A coffee can portfolio for the future

What to put in a coffee can portfolio? If I were burying a coffee can nowadays for the next forty years, would it be Gold? No, there is no better passive investment than prominent stock in a company which can compound investment returns for over 10% annually for many years or even many decades - No other investment instrument comes close to this one.

For example, $1 compounded at 10% annually grows into $45 for over forty years. Next compounded at 15% annually, it builds into a $268 return. And compounded at 20% annually, it turns $1 into a whopping $1,470 over four decades.

The difficulty is finding a reliable company that will deliver compound returns, as an example above, for over the next forty years. Many of us cannot see deep into the future and can't make revisions while the coffee can portfolio is buried.

Thus, if I had to set up this type of portfolio nowadays, I would get around these dilemmas by acquiring stock in Berkshire Hathaway company, managed by super investor Warren Buffett.

Why coffee can portfolio stuffed with Berkshire Hathaway

The coffee can portfolio can benefit because these guys who manage Berkshire Hathaway and its subsidiaries know the power of compound investment return rolling over the long-term much better than anyone on the planet. Also, because Berkshire Hathaway holds a collection of compounders, I would not have to agonize about the company I pick becoming an old hat over the next four decades.

Choosing Class A stock in Berkshire Hathaway would set you back approximately $420,000 per share today. That is being up 23% gain from its widespread pre-pandemic high.

However, this is not the same narrative for Berkshire’s Hathaway's more affordable Class B shares. Priced at $278 a share, they are up a hefty 21% from their pre-pandemic high price.

That is seemingly not that significant if one will hold a coffee can portfolio for over the next four decades, come what may. The power of compound interest returns is so mighty over such an extended period that it is irrelevant to the purchase price.

Although I believe within an intermediate time frame, we can achieve far better protection for many investors by containing Gold, Silver, and selective high-yield shipping stocks as we wait for the high-end compounders to go on the sale block. They invariably will sooner or later when companies' valuations are extremely high.

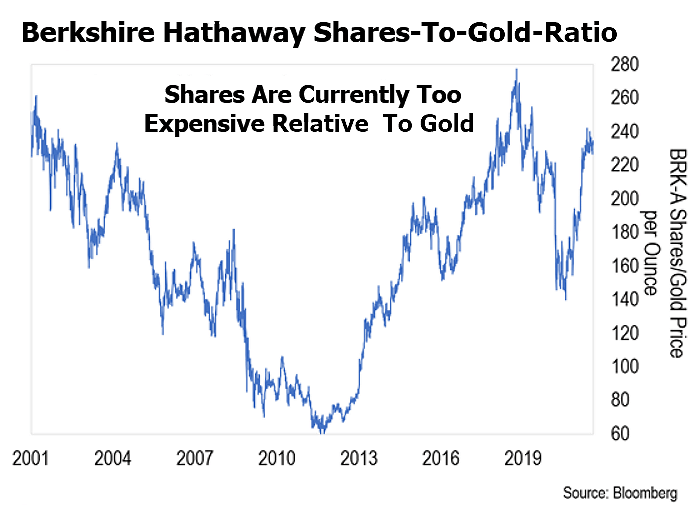

Below is what the Berkshire Hathaway-to-Gold ratio chart looks like over the last two decades, applying Berkshire’s Class A shares stock.

Note that when the stock-to-Gold ratio is high, Berkshire Hathaway shares are priced high relative to Gold. However, when the stock-to-Gold ratio is low, it suggests Berkshire Hathaway shares are discounted relative to Gold.

Currently, it is at 235. Once the ratio gets down to 120 thereabout, We would likely, in all probability, begin converting a portion of our Gold holding into compounders. Furthermore, if it ever gets in the vicinity to 60, We want to consider going all-in and begin burying coffee can portfolio(s) in many places for yourself and your loved ones.