Chart Analysis With Support And Resistance Levels

The chart analysis concept of support and resistance are certainly two most widely talked about tools in technical analysis, and they're frequently viewed as a subject matter that's complicated by those who find themselves just learning to trade.

When you take a look at any price chart, for virtually any market sector, just about any time-frame, a couple of specifics will end up evident which are depending on attributes that regularly show up. One of those attributes would be that the market price shown at any point at a particular time doesn't remain there for too long. Given the time, the marketplace price will be drastically changed. Therefore, virtually any prices displayed on the chart can be used as a reference point.

Chart Analysis Price Effect

Chart analysis of the total prices, however, behave as better references than the others. Among the fact, as pointed out earlier is the fact that any chart may have certain prices after which the marketplace trend will reverse. Frequently, the marketplace will often achieve these price levels and alter direction soon after.

Fundamental essentials support and resistance levels that almost any trader is familiar with. Support is a price level where the prices are established below the market by preventing the price from declining further. Resistance is a price level where the prices are set above the market by preventing the price from where the forces of demand were advancing further.

The support and resistance levels also are referred to as tops and bottoms, and a reminder that this is as far the market goes - for the time being. Support and resistance levels are important as a reference points because they signify prices levels where a brand new trend can begin or delay in market decline/advancement with greater probability.

Other prices, found roughly halfway between two relative support and resistance levels, will also be useful reference levels. These levels are known as midpoints. When a support as well as level of resistance is impaired, this indicates that the relationship relating to supply and demand is different.

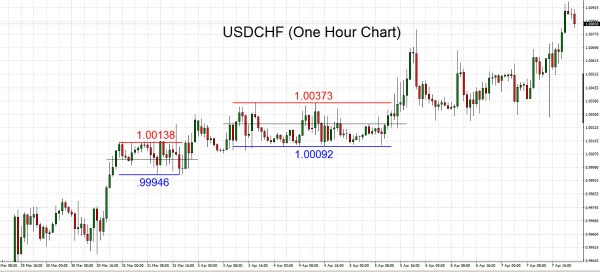

Any part of a chart could be marked up by drawing horizontal lines at critical support points, or resistance levels, and outlining midpoint prices for use as references. A chart analysis of USDCHF below is a typical example of support, resistance, and midpoint lines.

The “Blue Line” signifies support at .99946 and 1.00092. The “Red Line” means resistance at 1.00138 and 1.00373, with "Black Line indicating midpoint.

The precise support and resistance identification is subjective and may vary according to your selection of the possible market buy and sell entry. One might choose to initiate a trade at or near a very specific bid or ask price. The trade entry may also be taken at any one broader choices of support, resistance and midpoints price levels. It all depends on your personal trading approach as well as profit margin objectives.

The gap in between the support and resistance price points will vary quite a bit. They're simply references that can be used in identifying suitable trade criteria. Most of these reference price points reveal zones to look out for targeted types of entry action. A trade entry setup takes place when these kinds of price action are identified by performing the chart analysis.

Conclusion

As you can see, from the chart analysis of the USDCHF study example provided above, the usage of price action in conjunction with the keeping track of support as well as resistance ranges can be incredibly useful in identifying buy and sell setups.

However, identifying possible prices of support could significantly enhance the results of the short-term trading technique because doing so provides traders a detailed snapshot of what price ranges might prop up the price of a particular contract/security in case of the correction.

Alternatively, calculating a level of resistance could be rewarding since this is a price point that may damage a long position mainly because it implies a location in which traders have a great determination to sell the contracts/security.

GOT SOMETHING TO SAY:

Related articles

Trading signal service for you!

News Blog