Weekly Market Review & Analysis For June 7, 2021

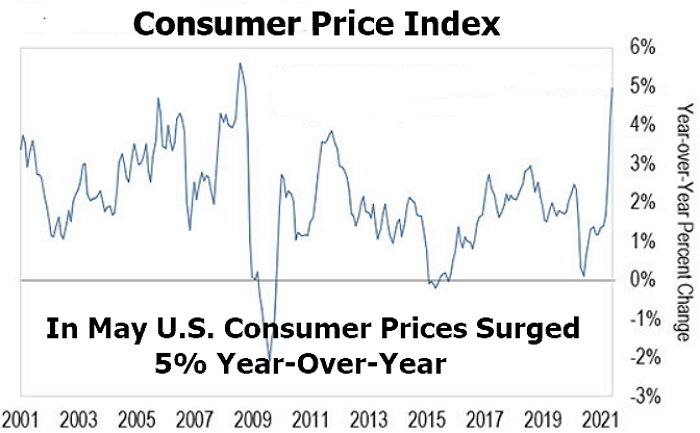

The market - Inflation has returned with a roaring vengeance since January of this year. And as of Thursday morning, the U.S. Labor Department announced that consumer prices in May climbed 5% year-over-year. As we can notice in the chart below, that is the highest yearly inflation rate of change in nearly 13 years.

And it is not only the Consumer Price Index. The Core Price Index – which removes out the prices of energy and food, two together incline to be more volatile - increased 3.8%. That is the biggest gain since 1992.

As an observation. Are you spending less on purchases presently? Have you been to the grocery store lately? Fill your gas tank? Bought any clothing, traveled someplace?. Bought a home?. The economists are not the only ones noticing inflation.

For those of us individuals who anguish about our investments, savings, and the cost of everyday goods and services, these prices are not very good news. However, this case scenario keeps me concerned if this trend will stay with us for the upcoming year.

To some extent, inflation is foretold and will more likely be short-term. For instance, we should presume that the prices of commodities such as crude oil will arise. As of late, most of the world has been under stringent restrictions for any traveling. As a result, the market was not there, and the vest supply chains decreased their size position accordingly.

However, the economy has swiftly bounced back. Things have broken right open, and I can tell you that coming from a data perspective, the flights are full-on vastly domestic and international destinations.

What we see here are positive signs. Supply and delivery chains are building good progress, improving lead times for goods and services also many kinds of commodities, albeit perhaps not as quickly as we would like.

And it is encouraging to see that the many prices of various commodities are falling. Copper, aluminum, steel, and corn have all backed off more than 10% since April. And lumber prices, which are closely bound to the housing market, have fallen more than 30%. So let's have faith that this trend continues onward.

We will be watching very closely if inflation proceeds to increase even though commodity prices continue to decline. If that occurs, we are in for an extended period of more high-priced goods until the Fed dramatically shifts its monetary policy.

Now let us move to this week’s market highlights

The first three days of market trading was a tease for many participants in that the S&P 500 index by a whisker missed out on an all-time closing high in each session. It eventually got over the bump on the Thursday session and closed the week with a slight 0.4% gain. Price action was moderately tight-ranged throughout the abbreviated week for the broad benchmark index.

The DJI Average with -0.8% posting faded nearly 1.0%, while small-cap Russell 2000 with +2.2% and Nasdaq Composite print of +1.9% each advanced around 2%.

From a market sector outlook, the S&P 500 information technology with +1.4%, consumer discretionary with +1.6% (propped up by a 4% increase in Amazon.com), health care with +1.9%, and real estate +2.0% were the sectors that finished the week as leaders.

On the contrary, the industrials with -1.7%, materials with -2.0%, and cyclical financials with -2.4% postings were the market sectors that declined around 2%.

The underachievement of the cyclical stocks was somewhat due to the profit-taking case and a fundamental belief that the U.S. economy is moving into peak growth rates. The last-mentioned viewpoint was indirectly supported by the U.S. Treasury market, which seemed to cling to the peak inflation hypothesis.

