Two investments assets to buy to safeguard your wealth

With investments assets to buy, we don't want to think of War as a circumstance where investment decisions need to be taken. But the world is moving in this direction. The main reason is the usual suspect, namely inflation.

Global central banks, including the US Federal Reserve - have created more than $30 trillion of new fiat currency since the financial crisis of 2008.

This means that the purchasing power of every dollar you have in your savings account decreases each month. However, the stock market, as well as other investments assets to buy, keeps rising.

It is a segment of the distortion between the real economy and markets that we've been talking about in the past, and this will not be changing anytime soon.

Although making money in the market is excellent, it's also risky. If you were a stock owner in September 2008 and March 2020, or even January 2022, you'd understand precisely what we are talking about.

Keeping the right assets to buy in your portfolio to protect your financial wealth from the harmful effects of the government's wildly monetary and geopolitical policies is equally important.

In this article, I have explained why bitcoin and gold safeguard the value of your hard-earned capital. In the current era of a soaring inflation rate, this protection is more critical than ever before.

Some investors may be skeptical about bitcoin. However, we think it is worthy of being part of a well-balanced portfolio, in addition to gold. Particularly in the current global financial state of affairs.

Holding both bitcoin and gold in your investment portfolio for the long term is the best practical thing to do. Both have a vital function in preserving the value of your hard-earned monies in the long run.

Therefore, I'd like to share a different aspect of the two currency alternatives. It emphasizes why they will remain a valuable store of value, and that is that they are both "hard" assets to buy.

Ratio introduction to the Stock-to-Flow

- The term "hard" does not mean in hard physical form. It's a term that means difficult to generate.

- The best method to gauge the hardness of assets to buy is to evaluate the ratio of its Stock-to-Flow.

- The "Stock" part refers to the quantity of something available. It is the supply that has been mined - immediate availability.

- The "Flow" part refers to the supply added by yearly production.

- The ratio of Stock-to-Flow is the number (years) of renewed supply (Flow) required to match the current supply (Stock).

- A high Stock-to-Flow ratio indicates that the new inventory supply is smaller proportionally to the existing stockpile. It suggests hard assets to buy.

- A low Stock-to-Flow ratio indicates that the new inventory supply is larger proportionally to the existing stockpile. Therefore, it can influence the balance of the market readily.

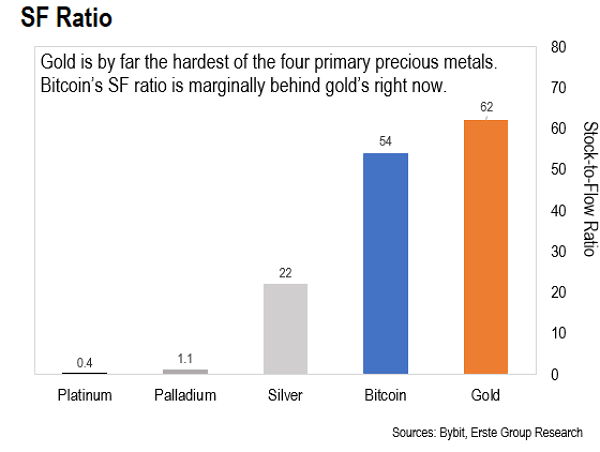

Gold and bitcoin are among the best hardest assets to buy. Take a look at this chart of Stock-to-Flow ratios of both metals against the most commonly used commodity metals.

Bitcoin is set to be one of the hardest assets to buy globally.

Humanity has used gold metal as a currency for more than 5,000 years. It's a fantastic asset of store value. And because it's challenging to produce, along with assurance, that the circumstances will not be changing anytime soon.

Bitcoin cryptocurrency is a relatively young asset that has been around since 2009. Therefore, I can understand why some of you might not have leaped into the coin as an investment. However, here is another reason I think you should seriously consider including it in your portfolio along with gold.

