Market In Review & Analysis For April 15, 2020

It was a good trading day for the stock market yesterday, as traders and investors showed optimism in a global economic recovery, notwithstanding the uncertainty beckoned by some of the nation's numerous influential banksters.

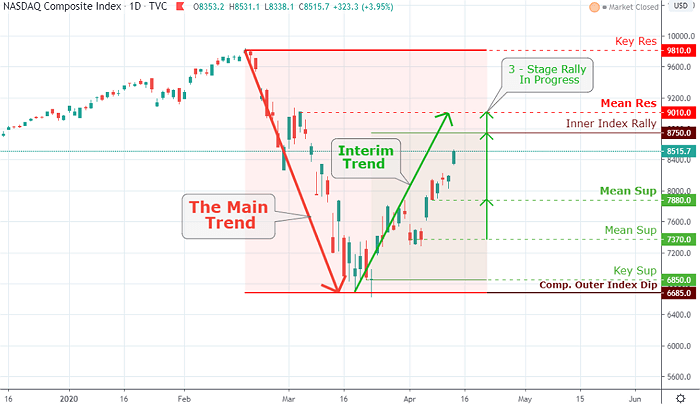

The Nasdaq Composite Index climbed 4.0%, uprooting ahead of the S&P 500 index, which posted +3.1% gain, the DJI Average posted +2.4%, and small-cap Russell 2000 index gained +2.1% on the day, for its fourth continuous advance.

|

JPMorgan Chase posted -2.69, or -2.7% along with Wells Fargo -1.25, or -4.0% kicked off the first-quarter earnings reporting period with disappointing quarterly returns. However, more appropriately, they aroused some attention by extensively increasing their requirements for credit losses. The latter exemplified the challenges the vest companies are preparing to given the unusual circumstances. Wall Street was not concerned with uncertainty on Tuesday's session, though, as it to be comforted by the impression that the U.S. economy will strategically return to its business through a coordinated strategy from federal as well as state officials. Furthermore, better-than-feared commerce data for the last month out of China might have aided traders and investor sentiment also. Market actionThe S&P 500 market consumer discretionary sector recorded +4.2% while the information technology sector with +4.2% outperformed on the back of robust gains from Amazon Inc. with +114.45, or +5.3% gain. |

Click the Image to Enlarge

×

NASDAQ's Outer Index Dip $6,685 is completed as of March 18 trading session. The current Inner Index Rally $8,750 is in progress, while there is Mean Res $9,010 resting above to complete the rebound. On the downside, there is Mean Sup $7,880 and $7,370 with major Key Sup $6,850 to be conquered at a later time. |

Apple Inc. recorded +13.80, or +5.1%, and Microsoft printed +8.19, or +5.0% on the day. The health care sector with healthy +3.3%gain was driven higher by Johnson & Johnson by posting +6.26, or +4.5% following its first quarterly outcomes.

It seemed, then, that only the financials sector with a +0.3% and vital energy sector with a -0.5% yesterday showed underlying anxieties many investors yet have with the U.S. economy. The essential energy space was particularly pressed by a 10% decline in crude oil prices with -$2.20, or -9.8% drop, as the oil industry continued to be hampered by the lack of significant oil demand, notwithstanding the forthcoming production cuts.

U.S. Treasuries market stayed firm, notwithstanding the bullish price action in the equity market. The Two-year yield decreased one basis point to post a 0.22%, and the Ten-year yield was unchanged, closing at 0.75%. The U.S. Dollar Index faded by 0.5% to close 98.85.

Tuesday's session economic numbers were limited to Import and Export Prices for last month: Import prices dipped 2.3%, while prices, excluding crude oil, were unchanged. The export prices decreased by 1.6% last month, and prices, excluding agriculture products, declined by 1.5%.

Gold continues the upward acceleration phase and established new highs in majority currencies except for in U.S. Dollars. Although our next Outer Gold Rally outcomes of $1,765 and $1,850 will soon be hit on the way to much higher price levels.

What's next

Glancing ahead, trader and investors will be engulfed by reports today: Industry Production, Capitalization Utilization and Retail Sales for March, for the April NAHB Housing Market Index, the Empire State Manufacturing Index, the weekly Mortgage Bankers Association Index, for the February Business Inventories, and Net Long-Term Treasury International Capital (TIC) Flows.