Why infrastructure is the top plan for building a better world

Infrastructure on our planet is broken on the economic, political, and social scales, and there's an ever-growing gap between the real economy and the market. This distortion is nowhere more apparent than in the realm of infra-structure.

Infrastructure is among the most significant investing trends that we are currently tracking. The absolute power drives and connects the five major profitable themes for 2022 discussed in this article.

The infra-structure affects everything from the supplies needed for a sustainable planet to the electricity grids that power our livelihood. For investors, that can be a lucrative source advantage for making profits.

There's no way to go back to the way things used to be. The distortion has sparked the desire to design and change the way things are done. Upgrade, repair the problem, create, and develop across different platforms.

Visionaries are not the only ones who labor to create a better world. Governments are also aware of the need to invest in infrastructure. Think about this one: The World Bank recently cut its global economic growth estimates for 2022.

This is despite the enormous amount of money central banks have created since the outbreak began. They claim that they used to aid in the actual economy. This is a significant statement regarding central bank printed monies. It is a fact that it can not result in a sustainable economic expansion.

It is a requirement for concrete projects that can spur real advancement. That means more infrastructure development at a global level. It's also the reason that politicians left, center, right are all in agreement that a construction-and-reboot plan is necessary, even if they disagree on the specifics.

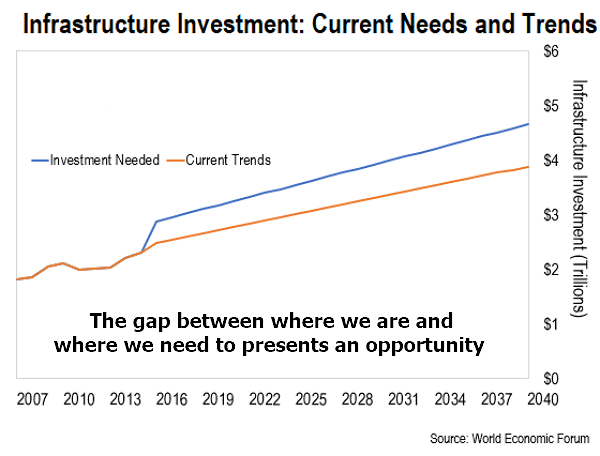

The chart below is of the WEF (World Economic Forum). This is the elite group aware of where the money is going because they control almost all.

The orange line shows present trends in infrastructure investments until 2040. The blue line illustrates how much countries must invest in infra-structure to compete.

Because of this, it will take time to reach infra-structure goals. However, the difference between our current situation and the future we want to go could be an opportunity for you to take advantage of this. Political leaders are now kicking off and allocating money for this sector.

The global competition to upgrade and construct infrastructure has led nations to boost public investment. This has attracted private sector investment also.

Today the private sector contributes only 1% of financing needed for infra-structure projects. However, it is anticipated to increase at least twofold due to today's distortions in the next several years.

The primary focus of the private sector has been to invest in financial assets rather than physical ones. It typically waits for the public sector to release cash and then does the same thing.

There's a massive demand for infrastructure investments by government officials. This means it is only a matter of time before the private money sector steps in to take its share.

A primary infrastructure turbocharger

I am expecting significant infrastructure capital inflow, where a large portion of that money will go to the raw materials of copper. Since the world has been running on crude oil since the past century, the 21st century will be the century of copper metal. Every significant economic component will require copper at the end of the decade.

Copper is already used in electronic devices for personal usage. It is used in construction, as well. At present, the demand for copper in energy and transportation is increasing. This is due to the desire for a greener future, another important driver for copper.

Demand will be generated from all sources, from solar and wind energy plants to EVs (electric vehicles). It takes between four and six times more copper to power wind and solar plants. This is in comparison to traditional power plants.

Electric vehicles, for instance, consume three times the amount of copper used in internal combustion engines. With countries across the globe striving to create a more sustainable future and they are expected to grow. The electric vehicles market is likely to expand exponentially.

10% of the new cars sold in developed countries are electrically powered. According to a Bloomberg source, in 2030, the number could reach as much as 50%.

A large portion of the demand is coming from China. It is currently responsible for 54% of the annual demand for copper as it continues to overhaul its infrastructure. This means using less coal and more renewable sources of energy.

What does this mean for you as an investment?

In all, the stage is set for a critical bull market rush in copper. Copper prices have rebounded more than other commodities in 2020. Currently, the metal has spent trading in the area near the peak of 2011. However, I don't think that will last long due to environmentally greener projects for the future. This means that now is an excellent time to invest in copper.

One method to achieve this for those who have not positioned themselves is to use one of the United States Copper Index Fund (CPER). It is an exchange-traded fund that surveys and tracks copper prices.

This article was printed from TradingSig.com