Weekly Market Review & Analysis For April 11, 2022

The market this week was cut short to observe Good Friday, but it was a "Bad Week" for the growth stocks in the face of rising tensions in interest rates. The effect of the growth stocks was apparent in the lower performance of those stocks. The S&P 500 dropped -2.1 percent, and the Nasdaq Composite posted -2.6 percent compared to the Dow Jones Industrial Average of -0.8 percent; however, small-cap Russell 2000 managed a +0.5 percent gain.

The small-cap index market ended higher, while the S&P 500 fell below its critical Mean Sup 4455 and closed lower. The information technology sector closed lower with -3.8 percent print, communication services with -3.0 percent, health care with -2.9 percent, and financials with -2.7 percent were sectors that led the downturn.

The drop in the two first sectors was tied to shifts in the U.S. Treasury market, and the 1Ten-year yield was up another 12 basis points closing at 2.83 percent, despite the revival of the narrative about the peak inflation. The report was further supported by a short, two-day decrease in rates in the wake of March's sizzling CPI and PPI data.

The Vanguard Mega Cap Growth ETF (MGK) decreased 3.3 percent, while that of the Invesco S&P 500 Equal Weight ETF (RSP) fell "only" 0.9 percent.

The financials market sector was particularly affected by an Earnings Per Share (EPS) miss posted by JPMorgan Chase (JPM) and a revenue miss by Wells Fargo (WFC). Other banks have posted better-than-expected results but mixed reviews for a more significant part.

The market had some positives, however. Materials with +0.7 percent, Industrials with +0.4 percent, energy with +0.3 percent, and consumer goods with +0.2 percent were sectors that finished the week on a high note.

Stocks of airlines companies were up following American Airlines (AAL) raising its first-quarter revenue expectations and Delta Air Lines (DAL) enhancing its better-than-expected earnings with positive bookings comments. The U.S. Global Jets ETF (JETS) has risen 8.0 percent in the week.

Market elsewhere

The greenback traded higher, and crude oil prices rose to boost gains. The eurodollar was down, and yields on bonds in the Eurozone were up due to the ECB (European Central bank's) policy decision to keep its base interest rate the same. The British sterling fell against the U.S. dollar, while yields on bonds within the U.K. have increased.

Stocks in the Asia region mainly were up with some resiliency after the markets digested the region's economic data and this week's continuing inflation reports coming from the U.S., which come as a need to confront the possibility of tightening monetary policy in Europe and the U.S.

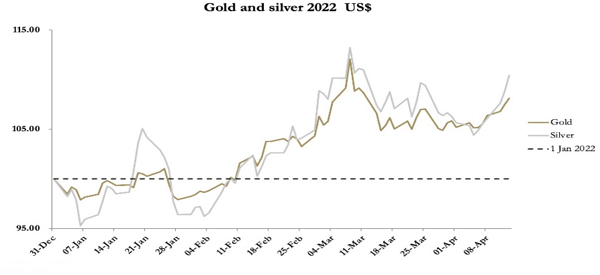

Precious metal market

The market prices of silver and gold climbed this week, with Comex silver volumes increasing while gold volumes stayed subdued ahead of the Easter holiday. Gold traded at $1,972, an increase of $26 from the closing on Friday, April 8, and silver traded at $25.64, up 93 cents in the same timeframe. Both metals face difficulties of crucial psychological price points, which are $2,000 for gold and silver at $26.

Cryptocurrencies and NFT market

This week has shown that, although confidence in crypto market is higher than ever, we still have a long way to go. For example, there was surprising news that the U.S. Treasury Secretary is not hostile toward cryptos.

On Thursday, the major cryptocurrencies have been rising, bouncing back from their low levels in the recent selling. However, data suggests that the biggest bitcoin holders are preparing to sell, resulting in price pressure in the short term. The bitcoin price experienced its most significant daily drop since February earlier this week and dipped below $40,000 on Monday, posting a low of $39,218.

Is the NFT market still booming? From $2.9 million to $280. For months, the NFT community has been screaming that this part of the market is not liquid. The high prices and huge profits are just a facade that could collapse at any moment. As the first million loss is now a fact, they seem to be correct.

Sina Estavi bought the first tweet from Jack Dorsey last year for $2.9 million. Not long ago, Estavi decided to put the NFT up for sale for $48 million. So far, however, the highest bid for bitcoin maximalist Jack Dorsey's first tweet has been a paltry $280 - No sh*t, Sherlock.

This article was printed from TradingSig.com