $4 on the week finishing at $1,775, and Silver climbed 24 cents to close at $17.99, having traded as high as $18.44.

Globally, major central banks added another 36 tons of Gold to their reserves in the month of February, which was roughly 33% higher than January’s grand totals. In 2020, the majority of central banks have bought in its entirety 64.5 tons of yellow metal.

In the last few weeks, Bitcoin has been riding the waves of the American stock market. Friday, they were all closed due to Independence Day, and the coin was not able to show its true colors. Its time for Bitcoin to show what it's made of!