Weekly Market Review & Analysis For October 12, 2020

The broad capitalized market indices concluded the week higher but noticeably much lower than where they were at the beginning of the week's highs - before earnings reports began. The tech-heavy Nasdaq Composite index promoted 0.8%, while the broad S&P 500 index managed +0.2%. The DJI Average eked out smaller gains posting +0.1%, as the small-cap Russell 2000 index decreased by 0.2%.

There was no evident leadership in this week's market as with five (5) S&P 500 sectors finishing a mere higher between 0.7% - consumer staples and 1.1% - industrials. On the negative side, the energy sector with -2.1% and real estate sector with -2.3% were the sectors with more than 2.0% loss, followed by the financials sector posting -0.9%.

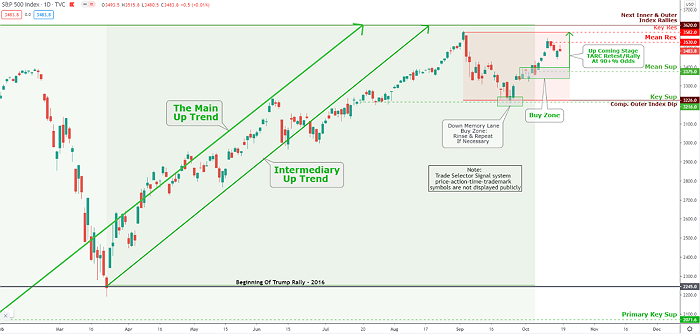

Click the Image to Enlarge

Technical Analysis and Outlook: The S&P 500 developed the Mean Res $3,530, on September 12/13. The current ''Buy Zone'' and Mean Sup $3,375 stands as an excellent opportunity for buying.

Growth-oriented equities, however, did ensure the slight advantage, with clear outperformance of the Nasdaq Composite index. That might have been as a result of the adverse sounding developments during the entire price action week.

Beginning with earnings, the prominent banks and the top health care companies drummed out the third-quarter earnings reporting season, and the responses to their number releases were generally dull or uninteresting. Citigroup, Goldman Sachs, and JPMorgan Chase, for their part, announced cautious-minded analysis about the market economic outlook.

Furthermore, investors and traders had to struggle with Eli Lilly and Johnson & Johnson halting their vaccine/antibody clinical trials, lawmakers fighting on second fiscal stimulus, weekly unemployment claims rising by 53,000 to 898,000 - act surprised!, and Eurozone declaring more drastic lockdown measures as a consequence of a second wave of the COVID.

Never there less these developments came in the nucleus of three-day falling prices in the S&P 500 index, which was finally snapped on Friday's session following retail sales report for September which increased more than anticipated and it was announced that Pfizer might file for emergency application authorization for its coronavirus vaccine hopeful by the end of next month.

It's worth pointing out that the S&P 500 index was up so much as 10.6% on the first day of the week, coming from its low on September 24. The broad benchmark index finished that day with a +1.6%, and no clear upside progress was made after that. Therefore, with all these developments in mind, it is fair to presume that the stock market may have just demanded some additional time to solidify those accumulations.

Market action elsewhere

The Ten-year yield market declined four basis points to close at 0.74%. The U.S. Dollar Index improved by 0.7% to finish at 93.71. WTI (West Texas Intermediate) crude oil futures rose to $40.85/bbl or 0.5%.

As economic difficulties increased in Eurozone, worldwide government bond yields declined, and the Eurodollar weakened. This, at the same time, pushed prices of commodities much lower, including Gold, Silver, and Copper.

Eurozone equity markets were under the water after France, the United Kingdom, and Germany announced more stringent limits on gatherings. France went to such lengths as forcing curfews for the next several weeks for several of their large cities, and mainly Paris.

United Kingdom market was particularly weak as a United Kingdom-European Union climax meetings meant to strike a deal on the post-Brexit trading alliance, which ended with no progress on the principal outstanding fishing issues.

Aussie stocks bettered most Asia-Pacific region markets after the RBA (Reserve Bank of Australia) proposed that interest rate cuts were being pondered to support the county's economy.

Reminder

Here at TSS, we are traders and investors hinting that our trades and investments can thus be on the same side of the market or, for that matter, short-term duration on opposing sides. This is the situation we are in now. As dog-eat-dog traders, we were/are short Nasdaq, S&P 500, and Russell 2000 indices; however, as investors, we continuously maintain a long position in precious metals through physical holdings.

Unfortunately, in investing and trading, many souls confuse the issues; investing is not trading. Investments should be kept for the purposes you purchased them in the first and foremost; investing, therefore, is not intended to be very active. Trading, however, is about grabbing the market moves in both directions without should-could-would theory, allowing one to earn money on the investment as well as the trade.