Market Commentary & Analysis January 4, 2020

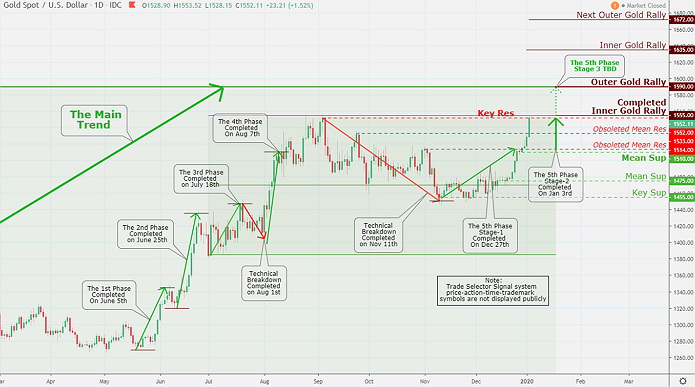

The Gold market past week was stellar. The closing price on Friday session was $1,552, up $38 for the week. The Gold prices opened on Monday at $1,511 traded as high as $1,553.50 on Friday.

The Gold main support level is now determined at Mean Sup $1,510, then $1,475, and Key Sup $1,455. With prices resting at Key Res $1,552, the foremost resistance predicted since August 7, 2019, is Outer Gold Rally at $1,590 and $1,672 respectively - in interim, we have Inner Gold Rally marked at $1,635.

The Friday trading session in the Gold market was very unusual. And the fact that Gold closed almost at the highs of the day, while it kept-on pushing higher every time it attempted to pull back suggests higher prices are due to follow next week.

Click the Image to Enlarge

The 2020 market ends the S&P 500's winning five-week streak

The stock market ended an outstanding 2019 on a quiet drive, starting a new year with a big bang, then yielded to some profit-taking after a United States airstrike intensified geopolitical tensions in the Middle East.

By week's end, the broader S&P 500 index declined 0.2%, the DJI Average faded 0.04%, and the small-cap Russell 2000 index backslid 0.5%. While the Nasdaq Composite index, nonetheless, did expand by 0.2%.

The optimistic, yet short-lived, incentive past week was China's announcement that it would lower the reserve requirement ratio for large and small banks by 50 bps on January 6. The adaptive policy contributes about $115 billion in extra liquidity that can be loaned.

The markets swiftly gave back gains the next day on Friday session following United States airstrike around Baghdad Iraq airport that killed General Qasem Suleimani - Iran's top military leader. Also, the latest Manufacturing ISM for December, which declined to its lowest level as of June 2009, damped risk sentiment.

Given the seriousness of the Middle East circumstances, the failing manufacturing numbers, and how far thus the stock market record run has become, traders and investors didn't overreact.

Selling influence was reasonably modest on the hypotheses that the geopolitical anguish is not something to get unduly concerned and that Fed's easing will aid the manufacturing sector in overcoming vulnerability.

In other worthy news, Trump said the Phase One trade agreement with China would be signed on January 15 at the White House, and he will later pay a visit to Beijing for Phase Two discussions. The market response was muted to the message, suggesting it was already priced in.

Elsewhere

United States Treasuries concluded the week higher, as traders and investors did find some protective positioning. The Two-year yield declined seven bps to close at 1.51%, and the Ten-year yield declined eight bps to finish at 1.79%.

The United States Dollar Index (DXY) ended flat at 96.89. The West Texas Intermediate (WTI) crude oil advanced 3.05%, or $1.86, to close at $63.05/bbl.