Money Market Rates Are on the Rise

Authored by: Jeff Brown via Bleeding Edge

The money market is an answer to the banking industry's predicament, courtesy of the record pace of interest rate hikes and the duration risk it’s created for banks.

Bank solvency has been preserved thanks to the Bank Term Funding Program (BTFP) injecting cash into banks in exchange for bank collateral in the form of U.S. Treasuries and mortgage-backed securities at par value. But it hasn’t stopped the capital outflows from the banks.

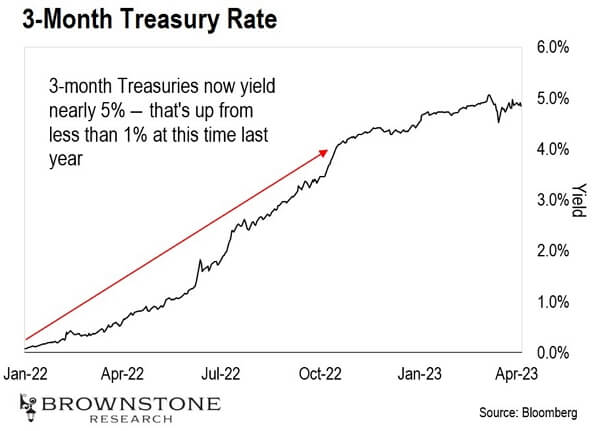

This is because unless depositors have $25 million on deposit – which would earn about 3% – most are making just 0.24% on average. Who would want to leave their capital in a bank to earn such a nominal rate? Especially considering the yield of the 3-month U.S. Treasury is at 4.8375%.

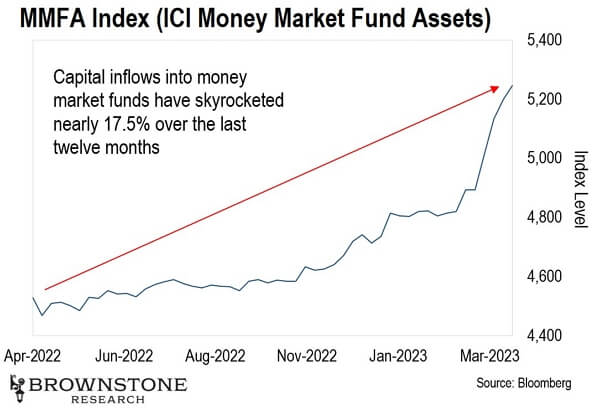

The real question I posed yesterday was, where is all the money fleeing to? Where is it running off to if it is leaving the banking system? The answer is money market funds. The intake has been stunning in the last year.

In the last 12 months alone, capital inflows into money market funds have skyrocketed from $4.45 trillion to almost $5.3 trillion and growing. That’s a nearly 17.5% increase in just a year.

The reason is simple – capital outflows are all about finding yield. And depositors don’t need a $25 million deposit to get just 3%. It’s normal to find money markets yielding between 4.25% and 4.75%, and many don’t have minimums. Money markets are for everyone, not just massive depositors.

And given the current direction of the 3-month U.S. Treasury yields, money market rates are likely going higher. Given the expectation of an additional 25-basis-point hike by the FOMC on May 3, and the continued quantitative tightening, we shouldn’t be surprised to see money market rates at, or slightly above, 5% in a matter of weeks.

With what the banks offer, it’s evident that capital outflows will continue into money market funds over the coming months.

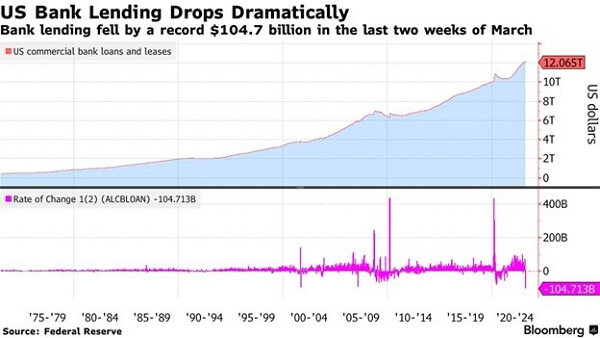

And that means banks – primarily regional banks – will continue to need liquidity injections from the BTFP to stay solvent and fund those capital outflows. It also means these banks will not have the liquidity to lend. We can already see this happening in the numbers.

U.S. bank lending has collapsed by the largest amount in history, dropping by $104.7 billion in the last two weeks of March.

This is the beginning of a nasty credit crunch. As yields on money market funds increase, even more capital will flee the banks. This will cause the banks to go deeper into “debt” with the Federal Reserve (FDIC) via the BTFP. Bank lending will continue to decline, which will directly slow down economic activity. And capital will continue to flee to safety and out of the equity markets thanks to the coming credit crunch.

This could be a better short-term environment for the markets. And the Fed appears hell-bent on making matters worse.

This article was printed from TradingSig.com