Weekly Market Review & Analysis For May 10, 2021

The stock market closed the week in the red territory, although it could have been a lot more severe after hot inflation numbers toppled the market in the mid-session. The Nasdaq Composite with -2.3% and small-cap Russell 2000 with -2.1% were this week's fallen victims with losses above 2.0%, while the broad S&P 500 index ith -1.4% and DJI Average with -1.1% settled closer to 1% mark.

During the first three trading sessions of the week, the Dow Jones was as low as 3.4%, the S&P 500 index was down almost 4.0%, the Nasdaq Composite with 5.2%, and the Russell 2000 with 6.0% were down the largest. However, over the next couple of days, the Dow Jones increased 2.4%, the Nasdaq Composite advanced 3.0%, the S&P 500 index gained a hefty 2.7%, and the Russell 2000 gained a whopping 4.2%.

The terrible start for the market was attributed to negative momentum within the growth equities, rotational determinants, and an observably hot CPI (Consumer Price Index) news on Wednesday. The m/m differences in consumer prices topped expectations. When viewing at the last half a year to eliminate easy base effect observations, the total Consumer Price Index was going at an annualized velocity of 5.0%.

The traders and investors used the vulnerability as an occasion to BTD (buy the dip) with some help from numerous factors:

- A pullback in long-term interest rates, flagging that the U.S. Treasury market was not troubled about inflation despite receiving new hot inflation numbers apart from the Consumer Price Index report.

- The S&P 500 index respecting its Key Sup $4,125 and Mean Sup $4,165 (our Buy Zone)

- A viewpoint that the stock market was oversold on a long-term basis and was very likely due for a rebound knowing that they have got this fixed up so good now with these robots - See how they run like pigs from a gun see how they fly. I am “They” as They are me as you are me, and we are all together….(credit partly to ''I Am The Walrus'' by John Lennon).

Eight of the eleven S&P 500 index sectors yet ended in the red territory, including the communication services with -2.0%, information technology with -2.2%, and consumer discretionary with -3.7% the sectors amid weakness their mega capitalization components. The materials with +0.1%, financials with +0.3%, and consumer staples with +0.4% were the sectors that finished higher.

It will be interesting to see how the growth and technology stocks perform, pushing forward when capital has been rolling into the cyclical and value equities on reopening the inflation outlook and many analysts calling for supported under-performance. Numerous growth stocks are down considerably from their tops in February.

Market action elsewhere

The Ten-year market yield rose six basis points to close at 1.64% from previous Friday's settlement, although this was under the 1.70% settling on Wednesday. Commodities prices such as copper declined 2% to close at $4.648/lb., rendering many of the other commodities that chilled off this week.

The retracement and consolidation in many emerging markets are not just technical analysis gobbledygook. Emerging markets encountered this major shake-out on a shift in fundamentals data. China's monetary policy tightens, and PMI (Purchasing Manager Indices) readings climaxed as distant in November of 2020.

These situations will ultimately visit developed markets also, although there is substantial uncertainty about the timing. On the Purchasing Manager Indices, that time might be now for many countries. The last month US ISM Manufacturing Purchasing Manager Index declined sharply; Canada’s manufacturing Purchasing Manager Index weakened; while Germany and France's are even.

Stating clearly, the numbers are still excellent, and one month doesn't delegate a market trend; however, ticks lower are the initial steps to signing a peak. Furthermore, the stats out of China remain robust, and we anticipate the similarity for other economies. But, capital markets are price at the margin, and shifts in direction and momentum are significant turning points.

The Gold market was trading higher on Friday's session for the second trading day in a row after rebounding off the intra-week low mark of $1,808 entered on Thursday's session. For the week, Gold has closed on its second favorable ending-pitch.

The yellow metal finished the week with gains of almost 0.30%, which is a tiny increase comparing the 3.35% gain achieved the previous week. However, the Gold Spot/US Dollar seems to be securing longs plainly below the $1.842 price zone, which has been re-tested numerous times during the week's session.

Thursday night's CoT (Commitment of Traders) Report marked a significant rise in OI (Open Interest) of 28,352 contracts. This was the Managed Money kind category producing the buying to the range of 27,990 net metal contracts. Keep in mind that the neutral area of the net long's is about 110,000 contracts, therefore at 81,615, there is nevertheless a great deal of buying to be made before it gets exhausted.

After a sharp decline on Thursday, the cryptocurrency market is recovering again. What is the reason for this sudden decline? We could never know for sure; however, the timing is suspiciously spot-on with a particular tweet.

On Thursday, Elon Musk tweeted that Tesla will no longer accept Bitcoin as a form of payment. Tesla is concerned about the energy usage of Bitcoin - Hello.

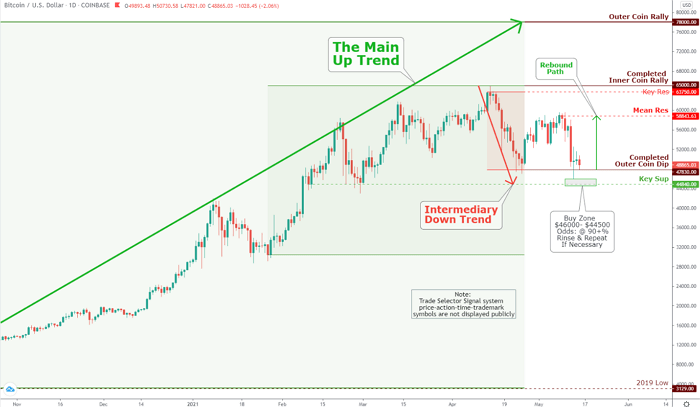

Also, the company announced that it would no longer be selling any Bitcoins. As you can see on the price chart below, the tweet left deep marks on Bitcoin's price.

At the time of the tweet, the coin price was hovering around $51,000. However, in a matter of hours, the Bitcoin price plummeted to $46,000. That's the lowest level since the 26th of April.

Ethereum, meanwhile, has climbed from zero to a market value of almost half a trillion dollars thus far. One could buy one Ethereum coin in 2020 for $187. As of now, the price is approximately $4,000. That is a 2,000% plus gain in a year – Not too shabby!

In another crypto market news, Dogecoin was back in the headlines on Friday after self-proclaimed “Dogefather” guru Elon Musk tweeted that he was “Working with Doge devs to improve system transaction efficiency. Potentially promising.” - causing Dogecoin to soar to 56 cents.

Technical Analysis and Outlook: Again, as a famous saying goes: ''Buy when there's blood in the streets''. Aggressive (Higher risk) buy could be done at completed Outer Dip $47,830, or it could well be a more prudent opportunity to buy at the zone: $46,000 - $44,500. Rebound path marked at Mean Res $58,840, on the downside primary show stopper is Key Res $44,840