Weekly Market Review & Analysis For November 9, 2020

This week's market - money disproportionally rolled into the economically and sensitive stocks on the story that the collaborative coronavirus vaccine from BioNTech and Pfizer was over and above 90% effective. The small-cap Russell 2000 with +6.1% and S&P 500 index posted +2.2% gains - both closed at new historical highs with 6% and 2% increases, respectively.

The DJI Average surged 4.1%, while the Nasdaq Composite dipped 0.6% amid relative vulnerability in the mega-capitalized, stay-at-home, and growth stocks.

In brief, the market continued confidently that a new vaccine will stimulate the economy and return to pre-pandemic levels next year and re-instill a feeling of normalcy once again (Dream on). Also, big Joe Biden being projected by the self-proclaim authority on the truth - MSM as the presidential election's victor faded out some political dilemma.

Simultaneously, notwithstanding the election implications on free money (Stimulus), which continued to be an impasse this week, the stock market took the new vaccine report as well as one could have expected. All four leading indices set all-time highs this week, and all eleven S&P 500 sectors finished in positive territory.

The energy sector stuck out with an extraordinary 16.5% weekly gain, supplanted by substantial increases in the financials with +8.3% and industrials sector with +5.3%. Conversely, the consumer discretionary sector with -1.1% and the information technology sector posting -0.4% were two sectors underperformed between profit-taking movement in some mega-capitalized stocks.

The market swept aside reports on daily records of the COVID-19 cases and hospitalizations in the United States, also a warning from Federal Reserve Chair Jeromy Powell that the U.S. economy will be challenging for the next couple of quarters. Investors, traders, and analysts continued to be bullish, with Goldman Sachs calling the S&P 500 to beat the 4300 marks by the end of next year.

The Ten-year yield rose seven basis points to close at 0.89% amid repeated heavy selling pressure.

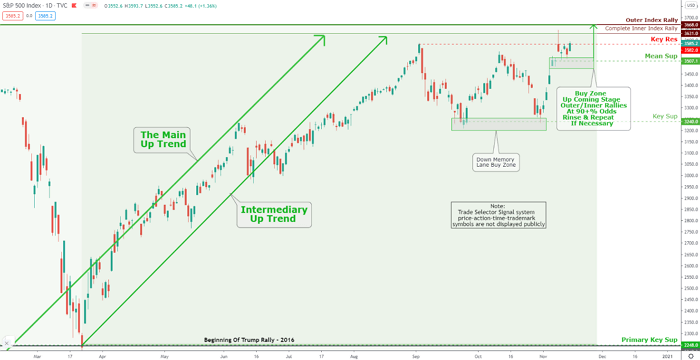

Click the Image to Enlarge

Technical Analysis and Outlook: The S&P 500 bounced off the Key Res $3,582 and completed Inner Index Rally $3.631 projection on October 9th. The current ''Buy Zone'' and Mean Sup $3,507 stands as an excellent opportunity for buying the zone.

Overseas market

All notable stock markets in the Eurozone and Asia region advanced higher. The major rally in Japanese stocks boosted the Nikkei 225 Index to its most high-priced level ever since early 1991. This week, Eurozone equities were usually much more active than those elsewhere; Spain’s IBEX 35 index was by far the best performer. This was unexpected, considering that Eurozone per the latest data seems to be heading for a double-dip recession because of its repeated lockdowns.

Market action elsewhere

Once again, it was an excellent week for the Bitcoin market. Last Thursday, payment giant PayPal announced that cryptocurrency trading is officially live for American customers. Due to this news and due to the generally positive sentiment, the price grew to a record high of almost $16,500 - the highest price since January 7th, 2018. Can Bitcoin reach an all-time high this year? We shall see.

For the week, Gold fell over $70 from last Friday’s close to finishing at $1889 on Friday, and Silver tumbled $1.27 to close at $24.65 over the same time frame. Except for Monday, when the high activity happened, trading volumes were otherwise tamed. There was a reason for both precious metal prices being beaten unusually hard other than the central planners and bullion banks' vested benefits.

In brief, every solemn student of Gold and Silver understands that Monday’s price dive was manufactured, just like dozens of many other price dives that have transpired over many past years of price capping in the Gold and Silver market by bullion banks and central planners.

BTW, those monopolistic attempts to drive precious metal markets lower are and will be unsuccessful. As a result, hose efforts are very much likely to find itself thrusting the Gold and Silver prices much higher.