Investing in “X-Bonds” & Addendum

Authored by: Jeff Brown via Bleeding Edge

“X-Bonds” is the name used to describe a particular type of convertible bond. Specifically, X-Bonds are convertible bonds in high-growth companies with little to no downside risk and still have the upside potential associated with exponential growth companies.

These are investments that very few people know about. But they are some of our best opportunities in this volatile market.

A convertible bond is a type of corporate debt at a high level. Its hybrid security is valued for both its interest payments as well as the potential convertibility into equity. Like most debt, these bonds are issued by growth companies looking to raise capital. Holders of the bond will receive regular payments (referred to as a coupon) and will reclaim the bond's par value at the time of maturity.

And because these assets are bonds in high-quality companies, they are a very conservative investment. The issuing company is obligated to pay its bondholders.

Assuming we hold to maturity, the only real risk is if the issuing company goes bankrupt before maturity. But I don’t see that happening. The only companies I consider for X-Bond investments are businesses with strong – and growing – free cash flow. These companies are leaders in their space and have attractive product portfolios, ensuring future growth.

This ensures that they will have the capital to make their coupon payments and return the bond's par value upon maturity. So far, this should sound relatively familiar for a bond investment. But here’s what makes convertible bonds different.

As the name suggests, these bonds can be “converted” into shares of stock in the underlying company. This is an essential feature of these assets that gives us significant upside potential.

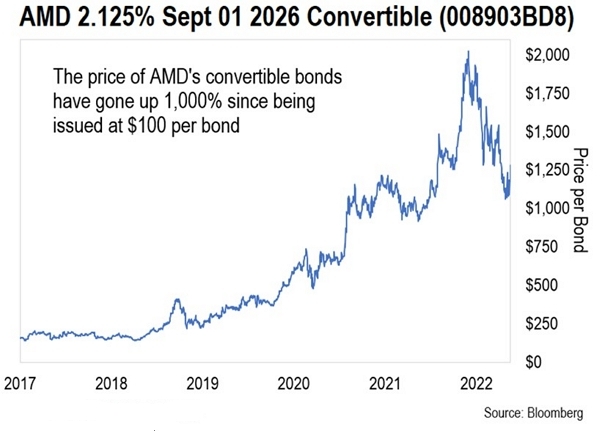

For example, a convertible bond issued by Advanced Micro Devices (AMD) in 2016 shows a return of more than 10x.

This is only possible because of the convertible feature built into the bond. When these AMD bonds were issued, the price of AMD’s shares was $5.90. And the conversion price for the bonds was $8. That means holders of those AMD bonds could convert their bonds at just $8 a share. And with AMD currently trading at about $80 a share, it’s easy to see how investors made a 10x return.

And what I love about these assets is the built-in downside protection. If AMD’s stock had not performed over this period – even if it fell – bond investors would sit back, collect their coupon payments, and receive the bond's par value at maturity.

At a time when markets are incredibly volatile, that sort of downside protection is incredibly valuable. And it keeps us open to the future upside when equity markets return to “growth mode.”

X-Bonds important questions

These X-Bonds issue regular coupon payments. This is money that will be deposited into our brokerage accounts. We can think of the coupon as interest payment and is therefore taxed at an investor’s marginal tax rate.

When we reclaim the bond's par value, this will be treated as capital gains and taxed accordingly. Example: If we buy a bond at $700 with a par value of $1,000, we’ll reclaim the total $1,000 at maturity. This is a 43% return and will be taxed as if it were capital gains (long-term or short-term, depending on the duration of the investment).

And if the bond goes well above the par value – which will happen when the underlying stock climbs higher above the conversion price – this will also be taxed as a capital gain.

So, these bonds have varying dates of maturity. Some bonds have maturity dates just a few years in the future. Others have maturity dates that are a decade away.

Some X-Bonds will have a specific maturity date. Some companies have different issuances at different maturities, conversion prices, and coupon payments. Investors can choose which bonds work best for their circumstances.