Bitcoin is poised to become the hardest currency the world has ever seen. There will never be greater than 21 million Bitcoins in existence. This is a fact that bitcoin has written into its code. As of date, there are 18.9 million Bitcoins in circulation on the market. This is approximately 90% of the possible total supply demand.

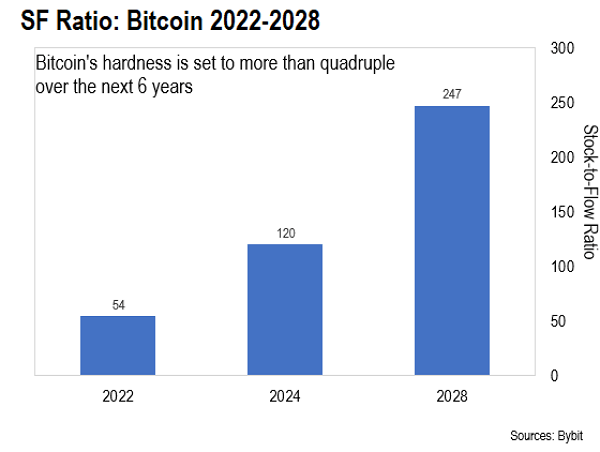

The new bitcoin supply is reduced by 50% approximately every four years. This is referred to in the industry as "halving." Bitcoin "miners" get Bitcoins as a payment to process transactions. A bitcoin Halving event occurs at the time when this reward is reduced to half.

The first bitcoin halving occurred in 2012, reducing the number of Bitcoins rewards from 50 to 25 Bitcoins. 2016 we saw the subsequent halving reduction from 25 to 12.5 Bitcoins. The latest halving in May 2020 slashed the reward to 6.25 for every new Block processed.

The next halving is scheduled to occur around mid-2024. The reward for mining will decrease from 6.25 to 3.125 bitcoin. In the spring of 2028, bitcoin is expected to undergo its 5th halving by reducing to 1.5625 bitcoins.

The final result is that 10% of Bitcoins that are added will be augmented at an ever-decreasing content. This will impact the hardness of bitcoin, as you will see in the following chart below.

By 2028, bitcoin's hardness will more than quadruple. What about gold?

We can not foresee the exact supply of gold or the Stock-to-Flow ratio. Unlike bitcoin, the supply of gold is dependent on a myriad of aspects, such as market demand, the price, new mine starts, and other factors. However, the average Stock-to-Flow ratio of gold over the past 120 years is 66. The highest ratio was 90 - in 1920.

Therefore, even if it does reach this level once more within the next few years - which is unlikely - it will not be as high as the bitcoin Stock-to-Flow ratio. So, bitcoin will be about four times harder than gold in just six years.

So this means that it is an additional option to the current fiat currency system if you are looking to preserve the value of your hard-earned money.

The practical investing assets to buy strategy

Therefore, including simultaneously assets to buy in your investment portfolio is the sensible way to go in the long run. It's always beneficial to include gold and bitcoin within your investment portfolio, which are challenging to produce and are scarce, notably when the money you hold decreases each passing day.

Currently, gold and bitcoin are the "hardest" assets to buy. You may consider investing in the SPDR Gold Shares ETF (GLD) to get exposure to gold. It closely monitors the price of gold, granting a convenient exposure.

In the case of bitcoin, there are numerous options to purchase it. One option is buying bitcoin via a crypto exchange like Coinbase or another suitable exchange you choose and keeping it in a hot or cold wallet.

If you're buying bitcoin for the first time, Block's (previously named Square) Cash App or PayPal might be convenient choices. With these well-known apps, you can begin your crypto investment pilgrimage at as little as $1.

You could also consider the Swan Bitcoin platform - It is a relatively new platform. It provides easy, frequent savings options for converting your money into a bitcoin savings plan. The fees are also minimal when compared with other larger platforms.

This article was printed from TradingSig.com