Market In Review & Analysis For April 4, 2020

The stock market this week had its great days and its bad days. Regrettably, the losses on the lousy trading days outran the gains on the great days; therefore, overall, it was a losing week for the leading stock indices.

The small-cap, as well as mid-cap stocks, were hit the hardest; however, the large-cap stocks felt the pain as well as traders and investors sold into prevailing strength, frightened by the expanding economic, social, medical, and psychological repercussions of C-virus, also doubts about potential American economy's rebound.

Market action

The S&P 500 market started the week $2,541 ended the week at $2,489 for a change of -52 points or -2.1%. The DJI Average index fell -584 points or 2.7%, Nasdaq Composite index dropped -129 points or 1.7%, and the small-cap Russell 2000 index succumbed -80 points or 7.1% for the week.

|

Crude oil prices bounced back off the chart as was one of the several winning bright spots, rising as much as 35% on the back of stories that Saudi Arabia and Russia are approaching to the mutual agreement to cut production to stem the slide in crude oil prices. That thought triggered a short-covering oil rally that turned into a rare trading week where the energy sector posting +5.4% gain come to the fore as the best bearing sector. The weakest areas were the utilities with -7.1%, financial with -6.8%, mighty real estate sector with -6.2%, consumer discretionary sector posting -4.7%, and industrials sector print of a -4.5%. The stock market as a whole had a customarily risk-averse mindset, demonstrated by the top performance of the consumer staples sector with a +3.5% and health care sector with a +2.0% gains. The latter was backed by a report of Abbott Labs earlier in the week that it has begun point-of-care testing that can recognize C-virus strain in as little as five minutes. |

Click the Image to Enlarge

×

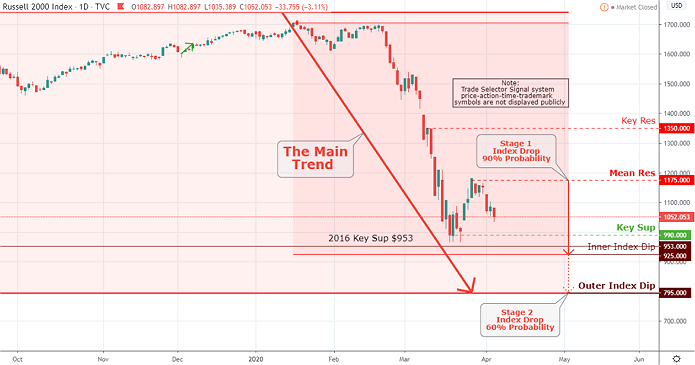

As remarked before, the Russell 2000 index is an outstanding overall market indicator; The index shows us a Stage 1 drop at 90% probability to an Inner Index Dip $925 with Key Sup marked at $990. With Stage 2 to follow to Outer Index Dip $795. The short term upside resistance is marked at Mean Res $1,175. |

Also, Johnson & Johnson announced that it identified a leading C-virus remedy candidate that could be set for human clinical testing as early as September of this year.

The sobering contention, however, came from President Trump's perception that the next two weeks of April could be a "very, very painful" time for America, which caused some mid-week shock for the stock market as culminated a 7.0% drop in the small-cap Russell 2000 index on Wednesday alone. The real hurt, though, was observed in the labor market on Friday.

Generally, people still do not understand that the global economy and stock markets worldwide were in bubbles way before the C-virus pinpricked both. Moreover, even after the C-virus is remedied, there is no turning back to the way things were before. There is no way to restart the global economy because it is inconceivable to reflate the bubbles.

Weekly initial unemployment claims rose to a record 6,65 million, bringing the two-week total for unemployment claims to close to 10 million. Those jobless claims, though, were mostly missing in the March Non-farm payroll report, which was based on the hiring survey carried out the week of March 12. Also, it was remarked on Friday report that non-farm payrolls decreased by 701,000 jobs in March and that the unemployment rate rose from 3.5% to 4.4%.

In reality, the unemployment rate is most likely closer to 10% at this point. That concept kept the stock market in check on Friday's session along with intensified concerns that the V-shaped U.S. economic recovery many were hoping for will not happen.

So, the poor performance of the small-cap and mid-cap equities, which have a consistent predominantly domestic orientation, have distinguished themselves as evidence of those concerns.

BTW, do you want to have a job with 100% job security? Strive to become a Federal Reserve president. You never need to be correct about anything, call and projected anything you want even if it never happens, you can carry out incredibly damaging economic and monetary policies with no ramifications and never be held responsible - What a gig.