Weekly Market Review & Analysis For September 13, 2021

The S&P 500 market ith -0.6% and Nasdaq Composites with -0.5% had modest declines, while Dow Jones Industrial Average posting -1.1% saw a small-cap Russell achieve 0.4% gains. The latter was buoyant by quadruple witching options expiration activity at the week's end.

Let's start by reviewing the positive economic market data that investors received this week.

- Retail sales unexpectedly increased 0.7% m/m during August.

- Total CPI rose 0.3% m/m, which was higher than expected.

- The September Philadelphia Fed Index had a reading of 30.7, which was better than anticipated.

- The September Empire State Manufacturing Survey came out much better than we expected, with a reading of 34.3.

- The 4-week moving average of initial claims and ongoing claims decreased.

- Industrial production data August rose in line with expectations, contrasting China which missed expectations.

This is a lot of positive news. However, nine of the eleven S&P500 sectors closed lower. Materials (-3.2%) and utilities (-3.1%), industrials (-1.6%) and communications services (-1.2%%) were the worst-performing sectors with losses of 1-3%. Higher closings were seen in the consumer discretionary (+0.5%) and energy (+3.3%) sectors.

This discrepancy could be attributed to the market's struggle with the peak-growth narrative. This leads to slower growth rates, especially when you consider other negative factors.

Companies such as 3M (MMM), American Express (AXP), Comcast (CMCSA), PNC (PNC), and Timken (TKR) all provided prudent-sounding commentary in the corporate space. Apple (AAPL), with its annual product launch, didn't excite investors. Oracle (ORCL), however, provided disappointing earnings news.

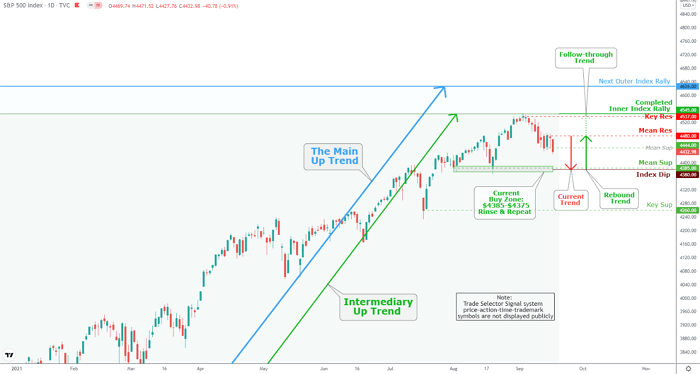

One good rebound day occurred this week, but sellers dominated the market. The closing S&P 500 index fell below its Mean Sup $4,444 at the close. The Spooz is currently in a downtrend. Forecasting a drop to Mean Sup $4,385: a strong buy providing ample opportunity for loading-a-boat for resurgence to retest Mean Res $4,480 and follow through to Key Res $4,537. The subsequent significant outcome is Outer Index Rally marked at $4,626 to follow.

There was also some selling interest in the Treasury market, regardless of whether this was due to good economic data, cash-raising efforts, or technical factors. The Ten-year yield rose three basis points to close at 1.37%.

Market elsewhere

Global equity market(s) slumped over the week. However, Japanese and Chinese equities managed to buck the trend despite tighter regulations applied to large internet companies like Tencent.

China's equities gained robustness on Chinese trade data despite the latest moves directed at the video game industry and include a temporary freeze in approvals for new online games.

There was also uncertainty over infrastructure and the debt ceiling. A few provinces were under lockdown by Covid, while reports talked about Evergrande, one of China’s largest property developers, defaulting on its debt. Hong Kong's Hang Seng Index rose by 1%.

The European Central Bank (ECB) unanimously decided to continue buying bonds at a "moderately slower pace." President Lagarde stressed that this is not tapering. Although the pace of purchases will slow, the total pledged amount remains at €1.85 Trillion. It is still scheduled to continue until at least March 2022.

Throughout the session, primary European market(s) moved to their downside. The French CAC 40 Index fell by 0.8%, while the FTSE 100 Index in the United Kingdom and the German DAX Index plunged by 0.9% & 1%, respectively

Precious metals market

After Thursday's $40 drop, Gold tried to regain its footing on Friday morning. It rose by more than $10 while Silver was up to 6¢. The week saw Gold drop $34 from Friday's close to trade at $1,753. Silver fell from $1.38 to $22.36 over the same period.

According to media reports, analysts attributed the sharp market selloff to several factors. These included the solid retail sales numbers and the ramp-up to next week’s Fed meeting. The metal's inability to gain a solid foothold above $1,800 and a stronger dollar.

There was no reason beyond generally calm trading conditions. The dollar's trade-weighted index moved slightly higher, possibly shaking out some weak hands holding long positions.

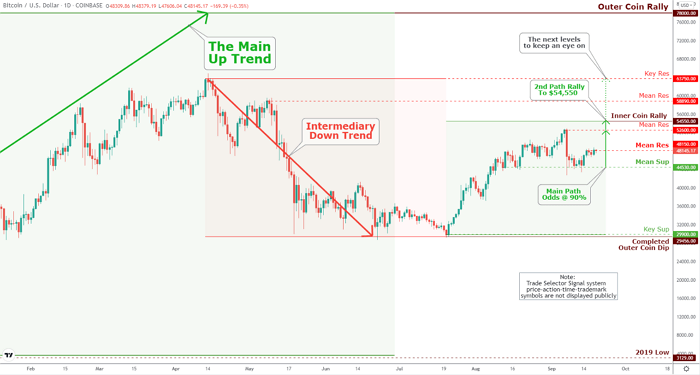

Cryptocurrencies market

Bitcoin has been moving upwards since Sept 14 by breaking out from a Mean Sup $44,530 accumulation channel and accelerated.

At that moment, the Bitcoin price is trading around weak resistance marked at $48,150 and is due to accelerate to our Mean Res $52,600 and Inner Coin Rally $54,550. However, BTC’s recovery at this level will face stiff resistance, indicating that bears will be very active at this higher tier prices.

On the upside, analysts remain bullish, as indicated on the August 9 chart and some other different fast-time charts that underline the bullish potential for Bitcoin.

Along with Bitcoin, Ether is also showing signs of accumulation. Could the top two cryptocurrencies rise to the occasion and their bullish projections, or will the surprise of the cryptocurrency market(s) move to the downside?. Stay tuned.