Weekly Market Review & Analysis For November 8, 2021

This week's market saw the end of the five-week winning streak. Also were ended the eight-session winning streak for the S&P 500 and the eleven-session winning streak for the Nasdaq Composite. Both fell 0.3% and 0.7%, respectively, while the Dow Jones Industrial Average dropped 0.6% and the small-cap Russell 2000 index fell 1%.

With 3.2% and 1.7% declines, consumer discretionary and energy sectors were the worst market performers. Due to a 15% drop in Tesla (TSLA), the stock was under pressure as Elon Musk began selling shares according to a Twitter poll which indicated that he would sell 10%.

However, five of the eleven S&P 500 market sectors closed higher. The impressive 2.5% increase in the materials sector is accompanied by no more than a 0.7% gain in all other sectors.

Profit-taking interest and a sharp increase in U.S. Treasury yields were the main factors behind the decline at the index level. Fed expectations for hawkish next Year's interest rates triggered this.

In particular, the Consumer Price Index (CPI) rose 0.9% and was up 6.2% year-over-year - the most considerable twelve-month growth since November 1990. Core CPI, which excludes energy and food, rose 0.6% and was 4.6% year-over-year.

According to the CME Fed Watch Tool, after market closure on Friday, the probability of a rate hike in June 2022 was 69.1% versus 50.9% last week. The second rate hike probability for the following November increased from 44.7% last week to 64.9%.

On the bond market front, the Two-year yield increased 12 bps to close at 0.52%. The Ten-year yield climbed 13 bps to settle at 1.58%. The U.S. Dollar Index rose 0.8% to close at 95.09.

Traders and investors largely ignored a report from the University of Michigan that showed a sudden decline in U.S. consumer sentiment during November.

According to preliminary reports, the consumer sentiment index in November fell to 66.8 from 71.7 in October. Economists were surprised by the decrease, as they had expected it to rise to a forecast of 72.4.

The unexpected fall in consumer sentiment this month saw the index lowest level posting since November 2011 of 63.7.

Look Ahead: Reaction to crucial economic data may impact market trading next week, including reports about industrial output, retail sales, regional manufacturing activity, and housing starts.

Asian and European market

European equity market(s) finished the week mixed, with the markets still struggling with rising inflation pressures following this week more than expected reads on U.S. inflation reports. The higher inflation data have fueled market volatility and uncertainty about the future direction of monetary policy.

According to economic news, the Euro zone's industrial production fell in September by less than expected. As crude oil prices fell, the pressure was felt in the Energy sector. The Financials sector also saw some weakness, with the yields on bonds in the Eurozone (and the U.K.) generally lower.

In Germany DAX Index ticked higher, posting 0.1%, Spain's IBEX 35 Index dropped 0.1%, and U.K. FTSE 100 Index fell 0.5%. Italy’s FTSE MIB Index rose 0.4%, the France CAC-40 Index increased 0.5%, and Switzerland's Swiss Market Index improved by 0.8%.

Stocks in Asia closed the week with the highest close. This is despite volatile markets that have been analyzing a variety of global economic data. These include persistently rising inflation pressures triggered by increases in U.S. consumer and Chinese producer prices.

Markets also absorbed yesterday's results of China's Singles' Day. This online sales event was more robust than 2020's performance and easily outpaced the U.S. sales activity on Cyber Monday and Black Friday.

Japan's Nikkei225 Index rose 1.1%. The yen lost some ground during the session. China's Shanghai Composite Index moved 0.2% lower, while the H. K. Hang Seng Index traded 0.3% higher. The S&P/ASX 200 Index in Australia gained 0.8%, India's S&P BSE Sensex 30 Index advanced by 1.3%, and South Korea’s Kospi index jumped 1.5%.

Next week's international economic reports could have an impact on the market(s). They include China retail sales and industrial production. India wholesale inflation and trade balance. Japan third-quarter GDP and core machine orders, and consumer price inflation figures. Eurozone third-quarter GDP and trade balance. The U.K. will post inflation statistics, retail sales, consumer confidence, and employment change.

Metals market

Early Friday trading saw the gold market slip, reversing some of its substantial gains over the past few days. Gold was up $48 to $1865 for the week. Silver closed at $25.30, up $1.15 during the same period. The precious metals are among those who have benefited from investors coming to terms with the possibility that inflation may be more severe than they thought.

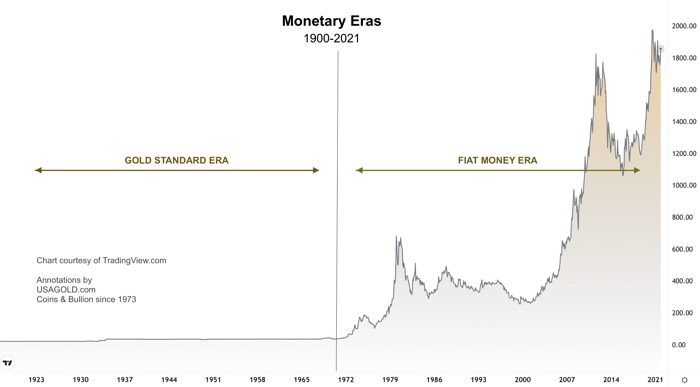

The chart above is crucial to understanding why gold continues to make sense as a long-term portfolio investment. The fiat money era was born in 1971 when the United States abolished the gold standard and allowed currencies to float against the U.S. Dollar freely. Today, we are still living in the fiat money era. The chart shows the performance of gold from the early 1900s through 1971, when gold supported the U.S. Dollar, and from 1971 until today when it didn't. Although gold has experienced ups and downs over the years, investors have been well served by building themselves on a portfolio for the gold standard.

Cryptocurrency market

This Sunday, two significant events will take place that can change Bitcoin forever: The first one is a given, the implementation of the Taproot update. This will increase privacy and decrease the file size of a transaction on the Bitcoin network.

Bitcoiners often call Bitcoin a hedge against inflation. Nothing illustrates that better than the chart below. With the 6.2% inflation rate in the U.S. for October posted, bitcoin rose to a new all-time high within seconds. Sure, correlation doesn't equate to causality, but it sure looks that way.

Stat of the week: When Bitcoin reaches block 709,632, Taproot will officially activate. After activation, all updated nodes and devices will make transactions using the updated protocol.

The update will, in essence, combine the Schnorr signature scheme with the Merkelized Alternative Script Tree (MAST). In addition, Taproot will bring about a new scripting language named Tapscript. So enjoy the weekend, grab some popcorn and take solace in the idea that bitcoin will continue to improve. Block after block.