Market In Review & Analysis For April 8, 2020

The market ended Tuesday's session with reasonable losses after capitulating their early opening gains. The broad S&P 500 index ended up slipping 4.3 points or -0.2% after beginning the session with a 93-point increase while the tech-heavy Nasdaq Composite index finished underperformed with -0.3%.

Market action

The market jumped out of the gate aftermarkets over in Asia, and Eurozone had another excellent drive overnight. The distinctly higher start was associated with optimism regarding a potential plateau in C-virus cases.

|

However, the significant indices cracked their best price levels within the first several minutes of trading, followed by throughout the day decline that sent the S&P 500 and Nasdaq indices into negative territory. Six sectors out of eleven finished the session with gains reaching from print by real estate of 0.1% to the materials sector of 2.4%. In contrast, the top-weighted vital technology sector posted -1.1% loss, which underperformed from the bell. Apple stock posted -3.04 or -1.2% loss as other high technology components wrestled in negative territory all afternoon. Chipmakers closed a bit higher of the entire sector, while the Philadelphia Stock Exchange (PHLX) Semiconductor Index was capitulating 0.5% on the day. On the other side of the coin, the materials sector posted +2.4% gain and energy sector with a +2.0% posting outperformed the others throughout the day. The volatile energy sector was capable of remaining in the green territory, even as crude oil sank into the pit closing, finishing lower with the close of $24.07/bbl or 7.95%. Exxon Mobil gained +0.77, or +1.9%, as announced a 30% cut to its capital spending programs for 2020. |

Click the Image to Enlarge

×

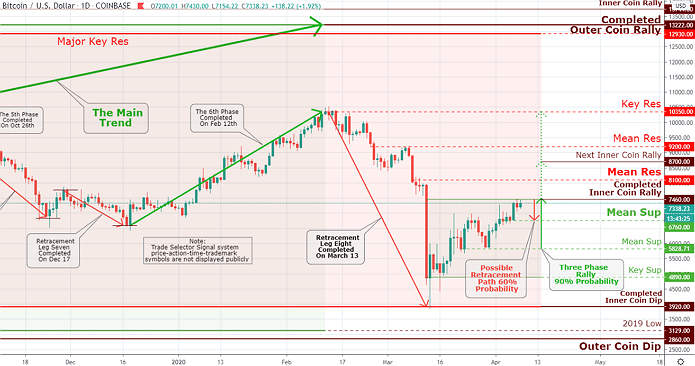

Bitcoin completed our Inner Coin Rally $7,460. So, what's next? We do have Mean Res $8,100 to be traded, while the upcoming Inner Coin Rally $8,700 is resting above it with 90% probability. Technically speaking, the coin has a great looking chart. The Bitcoin price charts are also showing a minor support level at Mean Sup $6,760 with a 60% retracement probability. |

As for the materials sector, the group's progression was determined by gains in names like Dow, Eastman Chemical, and Freeport-McMoRan. Vulcan Materials, as well as Martin Marietta Materials, also had a good showing, most likely as a consequence of expectations that the subsequent fiscal stimulus package will cover an infrastructure component.

With regard to additional fiscal stimulus, House Speaker Pelosi stated to Democratic lawmakers that she desires that the next spending stimulus package be at least $1T (Trillion). While Senate Majority Leader, Mitch McConnell, stated that he foresees the additional increment increase to the small business loan program to be approved on Thursday this week.

U.S. Treasuries went south during the first half of the trading session, though narrowed their losses as the trading session moved on. The Ten-year yield finished higher with six basis points closing at 0.74%.

The U.S. Dollar Index declined 0.8% to close at 99.96, retreating to price levels posted on Thursday. The cryptocurrency market is on the offensive this week so far, with Bitcoin's recent price popping well above $7,300 and the rest of the cryptos bettering the leading cryptos by market capitalization.