Market Commentary & Analysis February 5, 2020

The stock market rallied on Tuesday in risk-on trading that hoisted the Nasdaq Composite index +2.1% to a new historical closing record. The broad S&P 500 index gained +1.5%, DJI Average posted +1.4% increase, while the small-cap Russell 2000 index followed suit with a +1.5% gain.

Cyclical sectors produced most of the grunt work, notably the information technology sector posting +2.6% gain, as the market brushed off past a revenue miss coming from Alphabet Inc. with -2.6% loss. The interest rate-sensitive sector, such as utilities, posted -1% on the day and was the lone holdout yesterday, as the selling in the U.S. Treasury pushed yields higher.

The two-year yield climbed six BPS to finish at 1.41%, and the Ten-year yield rose eight BPS to close at 1.60%. The (DXY) U.S. Dollar Index raised a small 0.1% to finish at 97.93. Interestingly enough, the West Texas Intermediate (WTI) crude oil surrendered a 2.9% in intraday trading and fell farther into the bear territory with posting a loss of 0.93%, or $0.46, to close at $49.44/bbl.

Tesla stock was unquestionably the stock of the day on Tuesday, posting a +13.7% gain, obscuring Alphabet Inc. and its earnings results print. Tesla shares were up stronger than 24% past few days in a short squeeze trading and FOMO (Fear of missing out) frenzy.

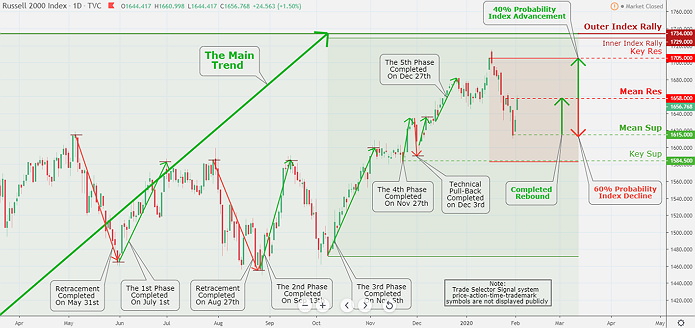

Click the Image to Enlarge

Technical Analysis and Outlook: As noted before the index is an excellent overall market indicator, The Small-Cap index, shows us a possible pull-back (60% probability) based on the hitting the Mean Res $1,658.

Currently, the Russell 2000 Index in no man's land in the middle of an intermediate downtrend. The possible retracement can take us down to a new powerful Mean Sup $1,615, followed by Key Sup $ 1,584.50.

If all fails on the downside, the short term upside move probabilities (40%), we have Major Key Res $1,705, Inner Index Rally $1,729, and Outer Index Rally $1,734 to conquer.

The Coronavirus and market(s)

Not very surprisingly, that global market(s) are edgy and fearful as the “coronavirus” contagion is spreading.

Most investors and traders are continually watching the headlines news; however, they are also watching the calendar. Why? The coronavirus is thought to be contagious for 1 to 2 weeks – As the U.S. officials with the Centers for Disease Control issued 14-day quarantine of travelers who left Wuhan.

China forced unprecedented massive quarantine back on the 22nd and 23rd of February. If the quarantine were adequate, the coronavirus should be held in its tracks and stop spreading after 14 days imposed quarantine. Hence, the coronavirus should cease spreading about the 8th or 9th of this month.

Keep in mind; we do not need to eliminate the virus to end the fear and panic. We only necessitate the “case numbers” game to stop rising for several days. The next weekend’s news reports will be very critical.

Elsewhere

The global stock market rally produced a very strong-risk on market sentiment, which by the way, in turn, put enormous selling pressure on the safe-haven assets, with Yellow metal having the most sweeping percentage price drawdown on Tuesday's session of the entire precious metals group.

Spot Yellow metal price also sold off massively and end-up fixed at $1552.80 after factoring in yesterday’s $23.88 drop. On closer examination, we did notice that that sell-off was a primary result of investors and traders bidding the Gold lower, which valued for $24 of yesterday’s slump. The Yellow metal correction could become semi painful below Mean Sup $1,546.

The cryptocurrency market segment is encountering a slight pull-back following the last week’s volatile crypto coin rally. With the past 24 hours trading, we saw a slight volatility decline that left the developing short-term crypto trends whole, with the majority of the significant coins all clinging close towards essential resistance levels.