Market In Review & Analysis For March 28, 2020

The S&P 500 market bounced back with 10.3% gain this week, as traders and investors stepped in to buy the depressed shares of companies following Congressional approval of the $2T (Trillion) stimulus bundle for families and businesses. The DJI Average index surged 12.8%, the Nasdaq Composite index climbed 9.1%, and the small-cap Russell 2000 index advanced 11.7%.

At a certain point this week, the S&P 500 market was up whopping 20% from its intraday low levels on Monday, mainly due to stimulus package expectations, however, also on account of some short-covering trading activity, first quarter-end re-balancing, and worry of missing out on additional gains.

The active trading week did finish on a lower pitch among some profit-taking case; nonetheless, all eleven S&P 500 index sectors still ended visibly higher. Seven index sectors promoted at least 10% for the week, including a 17.7% increase in the utilities sector. The vital communication services index sector advanced "only" 5.5%.

|

The Federal Reserve, meanwhile, proceeded to accelerate its stimulus pulls. Especially, as the Fed's lifted the $700B (Billion) lid on its purchases of agency mortgage-backed securities and U.S. Treasuries, it also said it would purchase "in the amounts needed." The Federal Reserve further installed new credit facilities and declared that it would be buying municipal debt, U.S.-listed exchange ETFs for investment-grade corporate bonds, and investment-grade corporate bonds. In another helping statement, Fed Chair Powell reemphasized in an NBC "Today Show" discussion that the Federal Reserve is not going to be running out of ammo and will proceed to grant credit to areas that need it. Separately, Trump set the Easter-day holiday as the primary goal for when he would want for the U.S. economy to resume its business as usual, which brought some objections for it being premature given that the C-virus infections are still climbing. |

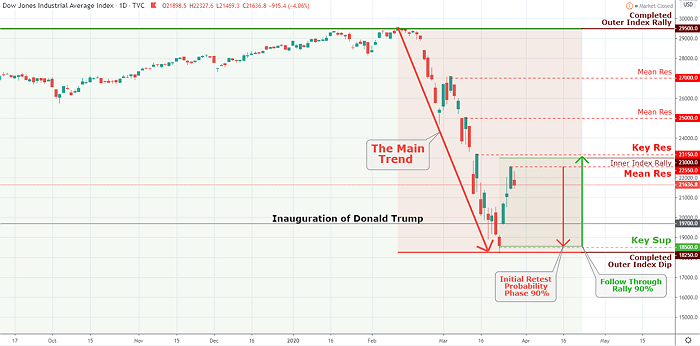

Click the Image to Enlarge

×

Since Dow Jones eradication 'Inauguration of Donald Trump' line, we have completed the Outer Index Dip $18,250 and significant Key Sup marked at $18,500, On the upside, the index will challenge a face-ripping rally of the Inner Index Rally $23,000, Mean Res in development $22,250, and Key Res $23,150; following the retest of the Key Sup $18,500. |

Elsewhere market action

Most top primary stock market(s) in Asia and Eurozone made gains. The ECB (European Central Bank) was amongst the central banks dropping limits on its bond-buying programs. Also, Germany, which is traditionally fiscally conservative, swayed towards a notable stimulus program.

A colossal stimulus package scheme gave a powerful boost to Japanese equities, despite the confirmation of a suspension of the Summer Olympics in Tokyo this year.

In a tense week, Gold and Silver metals rose steadily to higher on the deterioration of OI (Open Interest) on Comex exchange. These circumstances indicated a classic bear squeeze on the commercials and bullion banks.

Trading volumes, however, dwindled over the week, most noticeably in the Silver market, BTW, this is consistent with a lack of influential buyers other than surrendering bears.

The recent unusual selling load bullion prices encountered last week was credited in part to traders and investors compelled to sell to cover significant losses in other assets. Gold’s resilience is seen as a hint that the unusual actions of global central banks to introduce liquidity in financial markets are having the coveted effect.

A reversal in the U.S. Dollar was another indication of reduced stress in the global financial system. The U.S. Dollar Index declined by 4.4% to close at 98.30,

U.S. Government bond yields fell but settled into a moderately tight price range as opposed to the dramatic price swings observed in the past three weeks. U.S. Treasuries bonds promoted higher alongside the stock market this week. The Two-year yield decreased 14 basis points to close at 0.23%, and the Ten-year yield faded 19 basis points to finish at 0.75%.

Oil prices continued to be volatile as investors and traders began to fret that the world is running out of places to stock it. Demand for crude oil has nosedived due to the C-virus outbreak; however, Saudi Arabia has pledged to flood the global market after the breakdown of cooperation between the OPEC and Russia.

Experts are hinting that accessible storage will peter out by mid-year, placing even more severe pressure on prices. West Texas Intermediate (WTI) crude oil fell 8.8%, or $2.08, to close $21.64 as very little was created to help the struggling oil business industry.

In conclusion

Market volatility in global asset prices is expected to remain to be elevated for some time to come. So inquiring minds want to know, is the market performance this week implies the worst as well as uncertainty, might now be behind us?.

I believe that many investors don't realize the imminence of the financial failure which we are about to witness. This present crisis is not just a C-virus. Before that appeared, we were rolling down into the contracting phase of the credit cycle. And we are observing this in real-time.

We will notice that all of the payment breakdowns - fundamentally, all of the banks will require to lessen outstanding bank credit. Sadly there will be a considerable bank crisis in the Eurozone, and that will be a massive, significant development.

And that might happen very soon, perhaps a month from now. Currently, there are lots of bad debts which can't be carried by the present financial system. Thus this isn't going to disappear whenever the C-virus passes - whenever that is.