Copper supply is under threat; prices are rising

The landscape of copper energy is changing. The driving force behind this change is the New Energy revolution. This is the worldwide transition from fossil fuels of the past to more sustainable, cleaner, and more sustainable energy sources.

According to International Renewable Energy Agency, in 2050, renewable energy sources, mainly wind and solar power, will account for 85% of global electricity production. This is a considerable amount. Renewable sources are now the primary source, only 30%.

Therefore, a rise to 85% would need a significant overhaul of our energy production processes. To achieve this goal, the world will require lots of copper.

Because renewable energy sources like solar power, hydrothermal, and air-source heat pumps utilize 12 times more copper than conventional fossil-fuel-powered systems.

The world utilizes around 25 million metric tons of metal per year. It is extensively used in utilities, electronic manufacturing equipment, transportation, and other industries.

However, this New Energy transition will increase the demand for copper. The management consulting firm McKinsey and Company estimates that demand could rise by 50% in the next 20 years.

That should drive copper prices up. There's another reason to be bullish as an investor about copper.

Copper's stockpile is under threat

Copper demand is expected to rise, and the supply is also under threat. Global production of metal from mines is approximately 21 million metric tons each year. In addition, there are 870 million tonnes of copper in reserves worldwide.

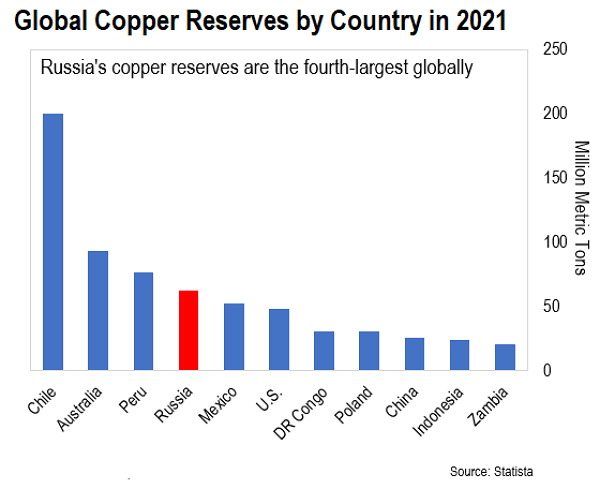

Russia produces about 1 million metric tonnes of refined copper every year. It's about 4% of the world's total supply. It also holds 62 million tonnes worth of reserves. This is more than 7% of the global reserves. It's also 30% more than what the United States holds.

The issue is that Russia's copper may be depleted. The West has hit Russia with unprecedented sanctions to force it to end its Russian Special Military Operations (SMO) in Ukraine. Russia has frozen foreign assets (theft). It has also snubbed all major banking institutions from SWIFT (a global interbank messaging system).

Imposter Biden prohibited all Russian gas and oil imports within the United States energy sector. At the same time, the EU (European Union) has pledged to reduce its dependence on Russian gas by two-thirds next year - good luck with that.

And we also are witnessing what is happening to the price of crude oil. It increased to over $120 per barrel during March and is currently trading above $100 per barrel - in 2021, the price was about $60.

Sanctions by a different name

Russian copper hasn't been sanctioned or banned at this time. However, with no indication of Russia stopping its SMO in Ukraine, there's no doubt that a possibility is coming. The LME (London Metal Exchange) copper commission has recommended the ban of a new supply of Russian metal from the exchange.

The London Metal Exchange is the central hub globally for trading industrial metals. It's the place where most non-ferrous metal transactions take place. Also, the London Metal Exchange adopting this decision will affect everyone involved in the world copper trade. Other marketplaces could take the same course.

It is yet to be determined whether this suggestion will be the norm. Even without a complete banning, Russian exports are already impacted. Most copper imports into China are transported through the Black Sea or European ports like Rotterdam.

But, the self-sanctioning practice of logistics firms has put a wrench in the Russian seaborne trade. This means that the shipping routes are becoming less accessible to Russian trade. In the words of Goldman Sachs, this could take up to 50,000-60,000 tonnes of copper each month from markets.

The market is in a precarious situation

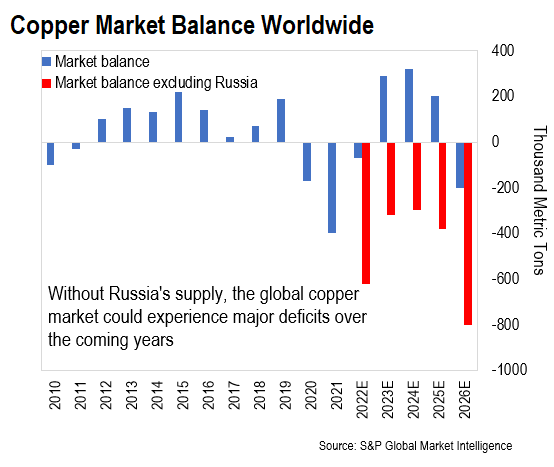

Let us see how removing Russia's supply would affect the market. Keep in mind that are 1 million metric tons of copper per year. You can visualize the effects in the following chart.

The bars that are above the zero mark indicate surpluses. Below it, the bars show deficits. The red bars show deficits that do not include Russia's copper supply.

Without the Russian copper, the market could result in massive deficits by this year. There are also significant issues developing in other major suppliers as well.

Production of copper in Chile, the world's largest producer, is down by more than 6%. In Peru, the production of the Las Bambas mine - which makes up 2% of the global supply - is now shut down due to protests. This puts the market in a challenging situation.

A timeless bull copper market scenario

We are witnessing the perfect environment setup for copper prices. Worldwide supply is in danger while displaying a rise in demand; as stated above, the New Energy transition is set to take off.

In reality, the Russian SMO in Ukraine has been a catalyst. The world's governments are working to decrease Russian gas and oil dependence. Therefore, they are rushing into new sources of energy. More copper will be required, which could be 50% or more.

Why don't they construct and build more mines? one might ask. It takes years to make a world-class mine. The major copper mines require infrastructures such as roads, railways, water treatments, and assembled workforce. In essence, they are cities dedicated to mining.

The lengthy lead time means businesses need a consistent government policy to begin construction. Many copper mines are located in countries that are stricken by political turmoil. Therefore, the possibility of changing decision-making following an election or coup and exiling miners is genuine.

It's a challenge for mining companies to get the millions of dollars needed to construct these mines. Since there is no construction of mining facilities, there's as much metal available to be thrown around. Even if the prices go up enough to stimulate mining expansion, it will be long before those mines are operational.

How to trade this market?

An excellent way to position yourself for the rise in copper prices is through the United States Copper Index Fund ETF (CPER). It closely monitors the metal price and provides a convenient way to invest.

Russia's potential ban on copper is not the only catalyst for a significant mental boost. At the moment, political leaders are focused on the $150 trillion transfer of wealth that could alter the course of the United States. It requires an overhaul in the system for the energy sector needed to support the New Energy transformation - It could also boost your wealth.

This article was printed from TradingSig.com