Stock Market Investing Foolishness And Its Downside

High emphasis points in stock market investing, like high emphasis points in life, are both enlightening and humbling. One minute you think you have captured the world by the tail. The next minute the rug is pulled right out from beneath you.

Where the stock market investing is concerned, many critical parts are shown following high emphasis points. These factors aren't always apparent at the beginning. However, they become evident over time. Most prominently, it is displayed that the time preceding up to the high emphasis points was more suspected than previously recognized.

The equity market, as represented by the S&P500 Index, became a sort of capital minting tool over the last ten years. Each month, each quarter, investors opening their brokerage account statements to the total enjoyment of a beef top portfolio. Trading and investing has been fun – and very easy.

Without any delays, investors and traders got lot more out of the stock market than they put in. Vest of them also took more out of the stock market than the underlying economy justified. The stock market investing given the illusion of prosperous accomplishment that many investors and traders substituted for the genuine thing.

Indeed, the economy expanded, and corporate earnings grew higher. Thanks to corporate debt based buybacks produced by the Federal Reserve’s cheap money, rising stock prices significantly outpaced real corporate earnings. Stock valuations rose exponentially, and yes, stocks became a lot more expensive.

With the end of a near ten-year long bull market produces further transparency as well as reflection upon the plenty of blunders that mounted over the agreeable boom. For instance, the reassurance of ever-rising stock results, over such a long term, taught a full spectrum of traders and investors a very critical lesson. That everyone can get fancy rich without applying one’s brain power.

Stock Market Investing Chaos and Catastrophe

Stock market investing over the past ten-years was degraded to a thoughtless effort. Why try deciphering a corporate balance sheet if you can purchase the whole market via a passive stock index fund? Why sort through a huge listing of companies hunting for value-laden diamonds in the unfinished state, while the entire unfinished state plays like a diamond?

Admittedly, for nearly ten years buying the market by investing in an Exchange Traded Fund, or stock index fund was an uncomplicated and triumphant strategy for creating investment wealth. If you invested $1000 in the S&P500 about a decade ago, you would have well more then $3000 now. Not too shabby return for foolishly disposing investment funds into the stock market.

The last successful decade, nevertheless, will be nothing like it for investors and traders as the earlier one. First of all, a decade running bull market isn't the typical norm; they are an abnormality. For the next decade, we suspect a passive stock indexing approach will confront a string of obstacles that many stock index fund followers are ignorant about it.

Legendary John Bogle, a founder of The Vanguard Group - Mutual funds, as well as the architect of the world’s first stock index fund, nowadays, has doubts about the innovation he built nearly four decades ago. At the Berkshire Hathaway shareholder meeting in 2017 he said:

“If everybody indexed, the only word you could use is chaos, catastrophe. The markets would fail.”

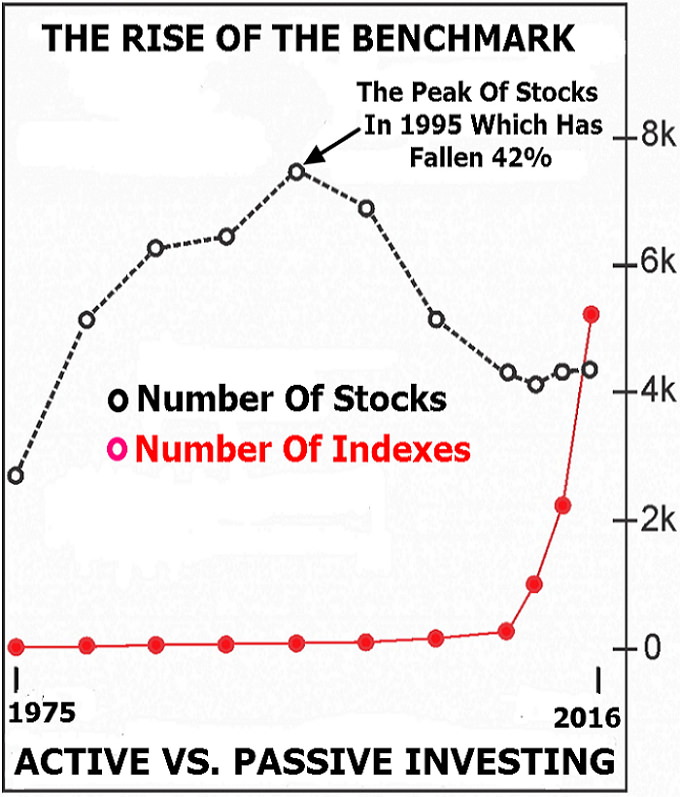

Looking at the chart it surely seems as though everybody is utilizing indexing strategy at this point (the chart is slightly out of date). This huge movement toward passive investing strategy has indeed created numerous unintended side consequences.

Unquestionably, stock index funds and Exchange Traded Fund's have given numerous advantages for investors as well as traders. Most importantly, they have reduced the excessive charges that mutual fund managers had been charging for what was frequently little more than closet indexing strategy. However, stock index funds, much like a second serving of chocolate strawberry cake, they have progressed as an unhealthy thing.

The Downside Stock Market Investing

A business, in theory, should reward sound as well as fertile actions and reprimand waste including incompetence. In practice, and mostly because of government interference, unproductive activities, like Federal Gov backing and subsidizing corn ethanol production, do regularly are rewarded.

There are examples where a business rewards fools, just like the Kardashians, for brazen attention inquiring or other barren indecencies. However, by and large, an open functioning marketplace compensates prolific performance and inventiveness.

Likewise, the stock market investing and trading, theoretically, one should efficiently manage capital funds to its safest and most productive use. In this regard, traders and investors should be careful and discriminant regarding the stock companies they invest in. In reality, this is merely the case. Individuals are prompt to invest in the latest fads or last year winning heroes without giving sufficient consideration or justification.

What is more, investing in passive stock index fund has transformed into an automatic and mindless undertaking. And as a larger and larger percentage of the equity market investing is formed of passive stock index investments the equity market becomes much more distorted.

Without thorough evaluation of companies, which occurs in compensating good businesses and punishing bad companies, putting monies into the form of passive stock index funds, is debasing to corporate welfare.

As of December last year (2018), stock index funds was dominated by 17.2% of American listed companies – Increase from 3.5% stats in 2000. Also, 81% of total indexed assets remain under the control of State Street, Vanguard, and BlackRock. To put it gently, these three giant asset handlers control approximately 14% of all American listed assets.

Within the bounds of a lengthened bull stock market, where liquidity is common, stock index fund traders and investors could market their holdings at any moment without any problems. How these stock index funds run throughout a sustained crash, when liquidity is limited, has not been tested at the popular market size and structure of the stock market.

That, and many other reasons why we foresee the down-side of this bearish stock market investing which will become much more significant than utmost general public anticipate – the core S&P500 index may indeed decline below 1000 level. After the shakeout, a new opportunity for value investors will be enormous. Following years in obscurity, dynamic handlers will hold another time and day in the sun too.

Related articles

Trading signal service for you!

News Blog