Weekly Market Review & Analysis For August 30, 2021

The market, after a quiet August, started the new month on a calm note. The S&P 500 gained 0.6%, while the Nasdaq gained 1.6%. The Dow lost 0.2% throughout the week.

The S&P 500 & Nasdaq market saw the majority of the gains this week on Monday. They were able to reach new record highs throughout the week.

The new month saw the release of non-manufacturing and manufacturing surveys from significant economies. Many of these surveys indicated deceleration. Manufacturing and non-manufacturing surveys in the U.S. continued to expand.

Friday's release of the August Employment Situation report was a mixed bag. Nonfarm payrolls rose by only 235,000, whereas the consensus forecast of 750,000. This headline misstep was accompanied by a 0.6% rise in average hourly earnings, which was much higher than the consensus 0.3% projected increase.

Seven market segments ended the week in positive territory, with gains ranging between 0.9% (technology), to 4.0% (realty). Financials (-2.5%), energy (-1.4%) and materials (-0.9%) were the worst performers. Industrials (-0.4%) had smaller losses.

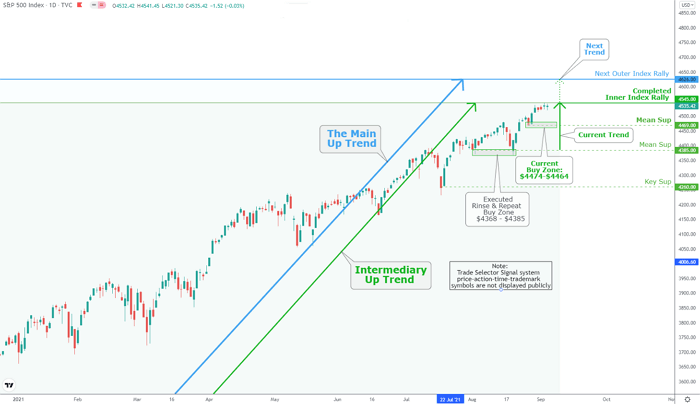

Our Inner Index Rally of $4,545 was hit on Thursday. The Spooz is currently in a tight trading range, and we are awaiting intermediate confirmation of the trend. However, a drop to Mean Sup $4,469 is a strong buy and provides ample opportunity to load the boat for resurgence to retest undeveloped key resistance and completed Inner Index Rally. The subsequent significant outcome is Outer Index Rally marked at $4,626 to follow.

Market action elsewhere

The global equity market(s), which suffered from a mid-August depression, has rebounded, and as central fears from the previous week eased, bond yields rose to their six-month highs in August. However, China's Caixin manufacturing fell into contraction. This prompted speculation about further easing.

Friday's trading session saw mixed results across Asia-Pacific stock markets. Japan's Nikkei225 Index soared by 2.1%, while China's Shanghai Composite Index dropped by 0.4%.

During the session, major European markets moved down. The French CAC 40 Index fell by 1.1%, while the German DAX Index dropped by 0.4%, and the U.K's FTSE 100 Index both declined 0.4%.

The monthly jobs report triggered a move in the bond market that saw U.S. Treasuries fall to the downside. The benchmark Ten-year note yield, which is opposite to its price, rose 2.8 basis points to 1.322%.

Precious metals

On Friday, the Gold market turned sharply in the positive territory thanks to a negative report on non-farm payrolls. The Friday session was up $17, closing at $1,826 and $10 for the week as we enter the long holiday weekend. On Friday, Silver was up 80¢ and 75¢ for the week closing at $24.69.

The NFP news continued a strong year for commodities, with commodities moving up. In 2021, the Goldman Sachs Commodities Index has increased 31.7%.

Thursday's Commitment of Traders report showed that the Swaps (mostly bullion bank) are losing the battle for reducing their short positions. Their net shorts have increased by 8,259 contracts, and Producers/Merchants have reduced their net shorts to 2,425 contracts. 80% of the short side now lies with the Swaps.

Regular readers of this site know that bullion bank trading desks were encouraged to reduce their trading volumes as much as possible under Basel III. However, in defense of their current position, they are cutting back even further.

Hedge funds have now added 6,233 contracts net longs, bringing their net position up to 81,677 net long. This is significantly lower than their average net long position of 110,000.

Cryptocurrencies

Bitcoin market finally broke above the $50,000 Maginot line (equivalent to 42,400 Euro) and our Mean Res $50,130. At the same time, Ether (ETH) has risen above the $4,000 mark for the first time on May 14, 2021. This indicates that the crypto market is gaining popularity, and legacy finance companies are taking steps to tap into the growing demand.

Technical analysis suggests that if buyers maintain the price above $50,000, the BTC/USD pair could rally to our Next Inner Coin Rally at $54,550. Although this level could act as stiff resistance, bulls may be able to push the price even higher. The pair could challenge our Mean Res $59 890, Key Res $63,750, and the all-time high of $64,899.

Turbulence is expected to continue in the crypto-world market as Bitcoin prices are trading above $50,000; while newer cryptocurrencies emerge, they will challenge established coins like Bitcoin (BTC) and Ethereum (ETH). It is essential to note which currencies have moved and which ones have slowed down - Stay tuned.

To our friends in America - Happy Labor Day Weekend.