Weekly Market Review & Analysis For September 21, 2020

This week's market was a typical roller-coaster ride that ultimately left the broad S&P 500 index down 0.6% - its fourth continuous weekly slump. The DJI Average index dropped 1.8%, and the small-cap Russell 2000 index sank 4.0%. The heavy-tech Nasdaq Composite, nevertheless, increased 1.1% for the week.

There has not been one thing stock market participants could look-up to and answer; this is why the overall market struggled. Instead, it was another week loaded with events filled into the prevailing uncertainty and the negative momentum seen this month in trading.

Growth challenges were evident in the cyclical energy sector's decay with -8.6%, materials sector with -4.6%, financials sector with -4.2%, and industrials sector -2.6% postings. The information technology sector prints +2.1%, while the consumer discretionary sector with +1.2% and utilities sector with +1.2% finished higher.

The Nasdaq returned positive at the end of the trading week, as shares of Apple, Amazon, and Microsoft bounced up charmingly on no news. These three stocks improved between 3.5% and 5% for the week.

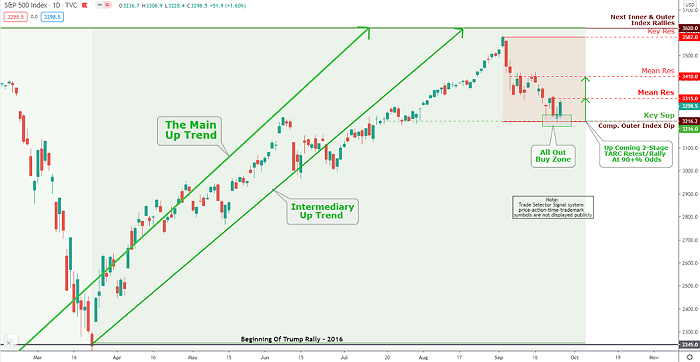

Click the Image to Enlarge

Technical Analysis and Outlook: The S&P 500 hit the Key Sup and Outer Index Dip $3,216, on September 24, respectively. The ''All Out Buy Zone'' and Mean Res $3,315 was an excellent entry up and down for the Trade Selector Signal system all week long - intraday traders accumulating a whopping 305 handles trading single E-mini S&P 500 Futures contract (We love this kind volatility).

In Washington front, the passing of Supreme Court Justice Ruth Bader Ginsburg, as seen through the Wall Street peephole, was another part that traders and investors initially thought could carry focus off from a fiscal stimulus bill before the election. Dems are reportedly cooking a $2.4 Trillion (That with the T) stimulus bill; however, it's dubious about having the backing of Republicrats.

On the COVID-19 front, Johnson & Johnson advanced its coronavirus vaccine hopeful to Phase-3 trials, while many countries in Eurozone reestablished business restrictions to help check a resurgence of the coronavirus. In China, Beijing refreshed its trade blacklist without identifying any involved companies.

Markets elsewhere

U.S. Treasuries ended mostly higher, especially on the longer end of the interest curve. The Ten-year yield faded three basis points to close at 0.66%. The U.S. Dollar Index gained esteem from posting a 1.8% increase to close at 94.59.

Over the last Thursday and Friday, the total cryptos gained above 3% in value. Ripple with 5.6% and Litecoin posting 4.7% gain were the winners. However, Bitcoin was performing well too, gaining almost 2% since Thursday. This week Monday felt like a Monday. Bitcoin’s value fell from $11,081 down to $10,135. However, Bitcoin regained its strength, as the price rebounded to $10,690.

Eurozone stock markets underperformed other regions of the world. Various countries, including the United Kingdom and Spain, responded to climbing coronavirus cases (It does matter who is counting) by reimposing many restrictions. Italian stocks held up relatively firmly after Matteo Salvini's Northern League movement showed poor results in a referendum to decrease parliamentarians' representation.

The forecasted result could have rocked the establishment of the current government. In Asia, the Japanese stock market weakened less than many others in the region, though they were closed due to Monday and Tuesday for public holidays.