Paying interest on cryptocurrency deposits is a crime in the U.S.

The crackdown against cryptocurrencies interest accounts is continuing. It was reported that the U.S. Securities and Exchange Commission (SEC) issued an amount of $100 million in penalties on BlockFi, a cryptocurrency-based exchange. $50 million will go to the SEC's fund, while the remaining $50 million will be distributed to the 32 states who imposed similar charges to the SEC. What is the "crime?" Paying percentage rate on deposits in cryptocurrency of up to 9.5%. I'm not kidding.

We knew it was going to happen. We discussed how the SEC was planning to take actions against another meaningful crypto exchange, Coinbase, announcing that it would begin the "Lend" program in the U.S.

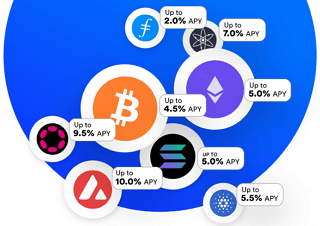

Coinbase Lend is similar to BlockFi Interest Accounts. It permits clients to receive interest from deposits made in cryptocurrency, which are much higher than available bank rates.

Coinbase Lend is available in more than 70 countries across the globe. However, due to the threat made by the SEC, it's no longer accessible within the U.S.

It was expected that BlockFi would be the next on the hit list. For one thing, unlike Coinbase, BlockFi has been offering Interest Accounts to customers since March of 2019. The SEC asserts that BlockFi's customers were technically loaning their assets to BlockFi; the Interest Account was considered a security.

I find this fascinating when we grant the money we have earned to a financial institution and put it in a savings account to make a percentage rate on the account - this isn't considered a security.

When I state "grant," we essentially land the monies to the bank. The bank receives our capital and lends the money to small businesses or invests it into high-yielding fixed-income investment. In essence, it generates more money from our capital than what we get from our nominal interest rates.

When I use the word "nominal," I mean it. The average national rate of percentage rate on savings accounts is 0.6%. To put it in perspective, a $10,000 deposit with Bank of America will earn you a total of $1, where the interest is 0.01%

I'm sure the absurdity of these double standards isn't escaped on anyone. If we loan our money to banks, we get practically nothing as a percentage rate. For a deposit of $10,000, this isn't enough to pay for a no-frills meal in the restaurant - all this is despite the inflation rate hovering nowadays around 7.5%.

Regardless, the Federal Reserve maintains an artificially low Fed Funds percentage rate that directly affects our savings.

It is evident as the day SEC does not want us to earn the interest on our cryptocurrency holdings over the actual inflation rate for any cryptocurrency deposit we keep through a digital asset exchange.

Interest in cryptocurrency exchanges should be universal

Interest in cryptocurrency exchanges' digital asset lending programs is prevalent for apparent reasons. Savers and investors can earn income from their digital assets, either at or over inflation. It's a meaningful way to make an income from investments, given the current trends in inflation.

However, the U.S. Securities and Exchange Commission would like to stop this. It insists that when offering the prospect of a return on deposits, the offering must be declared securities.

When an account of digital assets that provides yield must be classified as a security, the result is that there will be higher costs and fewer income-generating options available to ordinary investors. In addition, the yields of our accounts will decrease due to bureaucracy, and so will the programs that are classified as securities.

Unfortunately, more cryptocurrencies companies will be put on notice following the BlockFi charge, meaning that fewer options will be available for investors within the U.S. market. We hope that our Dear international readers will be more secure.

This article was printed from TradingSig.com