Market In Review & Analysis For April 18, 2020

The stock market had an extraordinary trading week, which is becoming, for the most part, cliche to say. Thus far, every week ever since February 19 has been remarkable, yet this week's action one ranks at, or proximate, the very top of extraordinary weeks.

In market action, the small-cap Russell 2000 index was the lonesome loser posting -17.6 or -1.4%. The DJI Average posted 523 points or 2.2% gain, the S&P 500 index managed a respectable 85 points or 3% posting, while red hot tech-savvy Nasdaq Composite Index climbed 497 points or 6.1% on the week.

Here are some topics of the importance we have learned this week:

- The American largest banks, including Bank of America, Wells Fargo, and JPMorgan Chase, recorded substantial increases in their procurements for credit losses as they prepared themselves for a probable huge wave of charge-offs.

- Retail sales sank 8.7% m/m in the month of March, which is the most significant decrease on record.

- The West Texas Intermediate May crude oil contract futures market plunged whopping 21.8% to close at $18.14/bbl.

- The industrial production index dwindled 5.4% m/m in the month of March, which was the most detrimental slowdown since 1946.

- The Empire State Manufacturing Survey report shows the lowest level on record an incredible -78.2 decline, while the Philadelphia Federal Reserve Index plummets to its lowest account since July 1980 with -56.6 posting.

- The National Association of Home Builders Housing Market Index, which is a mark of homebuilder sentiment, dived to a record low of 30 for the month of April from 72.0 in posting in March.

- Housing starts drooped 22.3% m/m in the month of March to a seasonally adjusted annual rate of 1.216 million units, recording the most significant drop since March of 1984.

- The Leading Economic Index (LEI) for the month of March showed the worst drop in the 60-year history of the LEI with a decline of 6.7% m/m.

- The Paycheck Protection Program (PPP) relinquished its $350 billion limits, leaving millions of small/medium businesses deprived of support.

- Initial job claims ending for the week April 11 added 5.245 million applicants, making the four-week total for the initial job claims to more than 22 million. Renewing claims for the week closing of the April 4 cracked a record of more than 12 million.

Those were shocking and ill-fated developments, underlining the depth of the U.S. economic downturn, which has been caused by the shutdown actions aimed at controlling the spread of C-virus. The equity market, though, did not trade so much on the duration of the downturn as it did on the anticipated depth of the decline.

To that tip, it rallied on the belief that local and state economies throughout the nation, and economies in the Eurozone, will be reestablishing their business activity soon as confirmation is growing that the C-virus curve is downturns, especially in New York, which has been the epicenter of the outbreak in the U.S. Apart from that, Germany announced it would start to ease some of its shutdown constraints beginning as soon as Monday, April 20.

The reopening expectation went well into overdrive on Friday trading session after the White House's released guidelines revealing which states can foster and begin resuming their economic business activities.

That announcement story was joined by a STAT News article which hinted at a clinical trial of Remdesivir experimental drug of Gilead Sciences, Inc. tested at the University of Chicago Medicine has revealed some very encouraging results in healing patients with critical cases of C-virus.

This viewpoint fired a robust rally on Friday session to close out the trading week, which had a bearing on investors sitting on the fence out of panic that they might miss an opportunity on farther potential gains.

That squeeze was strengthened by the understanding that the stocks have taken such an indifferent attitude in the light of dreadful economic reports. That is why there is a simultaneous argument brewing that the stock market has grown too fast and is due for a reversal.

The next week will present some answers concerning that argument; however, the trading sessions left behind this week stressed the outperformance of mega-cap companies like Apple, Alphabet, Microsoft, and Amazon, leadership from the consumer staples, and health care sectors, and relative vulnerability in the small-cap, mid-cap equities, and in both the energy and financial sectors.

|

In summary, there was some passive-aggressive positioning uncoiled during the week as market participators were driving toward stocks that likely have the means to hold up strong in a challenging economic environment, and shifting away from the equities of companies that are seen to be as the progressed risk of underperforming. The vital energy sector experienced the worst of trading ruts going into Friday session, never the less it closed with significant hoopla. The energy sector achieved a gain of 10.4% on Friday session alone, however, to give one a taste of how wicked it had been doing, the sector still only endured ending the week up barely 0.2%. Never the less it was a modest victory, though, in an extraordinary trading week for the stocks, whose resurrection expectation went unmatched in the U.S. Treasuries. The Ten-year Note yield closed the trading week down eight bps, finishing at 0.65%. Gold market |

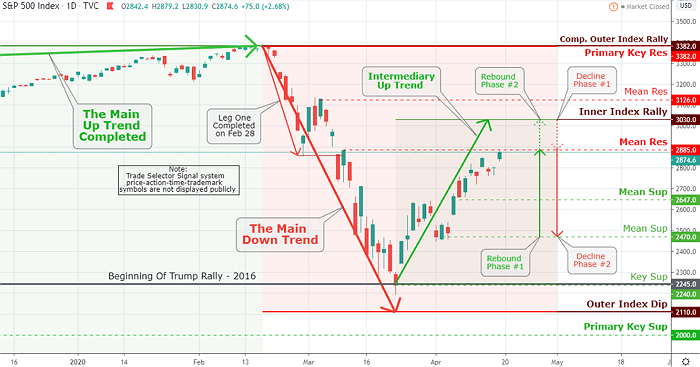

Click the Image to Enlarge

×

The Inner Index Rally $3,030 is in progress. The main Intermediary-tend is currently in the offing - with the Phase-one completed. Mean Res $2,885, the Mean Res $3,126, and Primary Key Res $3,382 idling above. The intermediate support level is established at $2,647. |

Following the market dash-for-cash sell-off, in the month of March, Gold has rallied powerfully to a 7-year high hitting just below $1750/oz. Notwithstanding the need to consolidate, the Gold surrendered $35 on Friday and with that, the risk flagging additional mini correction,

TSS's long term view continues to be firmly bullish. The level of stimulus monies currently working into the global economy is prone to support Gold over the upcoming years with yield curve checks likely to accelerate real yields much more in-depth into negative territory.