The DAX30 Index

The DAX30 is a group, or index, of the 30 stocks that are the most powerful, listed in the Frankfurt Stock Exchange of Germany. It is also referred to as Deutscher Aktien Index, incorporated on December 30, 1987. However, the date of foundation of the DAX is July 1, 1988.

While looking at the number of companies that make up part of this elite grouping, it is comparable to the Dow Jones, which is the index of the New York Stock Exchange. This is made up of the 30 most valuable businesses in terms of market realization.

Like the S&P 500 and the FTSE 100, this is a capitalization weighted index that measures the performance of these 30 companies that are large and publicly traded in Germany. It remains a strong indicator of the overall strength of the German economy and the sentiment of investors towards German equities.

Looking at the DAX30

DAX30 started out at the base level of just 1000 points, trading today for about 11,700 points. This shows an increase of about 1070%. Another fact is that the DAX, and sister indices, makes up the 10th largest stock exchange in the whole world.

Market capital of the FSE today is over $1.5 trillion, and the value of the DAX is well over $642 billion, 600 billion Euros. What this means is that the DAX contributes to roughly 60% of the Frankfurt Stock Exchange market capital.

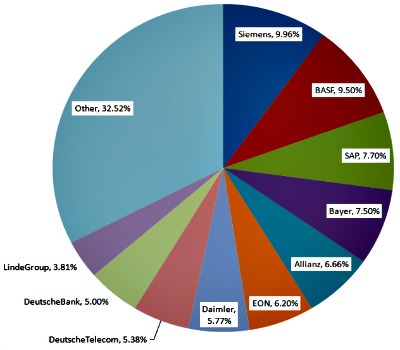

Power List

Many of these companies boast a global footprint and they provide services and products in major countries all over the world and in a variety of fields, to include pharmaceuticals, automobiles, banking, insurance, electronics, software, clothing, etc.

The Future Of Index

The DAX30 in Germany is a major player in significant stock market indexes across the world and maybe even the most prominent in Europe. Germany has long been considered a powerhouse, or the factory of Europe. The DAX index companies have established markets everywhere across the globe.

From 2008 until now,t he German markets followed along a positive trajectory. While world markets are improving, it is easy to see that German companies will mostly likely prosper and grow.

With all of the multinational corporations and the components of the index, the international investors should be taking a closer look at the index as a good way to diversify all over Europe. Overall, there is a lot to be said about the manner in which such growth has taken off.

Related articles

Trading signal service for you!

Are market indices confusing to you?

Exchange (EXCH) as an organized market