Market Commentary & Analysis February 12, 2020

The large-cap stock market indices began yesterday's trading session popping new intraday highs, only to see stocks firmly pulled back during the session amid of follow-through buying absence.

The broad S&P 500 index with +0.2% and heavy-tech Nasdaq Composite index with +0.1% print still farmed out new closing records, while the DJI Average index ended unchanged. The small-cap Russell 2000 index advanced 0.6% on the day.

Technical Analysis and Outlook: The Index completion of Outer Index Rally $3,382 is in progress. This may be the case of fulfilling its destiny and then deflate to Mean Sup $3,329 level. Time will tell 'the end of the intermediate rally' pending on Trade Selector Signal TARC symbol (Proprietary) confirmation.

Click the Image to Enlarge

Market action

The opening lift in the market was credited to news reports showing that the rate of new virus incidents was slowing down, and the Federal Reserve Chairman Powell told the House Financial Services Committee that the central bank would continue favorable monetary policy considering the risks that persist due to the coronavirus, which we will be "closely monitoring."

The S&P 500 index real estate sector with +1.2% and energy sector with +1.0% gain promoted at least 1.0% posting. The index communication services sector with -0.4%, consumer staples sector with -0.3%, and information technology sector with -0.3% marked underperformance: being pressed by the Facebook (-2.8%) downgrade from Hold to Sell.

The market ratio of advancers vs. decliners in the NYSE exchange was exceeding 2 to 1; however, yesterday's advance was thin, given the lacking the leadership from the big-cap tech stocks.

Also, the Federal Trade Commission (FTC) remarked it would be reviewing small acquisitions carried out by Microsoft (-2.3%), Alphabet parent Google Inc. (unchanged), Apple (-0.6%), Amazon (+0.8%), and Facebook.

Separately, the merger deal between T-Mobile US (+11.8%) and Sprint, which stock climbed more than 75% in response to confirmation and passing the merger by a federal court in New York.

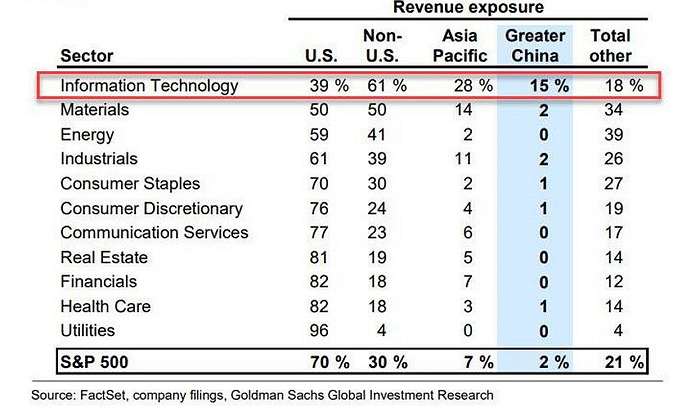

On the side note, is the tech stocks about to undergo a "Dot Com" bubble crash? It is suddenly everything in China's hands, the one S&P 500 sector with the most considerable exposure to Greater China as well as the Asia Pacific, by and large, is also the market sector that has outperformed all others in recent months - Information Technology.

Other market news

The earnings releases: The Goodyear Tire with -12.4%, and Under Armour with -18.9% posting disappointed investors with their returns and/or direction leadership. Both companies cited the negative result caused by the coronavirus outbreak. Burlington Stores with +6.5% outperformed after establishing guidance.

United States Treasuries ended on a lower note yesterday and hardly moved throughout congressional testimony by Fed Chair Powell's. The Two-year yield rose four basis points to close at 1.42%, and the Ten-year yield extended four basis points to finish at 1.42%.

The United States Dollar Index (DXY) faded 0.11% to close at 98.75. West Texas Intermediate (WTI) crude oil advanced 0.9% to finish the day with $49.92/bbl closure.

Then there is Bitcoin crypto, which kissed and passed the $10,000, Maginot Line, yesterday and is trading comfortably above it in pursue of Inner Coin Rally $11,040.