In a volatile market, search for a life-saving raft

The volatile market in the first half of 2022 has been the dominant action. And will be recorded in the books, but not in an exemplary manner. The stock market has finished its lowest six-month beginning in any historical year, dating back over half a century.

It's also been one of the few times in the past fifty years that the S&P 500 and bonds have fallen over ten percent. This is just how rare this present volatile market is. In reality, there has been virtually no place to hide.

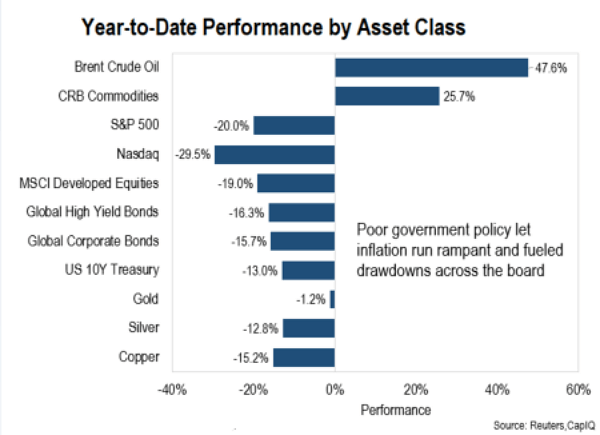

Unless investors were involved in crude oil-related equities or other selected commodities, as shown in the above chart, most investors are likely to see a sea of red on their portfolios.

The pace and severity of this drawdown blew many of our dear readers away. It's also true that this volatile market could manifest in the high-growth investments we usually cover in Market Intelligence.

We will pause in the stock market activity and explore new investment techniques that will allow us to weather this volatile market.

Currently, the interest rates are rising. In June, the Fed increased the benchmark rate of interest by another 75 (bps) basis points. The most significant rise since 1994. And that gives us a range of 1.5% to 1.75%. The Fed could likely raise rates at their meeting on the 26th and 27th of July.

Even though these are historically meager rates, it is not difficult to see how a fixed-income investment could unexpectedly be more attractive. For example, in recent years, many have been disappointed by the pathetic 0.5 percent offered through "high-yield" savings accounts.

The capital we hold at 0.5 percent in a world where inflation is 8.6 percent implies that we're losing money every month. Because we're not earning more than inflation, and our purchasing power decreases.

This is why it is crucial to put capital into investment assets to fight inflation and boost our purchasing strength. In the coming weeks, we will discuss investments that offer the most efficient method for the next six to twelve months.

In volatile market funding, our risk

In a volatile market, there is a way to build up regular income - monthly or annually can help us finance our higher-risk and higher-yield investments in the future.

While we are waiting for this wild, volatile market to end, we can guarantee ourselves by ensuring that we receive a predictable and steady return.

We can turn the tables and employ the earnings to benefit from the depressed valuations of assets. Many of these assets will have tremendous growth potential after markets return to their normalized stable trading mode, including high-growth small-cap equities, biotechnology in its early stages, and digital assets.

That way, as we continue to observe a volatile market in the short term, we will still have our capital safe with stable dividends or interest-paying investments. Furthermore, we will generate additional wealth that can be used to fund our future investing strategy.

We all know that the current volatile market can be challenging, and sometimes we wish to have days to short the entire market. When we observe these kinds of market behaviors and destructive Fed policies, we find it helpful to remind ourselves that equity markets will improve (And they always do). We will return to a growth investing mood.

We have been through hell on steroids for the last couple of years. We see the most destructive monetary, fiscal, and economic environment ever witnessed in our life cycle and raging inflation. All these things weigh very heavily on investors every single day.

Though, until we return to more healthier market situations and come out of the greenbrier patch, our regular strategy of investing in stable growth companies will not benefit us investors well.

Nowadays, we must make amendments and intelligently do things somewhat differently. However, when the time for some stability arrives, there are wise moves that we will be able to make and create with our capital, especially in an economic and volatile market situation as we have right now.

This article was printed from TradingSig.com