The Crypto Crackdown Intensifies by SEC

Authored by: Nick Giambruno

The crypto crackdown intensified as the US Securities and Exchange Commission (SEC) filed charges against Coinbase and Binance, the two largest cryptocurrency exchanges in the world.

The moves likely represent an opening salvo of government action against cryptocurrencies with profound implications that I'll unpack in this article.

The complaint against Coinbase centered on it being an unregistered securities exchange, explicitly targeting its "crypto yield" offerings.

The charges against Binance relate to running an unregistered securities exchange, issuing their unregistered security, mismanaging customer funds, and an assortment of serious market manipulation allegations.

Gary Gensler, the head of the SEC, described Binance's actions as similar to if the New York Stock Exchange was also operating as a hedge fund making markets.

Binance also raised money through an "initial coin offering" of their BNB token, which the SEC deemed an unregistered security.

The SEC determines if something is a security and subject to US laws through the Howey Test, which states something is a security if it includes an "investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others."

The SEC claims Binance knew precisely what it was doing and cited the words of its own Chief Compliance Officer in its complaint.

The SEC should have been abolished yesterday, and a free market in investments should exist. That would be better for everyone except the insiders who benefit from the cronyism of the current system.

Practically, nobody should be surprised that the SEC and US government go after those who defy it.

If you have a centralized group of people creating a digital token, giving a bunch to themselves, marketing it to pump the price, and then dumping it on the retail market without a registration statement and disclosing who owns the token, that's like sticking your head in a crocodile's mouth and hoping it doesn't bite.

You would have to be pretty dim not to see the SEC would inevitably go after crypto. Anyone with open eyes could have seen it coming from a mile away.

Gary Gensler repeatedly warned in crystal clear language what was coming and that most cryptocurrencies are "decentralized in name only."

Gensler recently told the US Senate that cryptos outside the public policy framework for investor protection are "not going to persist long."

In short, the crypto crackdown will accelerate and potentially wipe out hundreds of billions in market value. That's terrible news for every cryptocurrency—except Bitcoin.

Altcoins Are Securities but NOT Equity

Altcoins are all cryptocurrencies other than Bitcoin. Many people need clarification about altcoins. One of the most common misunderstandings is that altcoins are like equity or investing in tech start-ups.

However, it's essential to understand that just because something is deemed security—a broad umbrella term—doesn't mean it is equity.

When you invest in the equity of a business, you have an ownership stake. It's a legal claim to the assets of the company and its future cash flows.

However, altcoins do not represent any ownership stake or legal claim on assets or cash flow. That's why they are nothing like equity, despite what many believe. If altcoins are not equity, what are they? They are tokens.

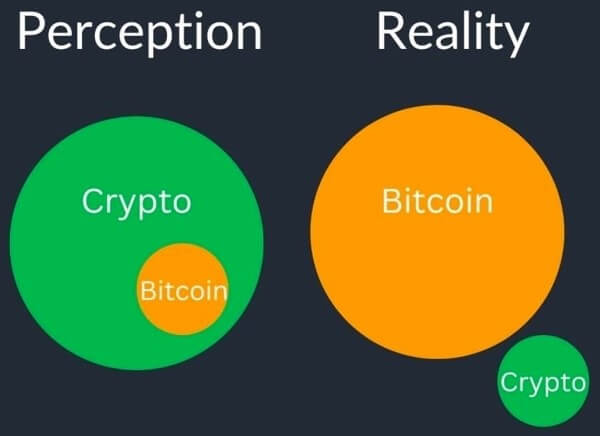

Bitcoin ≠ Crypto

The biggest mistake you can make in the coming Bitcoin bull market would be to get distracted with altcoins. Although many incorrectly lump them together, Bitcoin and altcoins are entirely different.

The real secret in the crypto space is that although there are over 25,000 cryptocurrencies, the only one that matters is Bitcoin. The growing crypto crackdown illustrates this.

Bitcoin is the only cryptocurrency that is unambiguously NOT a security. The SEC and the rest of the US government have been clear that it views Bitcoin—and only Bitcoin—as a commodity, a much more favorable designation.

That's because Bitcoin does not have an issuer, much like gold, silver, copper, wheat, corn, and other commodities do not have issuers.

Altcoins do have issuers. They also have founders, central foundations, marketing teams, and insiders that can exercise undue control. That means there are apparent targets when the US government wants to go after an altcoin.

Further, the IRS, the SEC, the CFTC, and other agencies have given Bitcoin clear regulatory and tax frameworks. This is not true of any other cryptocurrency, so companies involved with altcoins, like Coinbase, have massive legal and regulatory problems.

Suppose the US government changed its tune and wanted to go after Bitcoin. It would be problematic because no obvious target exists.

Bitcoin is the only crypto that is genuinely decentralized. There's no central location or authority for a SWAT team to raid. There's no CEO, founder, or marketing officer to arrest. The US government can do nothing but play an endless game of whack-a-mole.

They don't go after Bitcoin because they can't. That's a big reason why the US government correctly classified Bitcoin as a commodity, not a security.

Here's the bottom line

Stick to Bitcoin only, and you'll sleep much better at night. The upshot to the crackdown on altcoins is that it could be a tremendous catalyst for the Bitcoin price.

An ocean of capital could flow into Bitcoin as investors flee altcoins in droves. The image below from @TheBTCTherapist conveys this well.

In recent years, enormous money was poured into altcoins as the space was effectively unregulated.

But now that the SEC has initiated a growing crackdown on altcoins, the dam will soon break, and all that capital will be looking for a new home.

Over $500 BILLION is parked in altcoins as of writing. Much of that capital will soon make its way into Bitcoin as more people realize it is a superior asset amid the altcoin crackdown.

In short, we could be on the cusp of the Bitcoin price's next big upside explosion. Publicly-traded Bitcoin stocks stand to be a primary beneficiary of this trend.

Bitcoin stocks have the potential to outperform Bitcoin MASSIVELY—and deliver those enormous gains quickly.

I wouldn't be surprised to see the best Bitcoin stocks increase by 32x, 75x, or even higher during Bitcoin's subsequent upside explosion, which could be imminent.

That's why I just released an urgent dispatch that details what I believe to be the number one Bitcoin stock. It's easily accessible through any brokerage account.

This article was printed from TradingSig.com