It Became Necessary to Destroy the Global Economy to Save It

Authored by: Charles Hugh Smith

You've no doubt heard "We had to destroy the village (Economy) in order to save it." The origi-nal quote noted by reporter Peter Arnett in 1968 was "It became necessary to destroy the town to save it." The phrase (whether an exact transcript or not) became emblematic of America's war in Vietnam, encapsulating the impossibility of fighting an unconventional war without front lines for "the hearts and minds" of the citizens with massive firepower.

We find ourselves in a similar situation today as all the immense firepower of central bank stimulus and intervention will be unwound in a chaotically destructive fashion in what I term The Great Unwinding of all the excesses of leverage, debt, stimulus and feverish speculation that now dominate the global financial system and economy.

As in Vietnam, the policies were launched with good intentions: Saving South Vi-etnam from Communism, the Domino Theory, etc. were the stated goals at the start, just as the goal of all the "emergency measures" pursued by central banks and Treasury depart-ments in 2008-09 was "saving the system from collapse," a possibility succinctly expressed by President Bush at the time: "This sucker's going down."

Just as America's intervention in Vietnam was an "emergency measure" that started out limited and then ballooned into all-out war, the Federal Reserve and other central banks unleashed the financial equivalent of Operation Rolling Thunder while governments cranked up deficit spending, i.e. borrowing and spending trillions to prop up the economy.

The policies that were announced as "emergency measures" quickly became permanent and were expanded as ending the programs would have torpedoed the fragile debt-based asset bubbles being inflated to boost the wealth effect, a metric eerily similar to the Vietnam War's infamous body count, where "winning" morphed into counting the casu-alties of the "emergency measures."

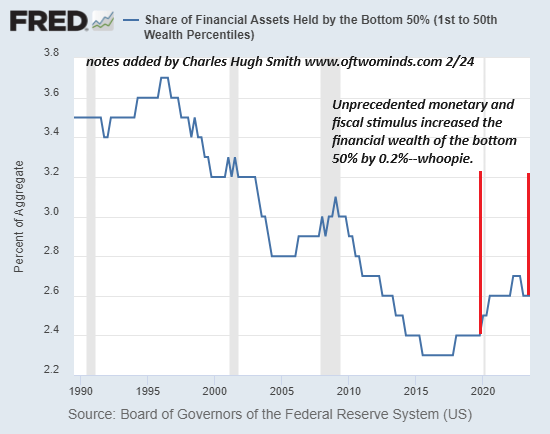

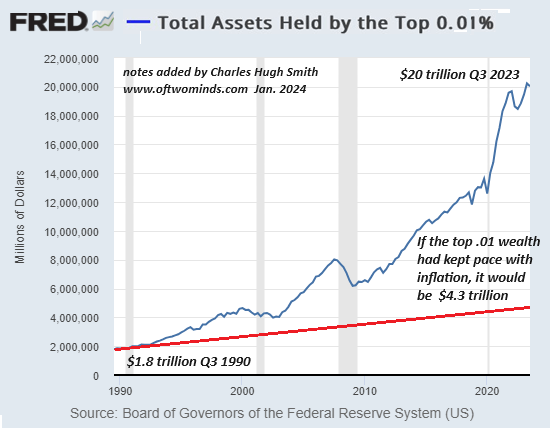

That the bottom 90% lost ground as the Fed boosted the wealth of the top 10% was another case of destroying the town to save it. Collateral damage is the antiseptic phrase of choice in such cases, and so as the Fed's bubble inflation enriched the already-wealthy--the wealth effect sounds so bubbly and positive, doesn't it?--the real economy be-came addicted to near-zero-interest debt, extreme leverage and gaming the Fed's expand-ing interventions: buy the dip, because the Fed will always leap into action to "save" the market.

The problem with interventions and addictions is that it takes ever larger doses to maintain the high. There is no consequence-free intervention or addiction, and so with each new round of stimulus, the economy's dependence on Fed / central bank manipula-tion--oops, I meant intervention--also expanded.

How the housing sector survived without trillions of dollars in Fed manipulation is a mystery, as the Fed buying trillions of dollars of mortgage-backed securities (MBS) is now the permanent policy, and reversing that "support" would unleash frighteningly uncon-trollable market forces.

That's where all this has taken us: the unmanipulated market is now Nemesis. Should the Fed and Treasury loosen their grip and the market wrenches free, then the global financial system and the global economy that now depends on it will both unwind in non-linear, unpredictable ways that will wipe out much of the debt, leverage and phantom wealth of The Everything Bubble.

