Weekly Market Review & Analysis For September 6, 2021

The stock market endured a difficult four-day week. The S&P 500 lost 1.7% throughout each session and closed lower as buyers seemed exhausted - however, that provided us to buy the market as shown on this chart. The Dow Jones Industrial Average with -22.2% and Russell 2000 with -2.8% fell more than 2.0%, while the Nasdaq Composite fell 1.6%.

For the week market ended in negative territory. All 11 S&P 500 sectors, except for the real estate (-3.9%) and health care (-2.7%), as well as industrials (-2.5%) which suffered losses above 2.0%. The information technology sector, which is the largest by weight, declined 1.8%. However, the consumer discretionary sector (-0.3%) performed relatively well.

The market was not dragged lower by any one event. Instead, it was a combination of negative-sounding news stories that pushed risk sentiment amid speculation about a more significant pullback.

The macro-related front

- Goldman Sachs lowered its Q4 GDP forecasts and 2021 GDP projections

- The enhanced unemployment benefits have expired

- Axios reported Senator Manchin (D.W.Va.) would only support $1.5 trillion in any human infrastructure plan

- The ECB stated that it might reduce its emergency asset purchases at a moderate pace

- Treasury Secretary Yellen warned of the economic consequences if legislators don't address the debt-ceiling problem

- The $24 billion 30-year bond auction and the $38 billion 10-year note market auction saw good demand. This is a reflection of lingering growth worries

- Cryptocurrencies have been sold; remind investors about reducing their risk exposure

The corporate market front news

- A court ruled that Apple must allow developers to create their payment options.

- Johnson & Johnson, Merck (MRK), and Amgen were downgraded at Morgan Stanley to Equal-Weight.

- Airlines and Sherwin Williams (SHW) saw their Q3 outlooks drop due to raw material issues.

The Ten-year yield rose two basis points to finish with 1.34% due to hot PPI data from August and improved weekly initial-continuing claims report.

Overseas market

Stock market(s) in the Asia-Pacific region were mostly higher on Friday due to overseas trading. Japan's Nikkei225 Index rose by 1.3%, while Hong Kong's Hang Seng Index increased by 1.9%.

Yoshihide Sug, the Japanese Prime Minister, announced Friday that he would be stepping down after only one year as leader of his country. The Topix Index in Japan rose 1.6%, reaching a record of 30 years after the announcement.

China's Services Purchasing Managers Index(PMI) fell to 46.7 in August, the lowest level since April 2020's pandemic. China's manufacturing PMI fell to 50.1 in August. A contraction is indicated by a number below 50.

European stocks saw seven consecutive months of gains, with the Euro Stoxx 600 recording an increase of 1.98% in August and an impressive 18.2% year-to-date. However, it ended the week negatively.

The Eurozone Securities and Markets Authority (ESMA) warned Wednesday that a possible market correction could occur due to the current financial markets being at or ahead of pre-pandemic levels and trading being encouraged via social media and message boards.

Gold market

This week was a busy one for the gold market. As its balance sheet reaches $6.3 trillion, the Federal Reserve continues to purchase everything. Everyone is left wondering what amount they will have when the Federal Reserve has purchased 15% of the United States Treasury. There were some significant headlines in the gold space as central banks continued to print abundant money.

1) India will issue sovereign gold bonds beginning April 20: India's government will issue Sovereign Gold Bonds in six tranches starting April 20th, the Reserve Bank of India announced Monday. Reserve Bank India will administer the Sovereign Gold Bond 2020-21 on behalf of the Government of India.

2) Turkish Treasury issues a Gold Bond: Turkey will issue gold-backed bonds and Sukuk for corporate investors, particularly retirement and investment funds. Settlement is set for Sept. 20th, the Treasury announced Tuesday. The Treasury Treasury stated that bonds would have a six-month interest rate or rent rate at 1% and a two-year maturity.

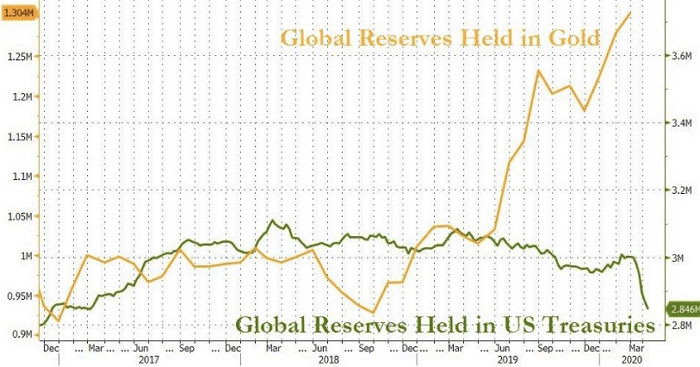

3) Central banks add gold to their reserves while dumping U.S Treasuries. Global central banks added 36 tonnes of gold to their reserve in February. This was 33% more than January's totals. Central banks have purchased 64.5 tonnes of gold this year.

It is interesting to observe that while gold demand continues its strong support from central banks all over the globe, the opposite cannot be said for U.S. Treasuries. In March, U.S. Treasuries were sold by central banks and foreign governments in a massive fire sale. In the three weeks leading to March 25, foreign holders of U.S. Treasuries sold more than $100 billion, the most significant monthly drop ever recorded.

Cryptocurrencies

Protests and technical glitches marred the Bitcoin market attempt to obtain legal tender status in El Salvador. This led to unpredicted volatility that shaken the crypto world.

Bitcoin reached a record high of $52,945 on Tuesday as it was about to become the legal tender for the small Central American country. The lead cryptocurrency fell by 18% on Tuesday to reach a low of $42,830. The current price is $45,560, which is a 1.7% increase from the previous day.

The panic in crypto markets was also mirrored by rival contender Ethereum (ETH), which crashed more than 22% after Tuesday's high of $3,973 and touched a low of $3,009. The current price is $3,320, an increase of 3.5% from the previous day's low.

The whole crypto market appears to be in a rut. All 15 coins that rank highest in market capitalization have fallen from their previous highs. We have been following them closely for the past twenty-four hours and have seen negative returns.

If the crypto world wants to be a leader among investors, especially the retail investor community, extreme volatility or whipsawing prices are not something it can afford. JPMorgan stated that the cryptocurrency markets were "looking frosty" with record-breaking retail demand.

A smooth transition to legal tender would have been a significant milestone for market leader cryptocurrency Bitcoin (BTC). It would have made cryptocurrencies once again the cynosure.

The drive could be rough till the world of digital currencies demonstrates resilience from Mean Sup $46,530, which in the progression as we speak to our Mean Res $52,600 to establish the acceptance in the mainstream financial world. Is this the time to buy the dip? You decide. Have a nice weekend!