Weekly Market Review & Analysis For November 29, 2021

The market experienced volatility during the week as uncertainties about the Omicron coronavirus variant were the main topic of discussion. It was reported that the Dow and the S&P 500 lost a respective 0.9 percent and 1.2 percent over this week. The Nasdaq did not perform as well, losing 2.6 percent.

The new coronavirus strain appeared to be in the background after a Monday rebound from the loss on Friday; however, selling pressure was evident in the market as the week progressed, increasing the S&P 500 towards Mean Res 4655, and the Nasdaq dropped below its principal support of 15,600 which was the lowest since the end of October.

Nine of the eleven sectors finished this week with negative numbers, with communications services (-2.8 percent), consumer discretionary (-2.4 percent), and financials (-2.0 percent) with the highest losses. The real property sector (+0.1 percent) and utilities (+1.0 percentage) ended the week in the green territory.

The growth stocks were some of the weakest market performers, with the likes of Microsoft (MSFT), Tesla (TSLA), along Amazon (AMZN) dropping between 1.8 and 6.2 percent. In terms of earnings, DocuSign (DOCU) fell to its lowest price level since mid-2020, when its shaky guidance threw off a beat in Q3.

Like the stock market, crude oil had ups and downs week, failing to sustain its support of $64. WTI crude finished the week with a loss of $1.79 (or 2.6 percent and the closing price was $66.39/bbl. OPEC+ announced on Thursday that it would not change its target of 400,000 barrels per day production growth in January.

Fed Chairman Powell declared during his Congressional testimony that the term "transitory" should no longer describe inflation. Powell also said that central banks might delay the scheduled end of purchases of assets by a couple of months. An acceleration of the taper is likely to be discussed during the December policy meeting.

Additionally, Congress voted in favor of a short-term funding bill that will put off the possibility of a shutdown until the middle of February.

We can all be sure that in 2022, we can be confident of one thing. The interest rates will remain close to zero, and the government in place will use every means to print money to stimulate the economy. Long-term, that's a huge problem. It's taking away to the future generation. Short-term, however, creates favorable market conditions.

Notwithstanding, it is possible to see an escalating rally as soon as it is transparent (Trade Selecter System BARC confirmation) in the context of the Mean Sup 4470 and Outer Index Dip 4480 completion.

Overseas market

European stocks ended down, with gains in the energy sector matched by weakness in the growing industries such as Information Technology and Consumer Discretionary. But, a lack of confidence was evident concerning the COVID-19 Omicron variant, which has been identified across the globe.

It was reported that the U.K. FTSE 100 Index fell 0.1 percent and Germany's DAX Index decreased 0.6 percent, and France's CAC-40 Index shed 0.4 percent, while Italy's FTSE MIB Index declined 0.3 percent. The Swiss Market Index was little altered, and The Spanish IBEX 35 Index dropped 0.7 percent.

A host of November services sector output reports were digested in Asia-Pacific. Japan's growth was revised to a stronger-than-expected pace than Australia's, while China and India reported that change came slower.

Japan's Nikkei 225 Index climbed 1.0 percent, with the yen extending its pause after a recent rise and China's Shanghai Composite Index advanced 0.9 percent. The S&P/ASX 200 Index in Australia grew 0.2 percent, and the South Korean Kospi Index rose 0.8 percent, But there was a dip in the H.K. Hang Seng Index with a dropped of 0.1 percent. At the same time, India's S&P BSE Sensex 30 Index declined 1.3 percent, trimming an increase in the weekly index in advance of the following decision on monetary policy.

Gold and Silver market

The gold and silver market whetted higher Friday morning as it was able to close out higher for the session what has been an uninspiring week. Doubt over the future central bank's monetary policy remains the main impediment on gold and silver pricing even though safe-haven physical precious metals demand continues to be strong globally.

The effort to shake out all weak hands of Comex paper gold extended to this week's session and into the beginning days of December trading. Gold closed down $9 from last Friday's close to finishing the trading week. Silver lost 59 cents to close $22.52 over the same period.

Bitcoin

Bitcoin started the week with a blast, but the price didn't move that much the past few days. However, it was time to pay attention, as a period of relative quietness often is followed by a significant price move.

And then BANG! The bitcoin price has plummeted by around $15,000 over the 24 hours. As of 08:16 GMT today, it was trading at approximately $47,580, down 16.14 percent, having plummeted by 31.6 percent from this year's all-time high of $69,000, which it attained on November 10 this year.

Therefore, we are looking at this significant crypto market pullback as a "breather" following reaching this low-level price. However, Key Sup $40,700 is the potential leading platform (or sooner) for the considerable rebound.

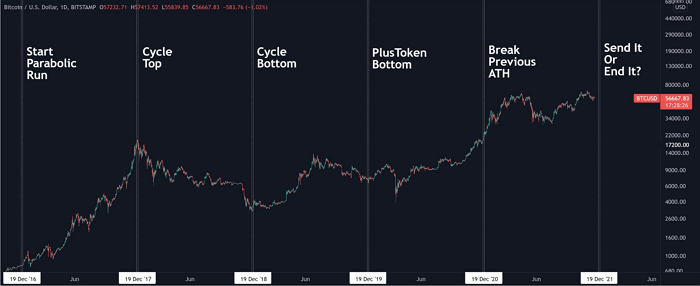

History doesn't repeat itself, but it often rhymes, a quote allegedly by Mark Twain. This quote also applies when you look at the bitcoin charts of the past years.

As the chart below shows, the bitcoin price always made a decisive move between the 15th and 19th of December. It could either be a start of a parabolic run like it did in 2016, a cycle top (2017, 2018, 2019), or a breakthrough at a previous all-time high (2020).

What will happen this year? Only two weeks to find out - It sends or ends?