Market In Review & Analysis For April 29, 2020

The S&P 500 market faded by 0.5% yesterday in a mixed trading session. Health care and large-cap technology stocks faltered while reviving enthusiasm continued to move into the small-cap Russell 2000 index, which gained +1.3% and S&P MidCap 400 index booked +1.0%. The DJI Average index dropped 0.1%, while the tech-heavy weighted Nasdaq Composite index declined 1.4%.

The trading session started with wide-ranging gains that boosted the S&P 500 index as much as 1.5% quickly after the opening bell, as part of the continuing drive from Monday.

However, this wide-ranging momentum very quickly evaporated, presumably due to valuation challenges, but stayed in sectors of the market that had underperformed while the shutdown dread was uncontrolled.

Many of those involved in the movement were the mid-cap and small-cap stocks, as earlier mentioned, and also the cyclical S&P 500 sectors such as financials with +0.9% gain, industrials posting +1.8%, materials with +2.0%, and energy sector with +2.2%.

In contrast, the large-cap stocks that were considered as comparatively safe, and thus bettered over the past couple of months, succumbed some of their appeals on Tuesday and heavily pulled in the broader spectrum market - Where noted in the health care sector with -2.1%, communication services sector with -1.9%, and information technology sector posting -1.4%.

Monday's market surge by small-capsIt was sort of a magical day in the equity market on Monday's session. Possibly due to investors and traders becoming confident about smaller businesses beginning to open up, in consequence, the small-cap Russell 2000 index climbed higher and left other main indexes notably behind. The Russell index duplication of the return on the S&P 500 has not occurred too many times ever since 1979. But all of them have been initiated at the beginning of 2000. The S&P 500 index managed to advance over the next several trading sessions every time but once. For the Russell index, returns were much worse. That suggests the ratio between those two indices usually suffered considerably. |

Click the Image to Enlarge

×

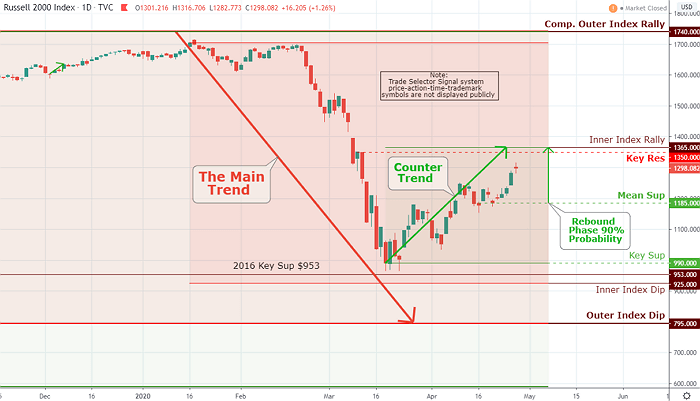

As remarked before, the small-cap index is an excellent overall market indicator; The Russell 2000 index confers an uptrend movement to our Outer Index Rally $1,365 and Key Res $1,350 territory. The short term downside support is marked at Mean Sup $1,185. |

Currently, the bulls are hoping that small-cap stocks superior performance can stay on. It is attempting to turn up after a dive, and it should be a strong indication for going forward. Throughout history, though, it has been very tough to do so following such a significant difference in returns be found on Monday.

Elsewhere

U.S. Treasuries market recovered most of Monday's damages, driving the yields lower across the interest curve. The Two-year yield faded three basis points to close at 0.20%, and the Ten-year yield sank five basis points to conclude at 0.61%.

The U.S. Dollar Index settled by 0.2% lower to close at 99.95. West Texas Intermediate (WTI) crude oil sank 1.6%, or $0.13, to finish at $12.09/bbl; however, it was depressed as much as 22% at a point in time throughout the session.

With Gold, we remain constructive for the metal short-term to medium-term price action. Nonetheless, we are more concerned about the danger of double top formed at the Key Res $1,729, very similar to what we saw in early March. The last week's close on Friday session above $1,729 was very valuable to medium-term progress; however, the lack of follow-through sounds an alarm bells.