It's worth mentioning that X-Bonds differ from a typical municipal bond offering. A primary offering for a municipal bond will raise a total amount, but that amount is broken up into a range of maturities across 10 or 20 years. This provides a lot of flexibility for investors as they can choose the maturities most suitable to when they would like to receive the par value of the bonds in the future.

Convertible bonds can be purchased in an IRA. That might be preferable for investors looking to use the tax advantages for these retirement accounts.

What if an investor needs to “get out early?” This is where some nuance comes into the equation.

We will reclaim the bond's par value at the time of maturity. But the value of these bonds can fluctuate between now and the maturity date. That means it’s possible to see paper losses for these bonds between now and maturity.

But we should keep in mind that this is temporary. The company is obligated to repay the bond's par value – typically $1,000 per bond – at the maturity date. As we approach that date, the value of the bonds will rise to par value.

Therefore, the prudent thing to do is to only invest in bonds that we are comfortable holding through to maturity. That’s how we’ll manage our risk.

If we follow this strategy, we have three possible scenarios:

- Worst case scenario, we’ll hold to the maturity date, and investors will receive the bond's par value upon maturity (usually $1,000 per bond). We will also collect our coupon payments along the way.

- The share price of the underlying stock rises, and with it, the price of the bond increases as well, as the AMD example above shows. This gives investors the option to sell the bond at a profit in addition to having received the coupon (interest payments).

- If the share price rises well above the conversion price, investors have the option to convert their bonds into shares of the company at the conversion price.

So, we will have two or three options before the maturity date. The next six months or so will certainly be volatile. But healthier markets will return. And when they do, the bonds will benefit from the rebound in equity prices, and we’ll be able to close out X-Bonds with a healthy profit.

And if this volatility persists longer, we’ll have option one available. We’ll collect our regular payments and make a great return when we reclaim the par value at maturity with no downside risk.

In our view, this is the best of both worlds. X-Bonds combine the conservative, income-producing nature of bonds with the upside potential of tech stocks.

Addendum

Where to buy “X-bonds”

Indeed, convertible bonds are not as easy as buying equities, but it’s not that difficult. Usually, all it takes is a simple call to the fixed income desk at our brokerage. But the extra few minutes are worth it; these are some of the best investments I know of to navigate a challenging market like the one we find ourselves in now.

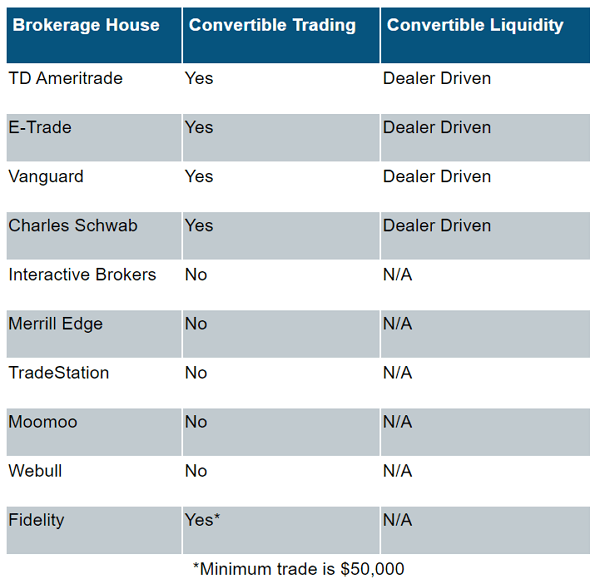

I anticipated readers would be curious about which brokerages are best for these assets, so I asked my team to survey the availability of several major brokerages. Here’s what they found:

Convertible Bond Availability by Brokerage

As we can see, at the bottom, Fidelity does have a minimum trade amount of $50,000 (50 bonds with a par value of $1,000). I know that’s not realistic for most investors. And it’s hard to understand why Fidelity does that, considering it is a retail brokerage house. But aside from that, there are some other great options listed above.

So for subscribers looking for access to these bonds, I would encourage you to open an account with one of the first four brokerages listed and contact their fixed income desk for specific X-bond investments.

This article was printed from TradingSig.com