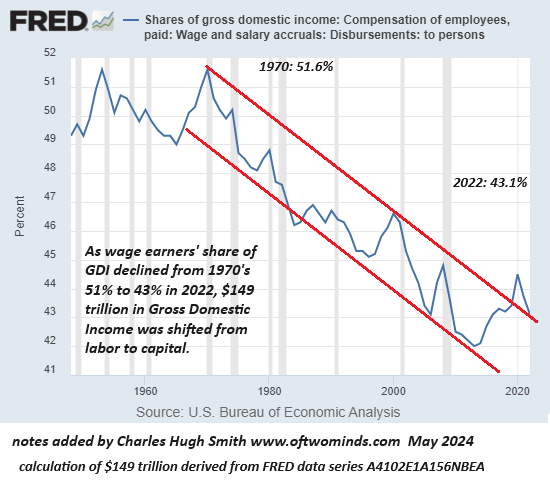

Lost in all the speculative babble of how to game the Fed's next round of Rolling Thunder is the catastrophic unfairness of the Fed's 15 years of propping up zombies and enriching the already-rich. The bottom 90% who live off their labor have seen their earnings lose purchasing power and assets such as houses soar out of reach, while the Fed and the other central banks have institutionalized moral hazard for the super-wealthy, who can count on the Fed bailing them out while the not-wealthy pay 22% interest on credit cards.

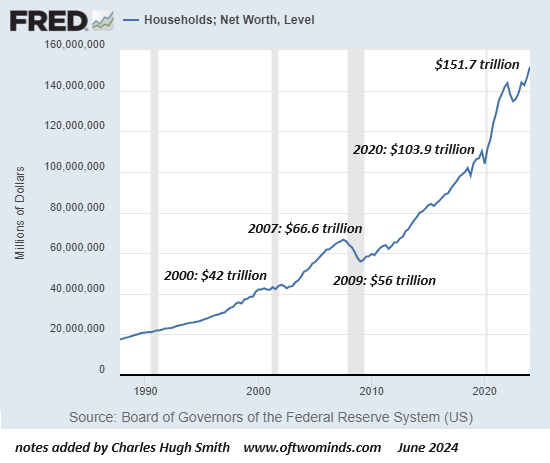

Equally catastrophic is the incentivizing of speculation over productive investment of capital. Yes, we're all fans of reusable rockets and battery factories, but the $100 trillion in "wealth" added since 2009 isn't the result of incredible leaps in productivity; the vast majority of that "wealth" is the result of credit-asset bubbles inflated by the Fed and other central banks.

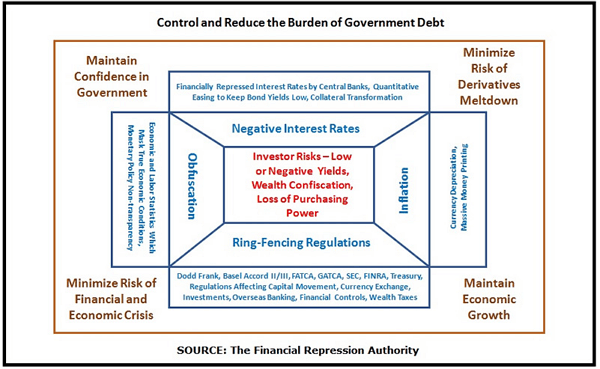

Meanwhile, the noose of financial repression keeps tightening, as depicted on this chart, courtesy of Richard Bonugli.

As the high generated by the previous iterations of financial repression wears off, the dose increases, as do the stakes when that high wears off. This is how we get to the body count phase, where statistics are issued to "prove we're winning," when in fact the financial sector is increasingly fragile and the economy is increasingly dependent on the next dose of Fed fentanyl.

We're now so high on Fed fentanyl--rate cuts incoming!--that we don't even notice that speculation has replaced productivity growth as the source of "wealth":

Financial Repression is generous with collateral damage. Trillions in Fed fentanyl and federal deficits, and the bottom 50% received a staggeringly large 0.2% boost in their signal-noise share of the nation's financial wealth, all the way up to 2.6%, yowza.

We got your wealth effect right here: lucky you don't actually need wages to live, right? Oh, you do? Well, sorry about that...

Too bad you weren't already wealthy, then the Fed would have made you a lot wealthier.

The unwinding will be uneven, of course, with a great many towns destroyed to save them, and eventually the dominoes falling will reach us, wherever we are. The financial system is tightly bound globally, so as it unwinds it will take down the equally tightly bound global economy.

And so here we are: it became necessary to destroy the global economy to save it. We hope you enjoy the fireworks.

This article was printed from TradingSig.com