If the SEC approves a spot Bitcoin ETF, what price will it be?

Authored by: Nomi Prins

"Gold 2.0." "Digital gold." You've no doubt heard these nicknames before when people talk about Bitcoin.

As we continue to follow the spot Bitcoin ETF story (catch up here)… it only makes sense to look at gold's history.

It can give us clues about where Bitcoin's Price might go next if a spot Bitcoin ETF is approved.

So, let's take a trip down memory lane for all my fellow gold bugs.

Gold's Price Soared 344% with the First Spot Gold ETF

I'm sure you remember the "old" gold days when no gold ETFs existed. Before 2004, you could only invest in gold through gold mining companies' bars, coins, certificates, and shares.

It was a different ball game compared to the ease and convenience of investing in an ETF (exchange-traded fund).

Then, on November 18, 2004, the first gold spot ETF was born: the SPDR Gold Trust ETF (GLD). GLD revolutionized gold trading. It made investing in precious metals a no-brainer.

That's because it eliminated the complexities of shipping and storing physical gold. And that gave investors a hassle-free and more cost-efficient alternative.

But did this revolution in gold trading also impact the price of gold? Well, let's take a closer look.

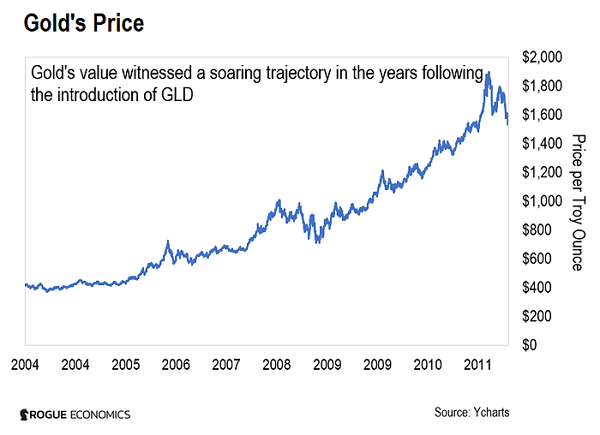

At the time of the GLD launch in 2004, gold was below $450 an ounce.

Fast forward to 2011, and the price of gold was soaring close to $2,000 per ounce.

Take a look at the chart below. You can see how gold's value soared in the years following the launch of GLD…

Now, it wasn't all thanks to GLD. There were other reasons behind gold's massive upward move, too.

There was also a lack of trust in government, stemming from events like the Iraq War, the 2008 financial crisis, Hurricane Katrina's response, and concerns about civil liberties due to the USA PATRIOT Act.

There were also periods of high inflation due to rising energy and commodity prices, the housing bubble, and the Fed's money-printing policies post-2008 financial crisis.

These also played a significant role in driving up the demand for gold. But none of that would have affected the gold price as much if GLD hadn't been introduced.

For the first time, GLD made it easier and cheaper for people to hold gold in their portfolios. It legitimized gold and transformed it into a mainstream investment that almost anyone could access.

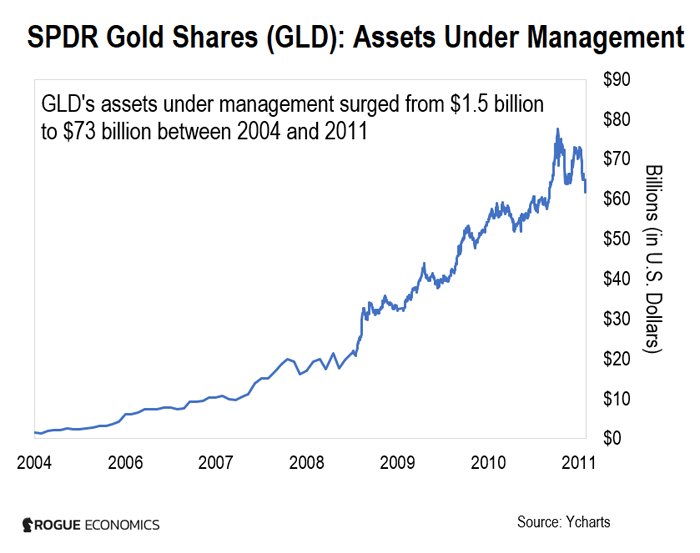

The numbers speak for themselves. When the SPDR Gold Trust was launched in 2004, it had just over $1.5 billion in assets under management.

Seven years later, that had soared to $73 billion, an increase of 48 times! You can see this in the chart below…

Again, this happened for ease, convenience, and cost.

The ETF gave people access to gold without the hassle of owning and storing physical gold.

And guess what… Most people would happily take that "trade-off" with Bitcoin today.

What a Spot Bitcoin ETF Could Mean for the Price of Bitcoin

So, how much money could flow into Bitcoin with the launch of a spot Bitcoin ETF? Let's do the math…

Take the top 100 asset management companies, which manage around $56.8 trillion. We'll round it up to a neat $60 trillion.

Let's assume that only 1% of all that money makes it into Bitcoin. That's roughly $600 billion. Right now, Bitcoin's market cap is $565 billion.

If that $600 billion from those top 100 asset managers flows into Bitcoin, it will double Bitcoin's market cap.

That's plausible, given that Bitcoin's market cap was roughly $1.2 trillion in November 2021.

Doubling the market cap should result in Bitcoin's price doubling, too. That would put the price of one Bitcoin at about $58,000 – up from just over $29,040 today.

Again, there is no crystal ball to tell us what Bitcoin will do next.

But I am confident that if there's $600 billion worth of real money trying to do actual buying… Bitcoin's Price will probably do more than just 2x.

And that's based on just 1% flowing in from the top 100 asset managers. It doesn't include all the other money sloshing around the economy, waiting to get into Bitcoin.

Smaller pension funds, sovereign funds, and individual investors watching from the sidelines will also want a piece of the action.

What This Means for Your Money

We'll have to wait and see if the SEC gives the go-ahead for BlackRock's Bitcoin ETF.

What we do know, though, is that BlackRock's move has reignited interest in Bitcoin ETFs.

Significant players like Fidelity and Invesco are all applying for their spot in Bitcoin ETF alongside BlackRock. They all want a piece of the potential trillions of dollars they could manage and collect management fees from.

And that alone is bullish. So, if you ever need another reason to add Bitcoin as a speculative asset to your portfolio, this is one.

Yes, Bitcoin is a volatile asset that undergoes periods of violent swings. Yes, it has fared very well in 2023, so you might think you've missed the boat.

And yet, as I write this, the Price of Bitcoin is still down about 57% from its November 2021 all-time high of about $68,000.

You can still buy it at lower prices before big players like BlackRock swoop in.

Remember, though: With Bitcoin, you want to avoid diving in headfirst.

Instead, consider investing a small amount of money regularly. That could be as little as $15 every two weeks. That way, you can "dollar-cost average."

Block's Cash App and PayPal offer a convenient way to do this. With these popular apps, you can start your Bitcoin portfolio with as little as $1.

But, again, remember that Bitcoin is a speculative asset. A small investment can go a long way. So, invest only what you can afford to lose.

This article was printed from TradingSig.com