Significantly, the Ten-year yield decreased ten basis points in this week's session to post 1.46%, despite though the total Consumer Price Index (CPI) was up 0.6% month-to-month in May. Amusingly, even the equity market liked the released numbers as it ran with the top inflation thought uttered by U.S. Treasuries.

The Silver $28 barrier has been broken again, and Mean Sup $28.18 is the strong line in the sand that needs to be crossed.

Bitcoin market

The market after Wednesday's news that El Salvador will accept Bitcoin as legal tender, the Bitcoin price shoot up to almost $37,400. However, since Thursday afternoon, the cryptocurrency has been moving sideways again. Or is this just the calm before the storm, and will Bitcoin surprise us with a hefty price increase?

Following the Bitcoin price is not for the weak-hearted. In just over one month, the price has halved. But there’s good news too. The Bitcoin price finds support at Key Sup $30,430 for the third time in a row. And you know what they say: third time’s a charm!

So what’s next

Keep in mind that this is not financial advice, but the next level of interest could be $48,000. This seems not far-fetched, but it has only been a month ago since Bitcoin hit this price. During the end of April 25 and May 13, $48,000 was a critical support level. In case Bitcoin could reclaim this support, this would be an incredibly bullish signal.

It’s difficult, if not impossible, to determine the future price action of Bitcoin and other cryptocurrencies. The market is still young, and the news can affect the price in every possible way. For example, if more countries follow El Salvador’s footsteps, this could fuel a new Bitcoin rally.

Google digital asset exchanges adverting will finally be allowed

This is a considerable development; Google recently opened the door for digital asset exchanges to be promoted and advertised on its platform. This is most revealing.

I presume some people do not know that Google back in March 2018 halted crypto advertising on its platform. And also, it promptly shut down all existing ads regarding cryptocurrencies and digital assets.

Many of us wouldn’t imagine that Google's business model would be censorship, notably not back then. Nevertheless, Google revealed its true colors. And this draconian move had a significant impact on the whole digital asset industry.

For all that, how can an emerging industry grow its customer base if it can not advertise its services? By all means, Google insisted that this restriction was to keep everyone safe. It also stated that there were way too numerous scams in the crypto industry.

There were indeed many bad actors in the cryptocurrency market, but there are frauds in every industry - Wall Street anyone!. That is why due diligence is necessary when performing both purchase and investment decisions.

Luckily, Google just lifted this taboo – at most inconsiderable partially. Google will currently allow cryptocurrency companies and digital asset exchanges with regulatory approval to promote its product and services.

So, as of August 3, the companies and exchanges that meet Google’s guidelines will be cleared to begin advertising. I am sure we will see a flood of digital asset advertisements as a result. It will be a significant weight shading from the industry shoulders.

And I will emphasize that the timing of this significant move is not a fluke. When Coinbase - digital asset exchange went IPO (Initial Public Offering) beginning this year, it provided a certain quality and credibility to the whole digital industry.

Forthwith that it is now a public company, Coinbase is obligated to report earnings results for each quarter of its operation. This presents a level of transparency that is never existed previously within the digital industry.

And as we reviewed this subject before, it became apparent that Coinbase is amazingly profitable. In actuality, it is now the biggest brokerage platform in the entire world by a wide margin. So no doubt Google wants to draw in new advertising monies from Coinbase based clients on its extraordinary success.

Also, other topmost digital asset companies like Ripple Labs, Circle, and Kraken are each attending to go IPO very soon. This will extend the digital industry’s trustworthiness even more.

What we are witnessing right now is a sign that the digital asset industry is growing and maturing. This is how all happens. And that suggests that Google can no longer stay clear by banning ads from exchanges and regulation-compliant companies in the digital industry.

So what this all means? Meaning is that a very bullish market for the digital asset is imminent. We will see the digital industry proliferate and attracting many brand-new users in the process. And I am sure some excellent investment opportunities will develop as a result of it.