Weekly Market Review & Analysis For November 16, 2020

The cyclical market held its monthly leadership positions this week following various positive vaccine advancements; however, the S&P 500 with -0.8% and DJI Average with -0.7% ended in negative territory. The small-cap Russell 2000 index climbed 2.4%, while the Nasdaq Composite rose 0.2%, notwithstanding relative vulnerability in the technology stocks.

The S&P 500 energy sector anchored the performance movement with a 5.0% increase to extend its monthly accumulation to 23%. The industrials sector with +1.1%, materials sector also with +1.1%, and financials sector with +0.5% gains followed suit, and the SPDR S&P Retail ETF (XRT) with +5.5% and the SOX (Philadelphia Semiconductor Index) posting +1.9% were other money of force this week.

The semiconductor area was fired up by the news that Taiwan Semi is extending production capacity to face high demand from numerous chip companies. The retail space attracted support from a multitude of better-than-expected earnings announcements from retailers like Target and Walmart.

On the contrary, the counter-cyclical utilities with -3.9%, the health care with -3.0%, the real estate with -1.7%, and the information technology sector with -0.9% were influential burden sectors on index overall performance.

On an individual basis, Boeing shares advanced 7% in part due to the Federal Aviation Administration (FAA) approving the 737 MAX jet as safe to fly once again, Tesla shares climbed 20% on account that it will be added to the S&P 500 index on Dec. 21, 2020, and Walgreens Boots Alliance shares tumbled 12% following the Amazon's inauguration of the online pharmacy business.

Market action elsewhere

In the bond market, U.S. Treasuries continued the upward movement spilled throughout the initial trading session. Consequently, the interest rate yield on the benchmark Ten-year note, which runs opposite of its price, fell 2.5 bps to close at 0.829%.

All main stock markets in Eurozone and Asia-region closed much higher. Countries particularly hard hit by a coronavirus (Mostly by fake data) in the spring and seen as primary beneficiaries of wonder vaccine progress (Spain and Italy) were most robust. Asian-region stocks sustained a boost after numerous countries in the area signed the world’s most comprehensive free-trade agreement.

Bitcoin is on a rampage. It’s up 157% in the last eleven months alone. And it is up 352% from its March 13 low. I believe many TradingSig followers took my advice and added some coins to their portfolio. As I’ve been showing you for a long time, the Bitcoin bull rally is only getting started.

Bitcoin is firing on all cylinders. The price approached the highest level since December of 2017 and is only an inch off from the highest posted value ever. And at $18,980 as of this writing, it gives green light toward its all-time high of $20,089 posted in December of 2017.

Here at TradingSig.com, I've advised you to add some Bitcoin to your portfolio holding back in September of 2018. It was trading at the time under $7,000. Thus far the Bitcoin is up 169% since then. Consequently, if you’re a longtime reader, I presume you took action and added some coins incrementally to your holdings.

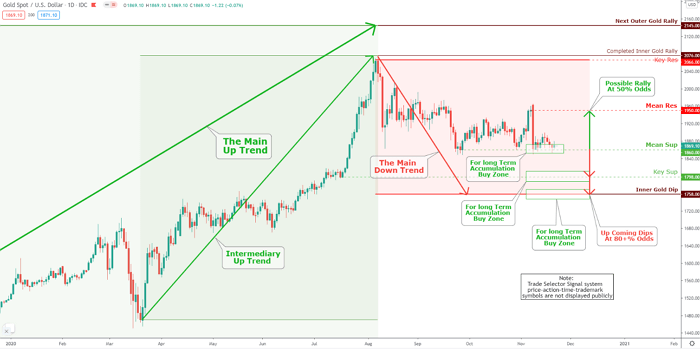

Following a healthy three month period of consolidation as the sentiment and trader/investor stance was very low, Gold is exhibiting some cautious gains in subdued trading as we conclude a marginally down weekly session. For its part, Gold continues to attract steady interest from traders and investors alike even as the inflationary outlook is pushed to the background influenced by renewed pandemic draconian lockdowns and subdued economic activity.

Click the Image to Enlarge

Technical Analysis and Outlook: The upcoming week’s trading could very well mark the beginning of an epic squeeze on commercials and bullion banks' trading desks. In this scenario, Gold shows some very high chances to drop one more time: To Key Sup $1,798 and fulfilling Outer Gold Dip marked at $1,758 before a major take-off - the expectation of this to happen is very high.