Weekly Market Review & Analysis For December 13, 2021

After the S&P 500 market ended last week at a record closing high, this week, the index has slid 1.9% after investors took some money off the table, taking in the FOMC policy decision. The small-cap Russell 2000 and DJI Average both fell -1.7%. The Nasdaq Composite with -3% was the biggest underperforming by its class.

As anticipated by the market, the Fed did not change the range for the federal funds rate at 0.00-0.25% and said it would decrease the amount of assets purchased to $30 billion a month ($10 billion in MBS and $20 billion in U.S. Treasuries) and also announced three rate increases in 2022 in anticipation of continuing inflationary pressures.

On a similar note, the Producer Price Index (PPI) for November exceeded expectations as the index for the final demand rose 0.8% month-over-month and year-over-year rose 9.6%.

The only day the S&P 500 ended higher was Wednesday - Fed decision day. And this was due in large part to short-covering activities on the assumption of Fed Chair Powell wasn't as hawkish as some had thought.

The market was unable to sustain that gain in the following couple of days due to the volatility on the market arising on a "quadruple witching" day, where stock options, index options, stock futures, and index futures expired. This left all sectors unbalanced by the time the week ended.

The information technology sectors with -5.1%, consumer discretionary with -4.3%, and energy with -5.0% were the worst performers, posting losses of more than 4.0%. The health care sector that is mainly defensive-oriented with +2.5%, real estate with +1.6%, consumer staples +1.2%, and the utilities sector posting +1.2% were sectors that grew over 1%.

As Apple neared touching the $3 trillion in its market value capitalization, investors probably thought it was an excellent idea to profit, especially when considering the negative guidance provided by Adobe and the ongoing spread of the coronavirus fearmongering.

The yield on the Ten-year U.S. Treasury bond fell by nine basis points and slipped to 1.40% amid a rise in demand, while the yield for the Two-year bond dropped to two basis points 0.64%, despite the Fed forecasting three rate increases in the coming year.

Market elsewhere

The Bank of England (BoE) increased its rate by 15 basis points to 0.25% in a stunning move in the interest rate market. It was also reported that the European Central Bank (ECB) and Bank of Japan (BoJ) have kept rates at the same level in line with expectations and also announced a new reduction in asset purchases. The central bank and the government People's Republic of China (PBoC) send out strong signals that after one year of tightening rates, the priority of the policy shifts towards supporting growth.

European equity markets ended the week with a slight decline, as concerns regarding the spreading of the Omicron variant remained and led to some restrictive government policies. At the same time, markets also absorbed news from the region and the monetary policy decision this week.

The United Kingdom FTSE 100 Index moved 0.1% higher, while the German DAX Index dropped 0.7%, French's CAC-40 Index declined 1.1%. Switzerland's Swiss Market Index and Italian FTSE MIB Index decreased 0.6%, while the Spanish IBEX 35 Index faded 0.8% lower.

Euro Dollar and the British Pound fell against the U.S. Dollar, while bond yields in Europe were lower, as the interest rates in the United Kingdom were essentially flat. At the same time, crude oil dropped due to inflationary pressure.

Market(s) in the Asia-Pacific region were choppy in the closing hours as markets continued to be volatile as the continuing uncertainty over the consequences of crucial monetary policy decisions. The Chinese, as well as an emerging market, were further helped by recent developments within China. The Evergrande and the Kaisa Group are now officially in default; nevertheless, the Chinese government remains in charge of the current situation; however, there's more to the story than the headlines in the real estate industry commenting.

In the land of the rising sun Nikkei 225 Index dropped 1.8%, and the yen modestly rose. China's Shanghai Composite Index dropped 1.2%. While H.K. Hang Seng Index fell 1.2%, and Indian's S&P BSE Sensex 30 Index fell 1.5%, respectively. At the same time, the S&P/ASX 200 Index of Australia climbed modestly higher, closing at 0.1% higher, and the South Korean Kospi Index moved positively 0.4%.

Precious metal market

The gold market rose convincingly, touching almost the $1,800 mark on Thursday, resuming the upward trend following Wednesday's Fed meeting rate decision. On Friday's session, gold was trading at a high for the week at $1,814 up and close net $28 from last Friday's closing, posting traded low of $1,753 on Wednesday. Silver is up 2 cents, closing at $22.34 over the exact trading time frame, falling as low as $21.43 on Wednesday.

This is not a time to try to make lots of money with the gold and silver market. This is a time to get ready and safeguard your wealth. This straightforward piece of recommendation is that those who relinquish the least will be the victors after the upcoming financial crisis is ended.

Remember, when the financial system breaks down, the PTB (powers-that-be) have always maintained their witty reputation by utilizing two simple policies scheme:

- Inflate from here their debt (inflate or die) and,

- Control their enraged masses with fear and the event of a threat of internal or foreign "enemies" instead of their corrupted criminal leaders.

