Market In Review & Analysis For April 22, 2020

The S&P 500 market declined 3.1% on Tuesday's session, closing in the vicinity session lows for its second consecutive decline, as trading risk sentiment remained subdued by the ongoing turbulence in the crude oil futures market. The DJI Average decreased 2.7%, the Nasdaq Composite index sank 3.5%, and the small-cap Russell 2000 dipped 2.3%.

|

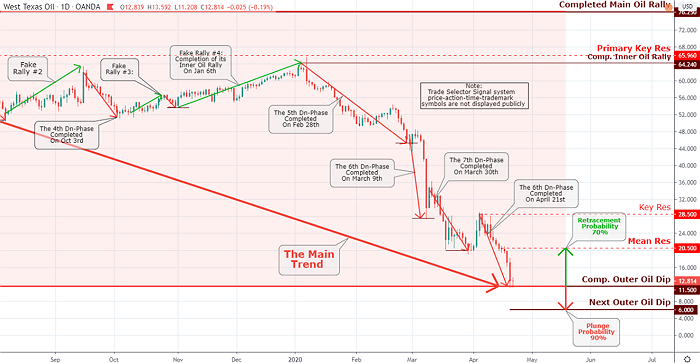

The WTI May contract officially expired at $10.0 per barrow after falling into negative territory yesterday. However, the fundamental dilemmas that drove the May contract into the red zone continued to irk the rest of the crude WTI futures trajectory. The June WTI futures contract dived whopping 43.0%, or $8.70, to close at $11.57 per barrow, much as it did reach $6.50 at its low. Concerning crude oil prices, there was one aspect of getting an abnormal collapse in a front-month (May) contract traded for a negative amount for the reason that no one wanted to accept delivery, and there is no place to store it. Also, Brent crude oil is showing that same uneasiness with its June contract being depressed by 15% after a 9% decline yesterday. |

Click the Image to Enlarge

×

WTI will advance in steadily to higher mode, following completion of our Outer Oil Dip $11.50 projection, and proceed to our Mean Res $20.50. on the downside, we have the next trading playing field, which is marked at Outer Oil Dip $6.0. |

You see, traders locked into futures delivery contracts are discovering it is more economical to pay someone to pick up the oil than to attempt to secure a site to store the crude. Distribution operates through oil future contracts created in the past for future distribution. These future contracts were purchased before the economic shutdown, which has considerably lessened the demand for oil. It is more economical to pay someone to pick up the crude oil than to break the future contracts - Wow!

Market action

Notably, the market of the S&P 500 index energy sector declined -1.7%, it showing was relatively good, notwithstanding the increasing risks of credit defaults, dividend reductions, and job losses fronting many of its components. President Trump might be able to have eased some problems on the jobs front after pledging to preserve and protect energy companies with appropriate funding.

As for the more ubiquitous market, there might have been a common understanding that it was slated for a breather following the awesome rally from the March 27 lows, with the trepidation in the crude oil market leaving for some rethinking regarding the future economic outlook.

The red hot information technology sector posting -4.1% and underperformed in a very rare drive amid broad-based selling action, which involved an earnings-related slump in IBM stock with a -3.65, or -3.0% decline. The utilities sector showed -1.6%, and the real estate sector posted -1.6% declines bestowing the least yesterday.

In other earnings announcements, Dow Jones components Coca-Cola posted -1.22, or -2.6% loss, and Travelers printed an unchanged result, concluding mixed following of their earnings summaries.

Separately, in the U.S. Treasury bond market, longer-dated trends proceeded to show strength in a financial protection trade. The Two-year yield dipped one basis point to finish at 0.20%, and the Ten-year yield faded six basis points to conclude at 0.57%. The U.S. Dollar Index increased by 0.2% to finish at 100.21.