Weekly Market Review & Analysis For June 22, 2020

Addendum, July 1, 2020

NASDAQ 100 index's The Main Trend, Intermediary Up Trend, Outer Index Rally $10,445, and Inner Index Rally $10,425 are all standing in an upward movement. The Trade Selector Signal BARC (proprietary symbol) formation formed at Mean Sup $9,860 is the lowest risk for entry into the exciting action. Although, push to Next Inner Rally $10,646 and Subsequent Index Rally $11,067 stands at 70%.

The stocks market began the trading week with a couple of days of gains; however, the rest of the week saw substantial selling. Many governments and companies were compelled to respond to an increase in new COVI-19 cases with preemptive measures.

The DJI Average declined 3.1%, followed by a slump in the S&P 500 index with -2.9%, small-cap Russell 2000 with -2.8%, and Nasdaq Composite index posting -1.9%. This week's most significant decliners were the S&P 500 energy sector posting -6.5% drop, financial sector -5.3%, and the communication services sector posting -5.2%. The hot information technology sector weakened by only 0.5%.

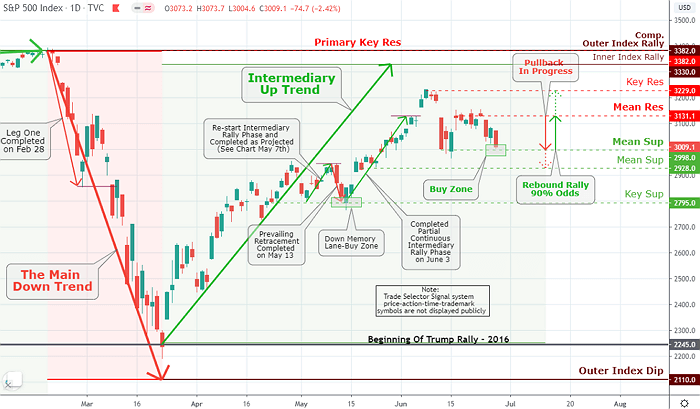

Click the Image to Enlarge

Technical Analysis and Outlook: The pullback phase is proceeding to a significant buy zone. The continuous rally phase will be triggered within Mean Sup $2,998 area; however, the retracement might push the price to the vicinity of next Mean Sup $2,928. The swift rally should take the index to Mean Res $3,131.

There was a barrage of negative-sounding news developments that raised concerns of the pace of an economic recovery, which sequentially put an end to the Nasdaq's market eight-session triumphing streak.

In the financial area, U.S. regulators loosened some Volcker Rule restrictions, permitting banks to expand their investments in a comprehensive set of venture capital funds. Out of plenty of caution, though, the Federal Reserve will require all banks to stay out of the share cap dividend and repurchases payments in the third quarter in the wake of its stress tests outcomes.

Separately, the majority of social media stocks surrendered to heavy selling pressure by the end of the trading week after exposing the fact that many companies will halt advertisement spending on Facebook - Shares of Facebook (FB) declined whopping 9.5% this week.

Market actions elsewhere

U.S. Treasuries market concluded the week with moderate gains. The Two-year yield faded three basis points to close at 0.16%, and the Ten-year yield decreased six basis points to finish 0.64%. The U.S. Dollar Index settled with a 0.2% loss to close at 97.45. West Texas Intermediate (WTI) crude oil sank -$1.35 or 3.2% to post a $38.49/bbl. Gold climbed higher.

Eurozone, like the U.S., saw symptoms of early recovery with Purchasing Managers' Index's (PMI) jumping throughout the economic region. Business and consumer confidence areas in France and Germany also improved.

Nevertheless, traders and investors directed their energies on coronavirus news, the discouraging International Monetary Fund (IMF) forecast, as well as the renewed threat by the Trump administration to inflict hefty tariffs on a long-standing controversy over the EU government subsidies to aircraft producers.

Meanwhile, the majority of Eurozone equity markets turned in a mixed performance in Friday's session. While the German DAX 30 Index has faded by 0.73%, the United Kingdom's FTSE 100 Index dropped by 1.1%, and the French CAC 40 Index sank by 0.2%.

In Asia-Pacific trading, equity markets across the region went mostly higher throughout the trading session on Friday. Japan's Nikkei 225 Index rebounded by 1.1%, while Australia's S&P/ASX 200 Index climbed by 1.5%.

Bitcoin market

It’s been a wild week once again in the crypto segment. The start of this week was great; Bitcoin reached a price of almost $9,800 on Monday. Since then, Bitcoin lost as much as $800 in value. What is the reason for this decrease?

Well, I could draw fancy lines and blow you away with Trade Selector Signal lines and projections, but the main reason is relatively simple. At this moment, there is a strong correlation between Bitcoin and the U.S. stock market. We’ll hope the upcoming week will be better!