Gold Open Interest And Physical Market

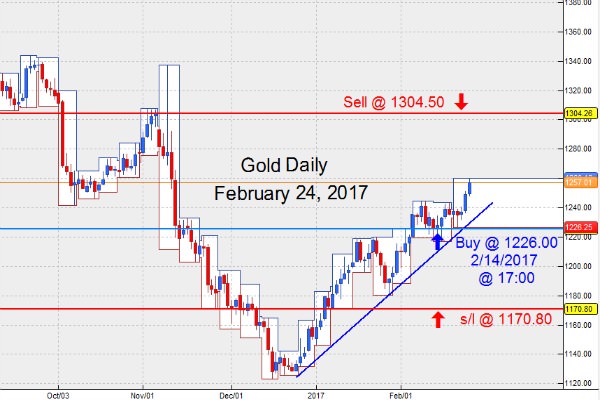

Paper gold and silver = a derivative representation produced by people. Except in cases where you are day-trading for the price, such as a chart shown, it is wise to keep away from paper gold and silver products.

The Thing I 'm attempting to convey to you here is the fact that virtually all paper precious metals products will go “poof” and a person's capital might be transferred away at the drop of a hat.

Those who manage these paper contracts fully understand this and so they in most cases put together their “terms along with agreements” in complicated legal language to protect themselves in the event that their highly developed gambling casino establishment implodes.

Paper gold fraud

The gold dilemma which comes up frequently is: Will there be adequate precious metal stored by the exchange(s) to fulfill and make good on all open contracts? The answer will be an absolute no. The contract open interest is a lot more than actual physical storage facility stock. Which means that every possessor of a long contract(s) wouldn't be capable of taking delivery.

The ratio relating to open interest compare with warehouse stock isn't a one-to-one. Sellers who've to ensure shipping and delivery, on the other hand, might also supply the metal from the outside the real storage in the physical marketplace.

Int the year of 2010 Andrew Maguire proceeded to go public in the one-of-a-kind King World News interview and revealed his alert to the authorities at the CFTC (Commodity Futures Trading Commission) of fraudulent activity being fully committed and price manipulation within the international yellow and silver trading markets.

This approach placed him in the center of the big controversy for revealing what might be the greatest fraudulent activity of all time. Connected with banks, countries, and politicians that there was in fact 100:1 leverage of the fact that investors/traders hadn't ever been aware of previously: However, today that is all public information.

In conclusion

Inside the yellow metal and silver market, there's not adequate authorized physical yellow metal along with silver backing the actual certificates which are currently being sold. For example, in 2016 there was a situation where a record 252 claims were on each one oz of gold readily available.

Keep in mind, that physical precious metals, conversely, do not provides any such risk. As soon as you purchase it, it's your own property. It may be kept in the location that you picked. It can be employed as a form of currency, and it is also extremely liquid.

The planners have now absolutely no readily available physical metal possession to be able to control/suppress the price of the yellow metal.

Therefore the paper market is virtually all they have gotten. The issue here is that every time that the paper market actually starts to lower the price. The precious metals physical purchasers are taking the stand by stating: ‘We understand the game, therefore we are sitting on the bid price, and we are just simply planning to get hold of it actual physical metal.

Related articles

Trading signal service for you!

News Blog