Why Crypto Based On Blockchain Technology Is Frighting Big Banks

Why is crypto currency based on blockchain technology frighting big banks? A question a large number of readers are asking. Knowing some of the benefits associated with crypto currency in a realm of fiat currency allows us to see the reason why creative designers came up with it, to begin with, and continue to come up with ever better crypto currencies. Let 's start with a few of the difficulties with fiat money:

|

Governing bodies can easily print as often as much fiat money as they desire, and in the course of history, there are numerous examples of monies which have been inflated to demise. The two main reasons this can't be carried out with cryptos. There is a maximum cap on the number of coins that can be produced. In Bitcoin case, this upper limit is placed at 21 million - therefore no inflation probable here. |

Crypto currency isn't centralized. On the other hand, all fiat currencies financial dealings are centralized, and now we willing to trust that the bank teller, our check clearing house, many of our foreign currency brokerage service, etc., will perform their job truthfully and fairly, and also at a competitive cost. There are many instances where this trust continues to be dishonored, and therefore, the need for something different was developed.

Here's an example of a blatant breach of client trust. Wells Fargo, a giant bank in America, generated around 3.5 million ghost bank accounts to allow them to charge patrons for products and services they didn't ask for or even want. The unwary patrons who didn't see the not needed additional accounts would carry on and pay the service fees, believing in that their financial institution has been looking after them.

It had been afterward that the public learned that Wells Fargo has also been enrolling customers for unwanted insurance coverage and once again charging patrons for products and services they didn't inquire. This is fraudulent activity on a massive scale, and here are the facts that we've learned. We can't trust the “Trusted” a go-between bodies.

Additionally, we saw that financial institutions happen to be making enormous profits for some time, levying transaction service fees which generated huge profits. Itis was not difficult to see the requirement for fresh new technology to allow safe, secure, trustworthy, low-cost, as well as transparent transactions without worrying about the possibility of manipulation and rip-offs by governing bodies and too big to fail financial institutions. All of this is precisely what blockchain technology would bring to the field of financial dealings.

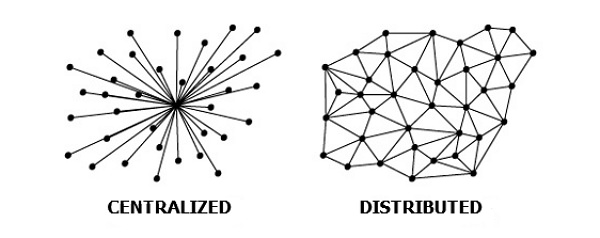

The central element is the fact that present systems happen to be “Centralized,” in contrast to where is “Distributed.” What is important is that “Trust” can be 100% transparent within the distributed model. The blockchain is undoubtedly an open source, P2P (peer-to-peer) technology which records data on all crypto transactions on the same in principle as a massive universal spreadsheet. There isn't any spreadsheet “owner” per se and each and every time a whole new batch of transactions is encrypted by the network system; it gets to be added onto an unalterable digital ledger - or chain as being a block.

The image listed below provides you with a concept of the visible difference between those two network systems.

In today’s entire world, virtually all government authorities, financial institutions, corporation, and individuals maintain their information data in a centralized database, typically having a centralized back-up of the particular one database. One only get to see the various parts of that data files that will concern you, and also you have to trust that “Privacy Policies” feel safe and secure and that data files integrity standard is very high. These kinds of centralized databases could very well be altered, records can be changed, data files could be missing, hard disk drives can easily crash, and the data files represent just one single party’s view of any given financial transaction.

In the realm of blockchain - distributed ledger journal technology, the exact opposite holds true. The financial dealings recorded on the ledger symbolize a transaction which takes place involving the parties concerned, and it is verified and confirmed by the blockchain network system via a consensus and smart contracts. This really is “Trust” on a massive scale. As soon as a transaction is printed to the ledger, it's immutable - it can't possibly be altered ever.

The specifics of each financial transaction happen to be seen by everyone (Think a house address), although the identification of the individual part remains safe and secure using private keys (Think a house key). Private Key owners can quickly identify their financial transactions within the ledger database, however, can't establish the identity of the parties in any other transaction which took place.

In a Nutshell

Crypto based on blockchain technology is going to transform our society. However, 99% of investors and traders are so incredibly distracted by Bitcoin mania; they are missing out on the bigger picture. In the 2017 run-up in BTC had all of the selling points of the enormous bubble (perhaps the largest in human history). And serious challenges ought to be expected, in many other ways we're at the frontier of a colossal experiment measuring only at its very beginning which will present us with a countless number of opportunities in the future.

Related articles

Trading signal service for you!

Understanding Crypto Popularity