Spotting stocks in the volatile market

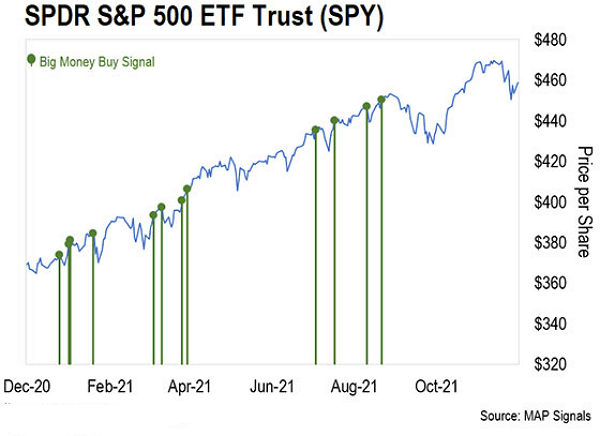

The stocks market at the time of writing for December and the cryptocurrencies market has been crazy. There has been a lot of volatility. But when we take a look at the S&P 500, it doesn't show anything more than a slight decline in recent weeks/months:

It's due in large part to the performance of big-cap stocks such as Apple (AAPL), Amazon (AMZN), and Google (GOOGL). At the same time, we might not see the volatility clearly in the stock market, though it's there.

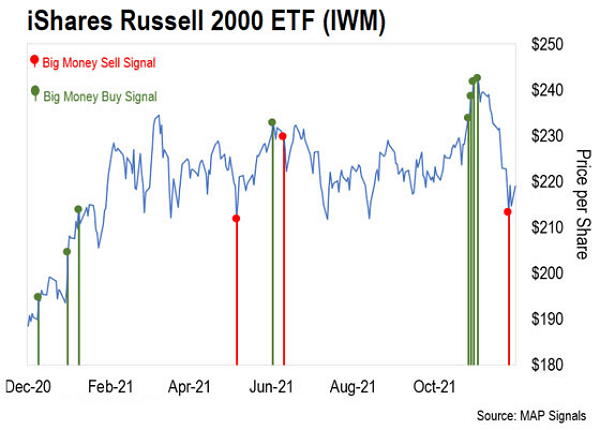

We get an entirely different viewpoint if we take out the large-cap stocks and look at smaller-cap stocks. Take a look at what we call the iShares Russell 2000 ETF (IWM), which is a tracker of small-cap Russell 2000 index:

This was a 12% decrease between the peak on November 8 to the low of December 1. Selling hit technology equities with a hammer and software received the brunt of the punishment. Growth equities were getting hurt also; nevertheless, I am a fan of growth stocks.

So what can we do to take away from this unsettling price movement? Should we be concerned? What are we supposed to be focused on?

I've seen the damage to growth stocks in the past. However, they always return more robust than in the previous condition. It brings back memories of "crypto winters" of the past, in which digital assets were subject to massive drawdowns. Cryptos were being looked over as significant opportunities in the months following these drawdowns.

Some of the top growth equities from the past year are beginning to feel the heat. If you know what to look for, opportunities could be waiting

We should generally seek out stocks with phenomenal growth in earnings and sales, good profit margins, and a reasonable amount of debt. This basic profile can eliminate a lot of equities that are not worth your time in the market.

Concentrate on stocks that matter

If you don't hold growth stocks, purchasing those in demand is an excellent opportunity to invest in the future. However, for those who have them and are experiencing suffering, you might be wondering what you should do.

I can tell you from personal experience I am in the two camps. I hold specific equities that are down more to my liking. However, I'm not too concerned.

Stocks we should pay attention to

If I hold available investment monies, I am adding it to my positions on days of down by buying any stock below my buy-up-to prices.

In this scenario, I am an investor, not a trader. So I am looking for longer-term investments to track the progress over time. This is usually the case with outlier stocks: with a long-term field of vision.

A real-world example I have a stock that increased ver 1,000 percent over three years. I'm continuously looking to find such opportunities. And the best ones are usually found during periods of market downturns.

There's little to do except sit back and wait to invest fully. Watching adverse price action with no ability to take action can be pretty low. It's not easy to keep an eye on the paper profit eroding.

That's why I have to keep in mind that investments made in the long term are considered to be long-term. For the stocks I've selected - those that might transform the future while executing in the present, well, they are business.

Even though the value of a company's value may change daily on the market fluctuation for equities ticker tape, we must recognize that their value should not swing valiantly as they do.

Imagine if you had the sign of a colossal red LED on the exterior of your home. On one day, your home's value has increased by 2 percent. The next day and it's down 10 percent. Ridiculous, right? This is what happens to stocks all the time. Even outliers are prone to fluctuate from day today.

They usually leap higher than other stocks, both upwards and downwards. The exceptions are the equities with 4% that have accounted for the majority of the growth of the S&P 500 index above bonds for the last 100 years. None of the other stocks could even match bonds.

When I'm locked in my portfolio and have nothing else to do but sit and wait, I focus on what matters to ensure that it doesn't involve blinking on a screen.

The investment process should be fun and improve our lives. Therefore, we should be focused on the time we spend with our family, friends and who we are in the relationship to the world.

This article was printed from TradingSig.com