Weekly Market Review & Analysis For September 7, 2020

The stock market selling from the preceding week carried over to this abbreviated trading week session. The S&P 500 index declined 2.5%, the Nasdaq Composite dropped 4.1%, the DJI Average slipped 1.7%, and the small-cap Russell 2000 decreased 2.5%.

The S&P 500 energy sector bled by 6.4% amid falling crude oil prices -$2.36, or 5.9%. However, the market's immense pressure was the information technology sector declining -4.4%, with the communication services sector -3.4%, and financials sector postings of -2.4%. Solely the materials sector with +0.8% gain ended higher for its second continuous weekly receipts.

This week's selling action was defined as technically-oriented. However, numerous adverse calling developments may have controlled risk sentiment levels; the sequentially appeared to be valid excuses for the stock market, notably with the mega-caps, which extend the previous week's de-escalation space.

Apple, Alphabet, Amazon, Microsoft, and Facebook declined between 4.4% and 7.4% overall. Tesla stock tumbled a whopping 10.9% and was ignored as a spot in the S&P 500 index by the selective committee.

As for the negative thundering news headlines, the U.S. Senate neglected to pass its $300 Billion COVID-19 stimulus bill. AstraZeneca ceased its coronavirus vaccine clinical trial in the United Kingdom due to a severe patient's negative response. President Trump proposed disincentives for American companies to outsource businesses to China, and China's most large semiconductor plant could reportedly be added to a trade hit blacklist.

By week's session end, the S&P 500 index was down by 7% from its historic highs, and the Nasdaq index was down as much as 10% from its historic highs as well. An encouragement for the bulls was that the S&P 500 index closed above its crucial Key Sup $3,325 level. However, the Nasdaq could not do as well as its counterpart, though.

Other market action

U.S. Treasuries market action concluded the week with moderate gains. The Two-year yield faded three basis points to close at 0.13%, and the Ten-year yield dipped five basis points to finish at 0.67%. The U.S. Dollar Index was promoted by 0.6% to close at 93.28.

Most Eurozone equities countered the technology-led downdrift on Wall Street. They alternately moved higher on more solid industrial production data reports, particularly in the United Kingdom, Italy, and France. On the ECB's (European Central Bank) pledge to keep rates cheap and keep purchasing all bonds under its PEPP (Pandemic Emergency Purchase Program) scheme.

Meanwhile, traders and investors essentially shrugged off the developing possibility of a no-deal concerning Brexit as the eighth series of talks got moving. Discussions looked especially vulnerable to collapse once again after the United Kingdom government confirmed it purposed a plan to disrupt international trade laws by unilaterally modifying the Brexit agreement.

Spain was the only significant Eurozone market to pull back. In the Asian Pacific region, Japan stocks rose. The stocks of the HK Hang Seng and Shanghai indices declined after the news of the possible sanctions against Semiconductor Manufacturing International Corporation (SMIC).

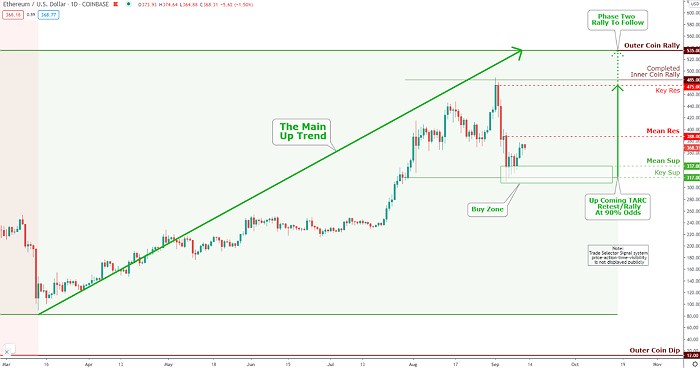

Since Wednesday, the prices of different cryptocurrencies began to rise again. For example, the value of the Ethereum coin increased by a hefty 10% since that day! Thus far, Bitcoin still manages to stay above the psychological mark of $10,000 (8,423 Euros). Bitcoin has had some ups and downs this week but remains more or less at the same rate as the previous week. Will the price rise next week? We shall see.

Click the Image to Enlarge

Technical Analysis and Outlook: The aggressive coin upside move started on Wednesday. Ethereum stays to play a role to move higher, as the second most significant crypto coin struck the lowest level ever since July 28 on September 5, following the anticipated breakdown by completing Inner Coin Rally $485.

The coin validated its severe relative strength by creating the TARC formation (Proprietary symbol-Not showed), and it is prone to the retest the Key Res $475 mark, which is the part of the TARC formation.

The support level is found at Mean Sup $337, and Key Sup $317; traders and investors should look for the opportunity to buy the coin is the designated buy zone.