Market In Review & Analysis For April 11, 2020

The stock market recovered through the past week as traders and investor sentiment stayed on the upside while the Fed proclaimed more proactive action. The S&P 500 index advanced 12.1% while the small-cap Russell 2000 posted +18.5% outperformed.

The advance was hindered by a retreat on Tuesday, although the next two trading days marked the S&P 500 index climbing to its best price level in almost a month. All eleven index sectors posted higher than 4.5% with nervous real estate posting +21.2% gain, materials sector print of the +20.7%, and financials sector putting +19.1% increase leading the trend.

Much of the market's enthusiasm for the past week was thanks to expectations that the top of the C-virus explosion is coming to an end. Yet, the latter part of the trading week witnessed more headlines news regarding stimulus programs.

Democratic House Speaker Nancy Pelosi announced to Democratic lawmakers that she fancies the following spending package to be no less than $1T (Trillion). At the same time, U.S. Treasury Secretary, Steven Mnuchin, stated that the airline's industry would be the recipients of the next financial assistance package.

Gold market soarsThe Gold market promoted sharply higher in early trading on Thursday after the U.S. government stated another 6.6 Million Americans working-class filing for unemployment prior week. The Gold continues to captivate the awareness of safe-haven traders and investors concerned about grinding disinflation in the short run, lurking financial system risks, as well as the potential for inflation moving forward. Gold was up almost $38 closing at $1684 on Thursday session (ending on Thursday due to Easter weekend holiday) up 4.5% on the week and up over 11% year to date (YTD). Silver market was up 49¢ on the day at $15.40, up 7.6% on the week, but down 15.3% YTD. |

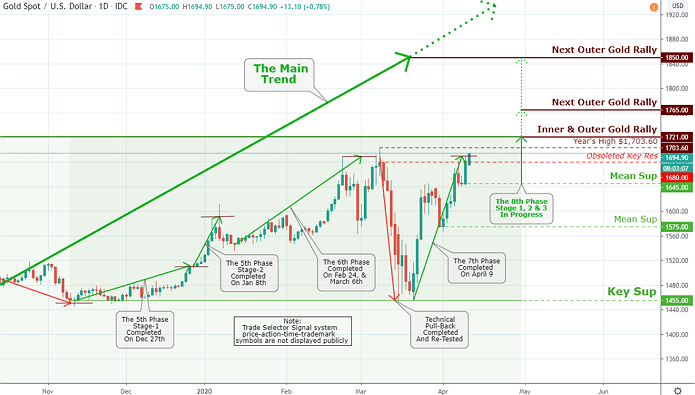

Click the Image to Enlarge

×

The major rally is on the way with the 8th Phase Stage 1, 2 & 3 in progress. The initial Inner and Outer Gold Rally is marked at $1,721, with following Outer Gold Rally projected at $1,765 and $1,850, respectively. The primary support now stands at $1,645. |

Federal Reserve ends the capital market(s) as we knew them

The Fed crossed a very complex but significant line on September 17, 2019, once the “repo” market burst into flames. On that crucial date and time, the Fed began directly monetizing the federal government’s big-spending appetite.

Or stated a different way, on that very date, the federal government no longer obliged to be necessitated by borrowing and taxation - the usual sources of finance for a U.S. Government. Because that vital day, it was given direct access to use and spend the Federal Reserve’s printed money.

This arrangement has a name. It is named “monetizing the debt.” And it is the thing many governments do when they choose to kill their currencies and serve their friends - Exactly just like in 2006 through 2009, gains and profits are privatized, and losses are socialized.

Ever since September 17, 2019, the Federal Reserve has monetized more than $2 Trillion of about 10% of America’s Gross Domestic Product (GDP). Thus, the main scheme of federal government funding seems to have changed in a long-standing way.

So, no longer will vest governments feel restrained by their abilities to borrow from bond investors and tax the population. They can instantly pay up and spend by directly tapping their central banks for newly printed fiat currency.

This past week the Federal Reserve stunned markets by creating something, not even former Fed chair Ben Bernanke attempted to do, start purchasing investment-grade corporate bonds.

The Federal Reserve's nationalization of the whole bond market was concluded when the Federal Reserve with the godsend of the U.S. Treasury - tossed the whole shebang at the most exposed and vulnerable verticals of the bond market.

So, the central bank will immediately start buying all junk bonds, municipal bonds, ETFs, and Collateralized Loan Obligation (CLO). With that, the only thing refraining from the Federal Reserve's total takeover of capital markets is stocks, which the Federal Reserve will begin purchasing after the next crash.

The bond owners are going to be served as the first dish at this meal. They just have not realized it yet; however, when they do, the whole bond market is going to get auction off to the Federal Reserve.

If I held any bonds in my investment portfolio, I would be stumbling over to exchange them for Gold, equities, real estate, commodities, crude oil, farmland, or anything else of tangible value.

By the way, this is why the stocks, Gold, and Silver are flying right now. In reality, it has nothing to do with the global economic realities of the C-virus or the harsh recession we are heading into.

It is just that the equities treasures it when the Federal Reserve creates money out of thin air and lets the feds spend as much as its hearts desire.

Next week will deliver the spring of earnings season for the Q1 with big banks like Citigroup, JPMorgan Chase, and Wells Fargo, set to publish their returns between Tuesday and Wednesday.