Weekly Market Review & Analysis For December 21, 2020

The large-capitalization market consolidated in the vicinity of record highs on this Christmas holiday-shortened trading week, as the small-cap Russell 2000 rallied an additional 1.7% to settle beyond the magic 2000 level and at afresh record highs. The broad S&P 500 index with -0.2% edged lower, whereas the Nasdaq Composite with +0.4% and DJI Average with +0.1% augmented out small gains.

Significant factors this week involved a 4.2% gain by Apple amid a story that it is striving to produce electric vehicles with self-driving capabilities; the Federal Reserve authorizing large banks (Too big to jail) to repurchase its shares in the Q1 in 2021, notwithstanding with income limitations; and Trump's demand that Congress raise the stimulus checks to Americans from $600 to $2,000.

The large-capitalization market sectors struggled to attain traction, although outside the information technology sector with +0.8% and financials sector with +1.9% helped by the Fed and Apple. The remaining five sectors faded at least 1.0%, including a 2.0% drop in the energy sector.

The unfriendly spin regarding the possibilities for boosting stimulus checks is that President Trump may delay the authorized $900 Billion stimulus agreement with a pocket veto. U.S. House Speaker Pelosi scheduled a whole House of Representatives vote on Monday to boost stimulus checks from $600 to $2,000; however, Republicans looked less willing to make concessions.

Small-capitalization stocks created their path, which was embedded in the recovery anecdote for the next year after considerably underperforming the large-capitalization stocks since 2018.

In other Market news

In Asia, the regional market moved mostly higher throughout trading on Thursday. Nikkei 225 Index rose by 0.5% in the rising sun, while the H.K. Hang Seng Index fringed upward by a meager 0.2%.

Meanwhile, the significant Eurozone stock markets turned in a somewhat mixed performance for the last trading day of the week, with the German market being closed for the Christmas holiday. The United Kingdom's FTSE 100 Index crawled up 0.1%, while the French CAC 40 Index mowed down 0.1%.

In the bonds for the week, the U.S. Treasury market closed at 2:00 p.m. ET on Thursday and have succumbed ground after coming underweight squeeze in the previous trading session. The Ten-year yield was lower by two basis points to close at 0.93%, versus last Friday's session.

On Christmas Day, approximately 2.3 Billion dollars worth of coins futures did expire, which has caused very active Bitcoin Christmas trading.

According to data company Skew, 102,200 Bitcoin options did expire on Friday. According to Skew, Friday's expiration has caused remarkable clusters around the strike price of $15,000 and the strike price of $20,000.

This is because contract holders adjust their positions as the market expiry date approaches. Traders who make a profit may also decide to receive the payout and dump their cryptocurrency.

Bitcoin Technical Analysis and Outlook

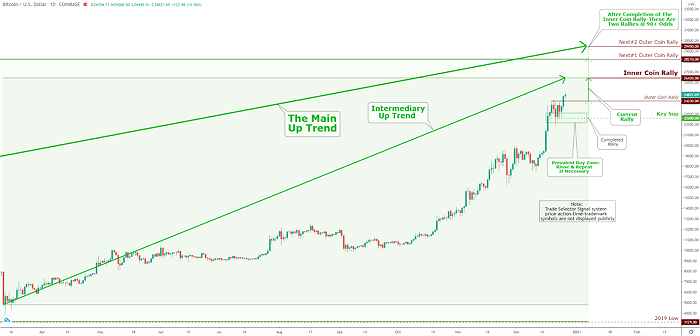

With the completed Outer Coin Rally $24,230, on Dec 20th, the coin traded at stagnation period for four days allowing us to lock and load for the next move to Inner Coin Rally $26,420. The major Key Sup $22,600 is currently representing a slight possibility of a drop before launching the next robust up movement.

Click the Image to Enlarge