Weekly Market Review & Analysis For September 28, 2020

The S&P 500 market with +1.5% and DJI Average with +1.9% snapped the four-week losing streak in this week trading, and the heavily loaded technology Nasdaq Composite index performed comparatively with a 1.5% gain. However, the real winner was the small-cap Russell 2000 with a 4.4% increase

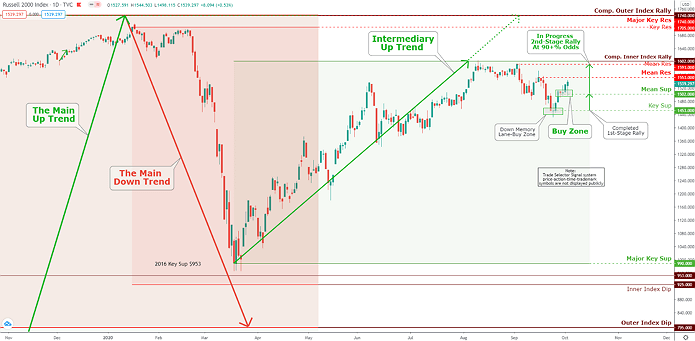

Click the Image to Enlarge

Technical Analysis and Outlook: As noted before, the small-cap Russell 2000 index is an excellent overall market indicator; The index shows us resuming it the Main/Intermediary uptrends since Sep 24. A buying zone is identified at Mean Sup $1,502, with the exit at Mean Res $1,553 and Mean Res $1,591, and completed the Inner Index Rally marked at $1,602 respectively, based on one's money management scheme.

Ten of the eleven S&P 500 sectors ended in the positive zone. The real estate sector with +4.9%, financials sector with +3.3%, utilities sector with +3.3%, and consumer discretionary sector with +2.5% exceeded. The lone energy sector with posting -2.9% was the only holdout, as market sentiment was pressed by an 8% slump in crude oil prices amid demand and growth concerns closing -$3.17 at $37.05/bbl.

Before the Friday session, the market had already built the week's gains, mostly on technically adapted trading activity in oversold equities. But at the beginning of the week, cyclical equities profited from mergers and acquisitions (M&A) activity, and better-than-expected economic numbers (though, less important reports), stimulus optimism, and analyst upgrades.

The mega-capitalized stocks also played in the rebound, with the market casting off any residential vulnerability that followed the presidential debate on September 29. However, Friday's session was when the actual news set in, and the mega-capitalized equities sold off to conclude the week.

In summary, President Trump tested positive for coronavirus, last month, unemployment increased by 661,000, and there were vital signs that the fiscal relief measure could soon be moved forward. The latter issue remains a show-me-the-money story; however, cyclical and value stocks benefited from the enthusiastic calling reports.

Bringing to light other vital economic reports, weekly unemployment claims remained upraised at 837,000 level, personal income decreased by 2.7% m/m in August, and the Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index for last month decelerated to 55.4% from posting 56.0% in August.

Market action elsewhere

U.S. Treasuries market ended lower on the longer-end of the interest curve. The Two-year yield was flat, closing at 0.13%, and the Ten-year yield rose four basis points to finish at 0.70%. The U.S. Dollar Index declined by 0.9% to close at $93.84.

Eurozone stock markets were all more high-priced, as European economic confidence increased for the fifth straight month. In other news, which boosted stocks involved falling unemployment data in Germany - and surprisingly, Italy had more robust retail sales numbers.

Even in Japan, whose whole economy has performed in a limp mode than many other Asian areas, recorded a surge in retail sales, however, the better-than-expected highest manufacturing PMI and industrial production in the past seven months.

Notwithstanding, Japanese equities underperformed as technical exchange problems forced a closedown of the TSE (Tokyo Stock Exchange). Much stronger data from China gave support to stock markets worldwide. Services PMIs (official/unofficial) and in Manufacturing China all bettered expectations, symbolizing an ongoing recovery.

Cryptocurrencies

Cryptos ended this week with a bang! Just not the charge we were hoping for. Bitcoin lost as much as 3.5% in value compared to Thursday, while the value of Ethereum and Bitcoin Cash fell by more than 7%.

Did BitMEX and Trump cause the crypto market to decline? Okay, we’re not saying there is a direct relation between these events, but it’s undoubtedly suspicious.

Thursday evening, the CFTC charged BitMEX with some serious accusations. According to the CFTC, BitMEX is operating an unregistered trading platform while violating Anti-Money Laundering regulations.

Directly after this news got out, the price of Bitcoin went down the drain. Friday morning, President Donald Trump tweeted that he tested positive for COVID-19. That news seems to have some impact on the Bitcoin price as well.