Gold and Silver Market Commentary & Analysis November 9, 2019

The Gold and Silver market suffered its most significant weekly drop in two and a half years this week (percentage-wise). The Gold declined $55 from previous Friday's close to trade at $1,466 as the Silver fell $1.33 to $16.75 or 1.99%.

Gold and Silver's intense selloff

Gold and Silver price action was to be expected, granted the metals have been severely overbought. We understand and know that in overbought circumstances, the commercial and bullion banks, which function as market makers became prominently short while the traders and investors are incredibly long.

All that is needed is a pause in the movement of speculative and investment buying for the commercials and bullion banks to hit the market, recognizing they will trigger critical stop losses placements, commencing a tsunami of selling by speculators as well as investors who will be frantic to avoid heavy losses.

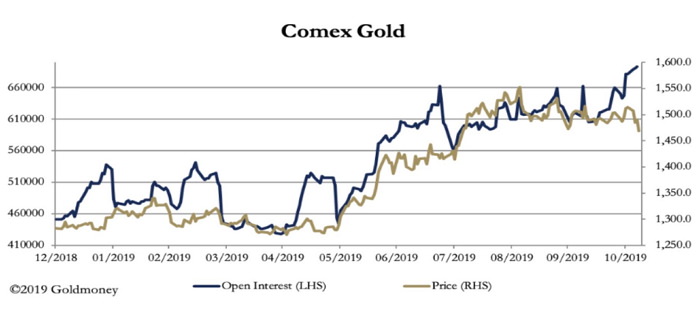

All this would be shown in a fall in the number of outstanding contracts. The commercials and bullion banks will have got their short positions back, and the rest of the players retreated to lick their wounds, while the trading volume subsides. However, this isn't actually what has passed, as the Gold' Open Interest' (OI) chart shows.

As an example, commonly, we would presume that the directions of both OI and the price runs in tandem. However, OI on Friday session sharply soared as the Gold price plunged, as did the trading volume. These conditions usually are linked with a bear market capitalization, which by the way, doesn't apply in this market.

Never the less we need to investigate farther. At the end of the month, the December Gold Comex contract expires, as it's opening the doors to be succeeded by the February 2020 contract. As the preliminary numbers are showing, the total December contracts of 19,158 were closed on Friday, while 37,088 February 2020 contracts were formed.

Consequently, notwithstanding the imminent ongoing contract expiry, some big speculator money is duplicating up rather than running frightened at this trading stage of the contract period. Furthermore, Friday's trading volume standing at 827,696 contracts was notably high, and OI stood at 709,497 contracts - this is a new record level by a considerable margin.

There might be a possible explanation for this condition, which we can't prove, and that is big and smart money expects and believes of a result which will push the Gold price a much higher. And within the same inside knowledge, the "institution" of government and central banks exchange stabilization funds are working in concert to hold the Gold and Silver prices down.

The difficulty always faces in assessing these circumstances is that Comex exchange is only a small part of the story. The London forward metal market is habitually much more abundant in terms of turnover. Then we have further issues of the availability of physical bullion metal upon which these and many other derivative masses are based.

Comex exchange is the only small part with a timely message. We shall have to remain patient and discern what will transpire in this hot atmosphere.

On the active news front line, there is not much that is new at this time. It seems the tariff war between the United States and China may be waning, and U.S. Treasury bond yields rates have escalated in the recent few weeks. Stock markets are tapping constant new highs. And with astonishing $17 trillion (That's with 'T') of negative-yielding bonds, these markets look destroyed, giving us little credible information.

Click the Image to Enlarge

Gold and Silver Technical Analysis and Outlook

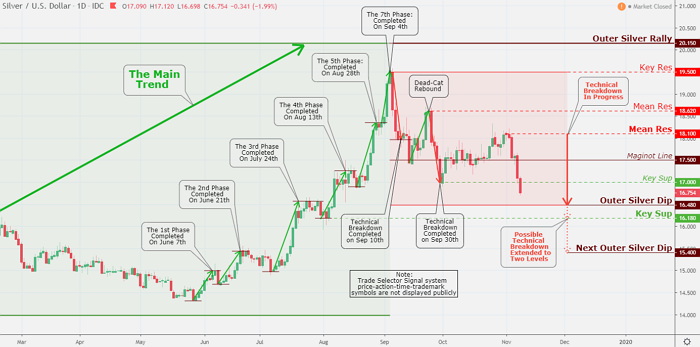

Thursday and Friday for Gold and Silver were an ugly couple of trading days; both metals broke down through critical supports. The selling was furious and fast throughout both days as there were no buyers. Silver went through Maginot Line $17.50 and Key Sup $17.0 levels and is heading towards Outer Silver Dip mark at $16.48.

The collapse was as we have scripted over all the logic why both precious metals should be higher. Yet here we are busting two significant support levels at risk of breaking down further to possibly Key Sup $16.18. If Silver can not hold the $16.18 support level, the next Outer Silver Dip is $15.40.