Weekly Market Review & Analysis For April 27, 2020

Addendum, May 7, 2020

Technical Analysis and Outlook: Mega-cap tech stocks sent the Nasdaq Composite index higher on May 6th; however, late fade in the market moved the S&P 500 index with a -0.7% in negative territory. The late fade was reminiscent of the May 5 session, which took down the communication services sector, which had been drifting for most of the afternoon near its even mark.

From the technical analysis and outlook, rebound Phase #1 is in progress and continues setting the final push to Inner Index Rally $3,030, while the Mean Res $2,938 idling above. The intermediate support levels are established at Mean Sup $2,800 and $2,738, respectively. See S&P 500 Index, Daily Chart Analysis May 7, at Trading View.

The broad S&P 500 market concluded the week with a 0.2% drop. However, it has reportedly been up as much as 3.9% middle of the week in a momentum trading fired-up by reviving hopes and coronavirus therapeutic development.

The DJI Average index posted -0.2%, and heavy-tech Nasdaq Composite index slumped -0.3% posting similar declines, while the small-cap Russell 2000 index gained 2.2% for the week. The index hit TSS uptrend movement projection to Inner Index Rally $1,365 and Key Res $1,350, respectively, on Wednesday. The short term downside support was tapped at Mean Sup $1,250 and prone to execute retest to Key Res $1,360.

The market sentiment was supported this week after Gilead Sciences Inc. affirmed that remdesivir, an antiviral remedy for coronavirus, met its first endmost in an NIAID placebo-controlled research. The U.S. Food and Drug Administration permitted and approved it for contingency use last Friday. With many states (18 in total as of May 1) beginning to reopen their economies, the market was confident that things could return to normality quickly.

The normality as of late, regrettably, has been an assaulted of very weak economic reports that have outlined a disconnect between the market and the economy—distinctly noted, by the Institute for Supply Management (ISM) Index for April which showed its lowest level since 2009. The first-quarter GDP numbers contracted at a 4.8% annualized rate, and personal spending plummeted by 7.5% in the previous month.

However, there is an overall expectancy, though, that the economic numbers will only become better rolling forward. Initial unemployment claims, for example, did decline by 603,000 to 3.84 million for the week ending on April 25 - In tandem with central banks' continued commitment to support the broken financial system. Important actions by three major central banks this week introduced the following:

*The Federal Reserve (Fed) unanimously voted to keep the interest target range for the fed funds at 0.00-0.25%, warned interset rates would stay there more lasting, and opened up the scope and qualification for its Main Street Lending Program (MSLP).

*The European Central Bank (ECB) announced it would carry out a net asset purchases program under its EUR750 billion pandemic emergency plan at least through the end of 2020.

*The Bank of Japan (BoJ) raised the cap on its Japanese Government Bond (JGB) purchases announcing it will boost its purchases of commercial paper and corporate bonds.

Market action elsewhere

Ultimately, after the market had an incredible rally of the March 23 low levels, valuation uneasiness curbed in the initial excitement. Five of the eleven S&P 500 index sectors finished lower, while six ended higher in a trading week that highlighted earnings reports from Alphabet, Amazon, Apple, Facebook, and Microsoft.

The vital energy sector posted a +2.9% gain. It marked the most considerable weekly increase amid a 16.1% increase in West Texas Intermediate (WTI) crude oil futures $19.77/bbl, posting +2.74, while the utilities sector with a -4.3% faded the most.

U.S. Treasuries were mixed, generating some insignificant curve-steepening action. The Two-year yield was unchanged, closing at 0.20%, while the Ten-year yield widened four basis points to post a 0.64%. The U.S. Dollar Index weakened by 1.3% to finish at 98.68

Bitcoin market

|

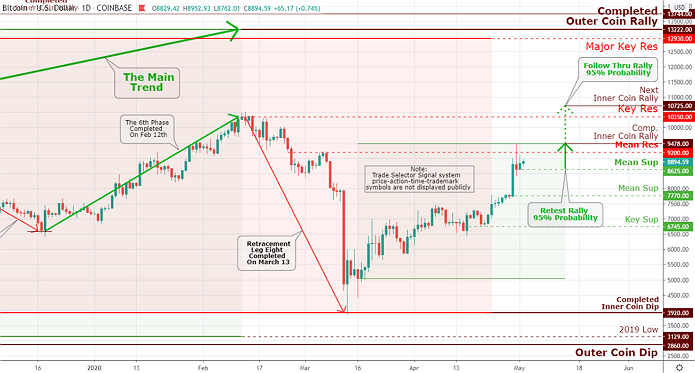

Bitcoin crypto is trading down narrowly at its current price of about $8,800. This signifies a marginal deterioration from April 30 highs of $9,479 that was set in, following completion of TSS Inner Coin Rally $9,478 and only creating a minor Mean Sup $8,625. The Bitcoin has now entered a consolidation stage as it strives to surmount the retest of the Mean Res $9,200 that ties the section between its current price action and completed Inner Coin Rally. |

Click the Image to Enlarge

×

|

Bitcoin block halving

Slightly with over two weeks to go before the Bitcoin block halving! During this event, the block reward for Bitcoin miners will be split in half. This directly affects the influx of new Bitcoins onto the market, which should have an impact on the Bitcoin price.

After this Bitcoin block halving, the annual inflation rate of bitcoin will go down from 3.65% to just 1.8%. For the first time in history, the yearly inflation of Bitcoin will be lower than this year’s global inflation rate, which is 3.56%.

It’s no surprise that many analysts refer to Bitcoin as digital gold, as Bitcoin is scarce and increasingly valuable. Speaking of that, the annual inflation of gold currently is 2.5 percent. After the Bitcoin block halving, Bitcoin’s inflation is even lower than gold’s inflation.