Weekly Market Review & Analysis For November 23, 2020

A weekly market trimmed by holidays in North America and Japan, stocks, bonds, and major commodities harmoniously signaled an increasing optimism that global economic activity will improve into the upcoming year. The trading week started with global stocks climbing higher in retort to a dose of cheering virus vaccine reports for the third week in a row.

Each of the leading indices increased more than 2.0% and established new record highs, particularly with regard to the DJI Average posting +2.2% gain, which crisscrossed above the 30,000 level for the first time. The small-cap Russell 2000 increased 3.9%, the tech-heavy Nasdaq Composite index lifted with 3.0%, and the broad S&P 500 grew 2.3%.

Cyclical, value, and small-capitalized stocks held their leadership positions in this part of the bull market. The financials sector climbed 4.6%, and the S&P 500 energy sector rose 8.5%. And all other sectors, excluding real estate with -0.4%, concluded the week with gains.

The bullish trading action proceeded to feed on itself, contributing to a FOMO (fear of missing out) on additional gains and parabolic movements in some segments of the market. Palantir stock swelled by a hefty 52%, and Tesla climbed 20% this week.

The S&P 500, Dow Jones, and Nasdaq Composite indices are now at the top between 11 to 13% this month; the small-cap Russell 2000 is up 20%, and the vital S&P 500 energy sector is up whopping 34% this month.

Market elsewhere

In the bond market, the Ten-year yield Treasury note yield creep higher by two basis points to finish at 0.85%, leading to the bond market close on Friday.

All significant stock markets in the Eurozone and Asia-Pacific region were higher as coronavirus vaccine enthusiasm trumped falling business and consumer confidence. Hints that virus cases may be peaking in Eurozone led to some countries briefly loosening restrictions for the upcoming holidays.

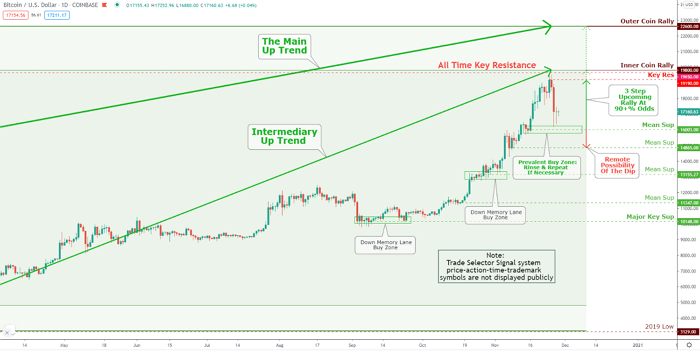

After Bitcoin has been rising for weeks, and we have almost reached the highest price ever, the price took a nosedive on Thursday, and reaching our prevalent But Zone marked with Mean Sup $16.003. Conceivably, next week will be better because the Bitcoin will climb to retest Trade Selector System TARC (proprietary symbol) marked at Key Res $19,190.

Gold and Silver metals were monkeys hammered on Friday (concurring with a vigorous flash-crash in CBOE Volatility Index - VIX). The Gold market concluded its third straight weekly slump and its fourth continuous monthly decline: this is the worst month ever since November 2016 for the Yellow metal.

Click the Image to Enlarge

Technical Analysis and Outlook: Bitcoin's sudden drop should not be a big surprise to us. The completion of Outer Coin Rally $18,500 on Nov 18th and significant TARC formation (TSS proprietary symbol not shown) within the buffer zone of All Time Key Resistance $19,650 was the red flag. The coin 3-Step rebound to Key Res $19,190, Inner Coin Rally projection $19,800, and the Outer Coin Rally $22,600 is in the process. There is, however, a remote possibility of one more drop to Mean Sup $14,865.