Whether it be a Biden, Putin, Franco, Romanov, Batista, Commodus, or Bourbon at the driver's seat of a sinking ship. The final act for bloated leaders commanding over-bloated debt, which without exception ends the same: More controls, more lies, less truth, less liberty, and less open free markets.

Bitcoin

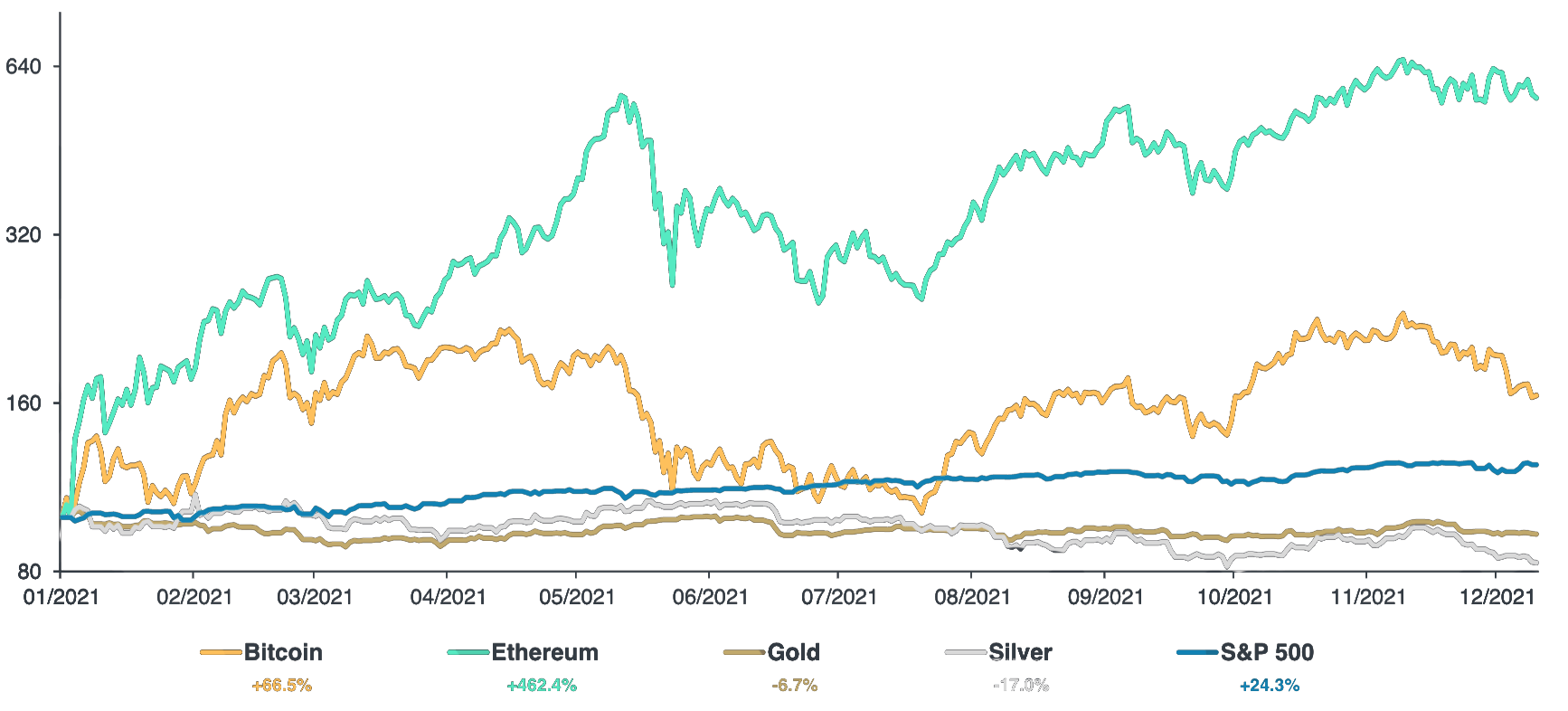

Feeling a little down because the Bitcoin market price took another hit? Please don't feel bad; it's almost Christmas! Besides, Bitcoin outperformed all other assets. The chart below is from this year's chartbook from Incrementum, and it shows Bitcoin having a better year than Gold, Silver, and the S&P 500.

Bitcoin took all the other assets to school (but Ethereum reigned supreme). Exactly three years ago, on the 15th of December 2018, Bitcoin bottomed out. The price reached its lowest point since the last bull run ended.

Bitcoin was available for as little as $3,122, so what happened afterward? Nothing special, the price only multiplied by 14.5 to today's hover at $47,000.

This article was printed from TradingSig.com