Market Commentary & Analysis For March 18, 2020

The S&P 500 market bounced back 6.0% yesterday, as traders and investors responded positively to new monetary stimulus proposals and the probability of an assessed $1T (Trillion) fiscal incentive stimulus package. The DJI Average climbed 5.2%, the Nasdaq Composite index advanced 6.2%, and the small-cap Russell 2000 index improved 6.7%.

The Gold's market rout and failure to rally over the past several weeks, as the coronavirus spreads rapidly and globally economic uncertainty rising, has triggered a significant proportion of skepticism about what role Gold does play.

|

But in the short and intermediate-term, the precious metal is being tested by a continued need for the pay up and “dash for cash.” The Federal Reserve, meanwhile, set up a temporary makeshift commercial paper funding office to help alleviate stresses produced on commercial paper markets, as many companies typically procure from the market short-term financing. The U.S. Treasury Secretary affirmed the decision, and the Treasury Department will grant the Federal Reserve $10B (Billion) in credit protection stability and the means to purchase up to $1T in the commercial paper if required. |

Click the Image to Enlarge

×

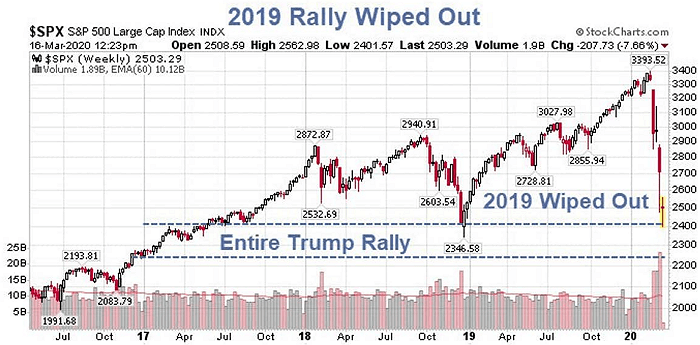

As you can see, thus far, not only all the gains of 2019 were erased, at least for now, but the entire magical rally since Trump assumed office is at risk. |

Addendum March 19, 2020

Dow Jones Industrial Average eradicates all gains since Trump assumed the presidency.

Market action

The market, despite the stimulus program and preventative measures, was on a defensive rally action commenced by the S&P 500 utilities sector with +13.1% gain, consumer staples sector posting +8.4%, and real estate sector advancing +6.9%.

The vital energy sector with +0.7% underperformed between on-going weakness in the price of crude oil with -6.3% closing at $26.90 on the day.

Separately, the tenuous underperformance of the Dow Jones was due primarily to the decline in shares of Boeing with -4.2% posting, which had it's Standard & Poor's Financial Services credit rating decreased to BBB level due to more inadequate cash flows - However, President Trump did express financial help to the company.

The uncertainty was also seen manifested in Marriott Hotels, which dropped -12.9% and started to furlough its employees without pay. On a similar note, Facebook posted a +2.3% gain and announced it would provide $1,000 to workers to cope with the C-virus situation.

United States Treasuries sold off in an interest rate curve-steepening trade; this is not because of a more favorable economic outlook but because of uneasiness that much longer-dated bonds will be required to fund a mounting national deficit.

The Two-year yield climbed eight basis points to close at 0.45%, and the Ten-year yield grew 27 basis points to finish at 1.0%. The United States Dollar Index advanced 1.5% to close 99.5 on the day.

In conclusion

It seems that people would do well in recognizing that the C-virus epidemic situation is quite tricky and develop a preparedness plan on a personal level for potential supply food disruptions as well as other unpleasantries.

I hope, of course, that coronavirus conditions will turn out much better than we presently fear, although we cannot blindly rely on such optimism.

Meanwhile, traders and investors should anticipate even more market turbulence in the many weeks and months ahead, especially if the economic consequence of the C-virus epidemic threatens to become more lengthy and severe than is currently believed. Caution emptor clearly continues to be the watchword.